- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

High Growth Tech Stocks To Watch This January 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism, driven by hopes for softer tariffs and enthusiasm surrounding artificial intelligence, major indices like the S&P 500 have reached new heights, while growth stocks outpaced value shares for the first time this year. Amid these dynamic conditions, identifying high-growth tech stocks involves looking at companies with strong exposure to burgeoning sectors such as AI infrastructure and those that can capitalize on favorable economic policies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Speed Tech (TPEX:5457)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Speed Tech Corp. is involved in the design, research and development, manufacturing, and sale of connectors for communication, computers, automotive, and consumer industries both in Taiwan and internationally with a market cap of NT$9.06 billion.

Operations: The company generates revenue by designing and manufacturing connectors for various industries, including communication, computers, automotive, and consumer sectors. Its operations span both domestic and international markets.

Speed Tech, amidst a dynamic tech landscape, has demonstrated robust financial performance with a notable 36.2% earnings growth over the past year, surpassing the electronic industry's average of 6.6%. This growth trajectory is underpinned by substantial increases in sales and net income as evidenced in their recent quarterly report which showed sales rising from TWD 4.77 billion to TWD 7.12 billion year-over-year. The firm's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in rapidly evolving tech sectors. Moreover, Speed Tech's earnings are projected to surge by an impressive 48.3% annually, highlighting potential for sustained upward momentum in a market where technological advancements drive demand.

- Click to explore a detailed breakdown of our findings in Speed Tech's health report.

Assess Speed Tech's past performance with our detailed historical performance reports.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. is a company that specializes in the research, development, manufacturing, and sale of electronic paper display panels globally, with a market capitalization of approximately NT$321.43 billion.

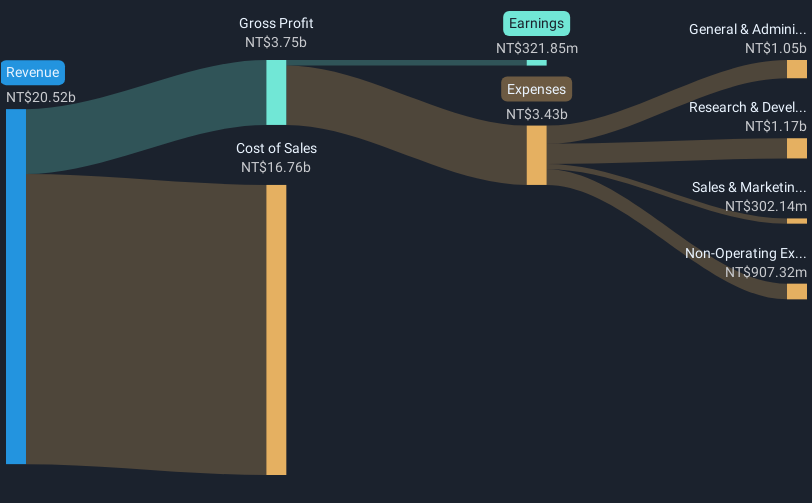

Operations: The primary revenue stream for E Ink Holdings comes from its electronic components and parts segment, generating NT$28.32 billion. The company focuses on the global market for electronic paper display panels through its comprehensive operations in research, development, and manufacturing.

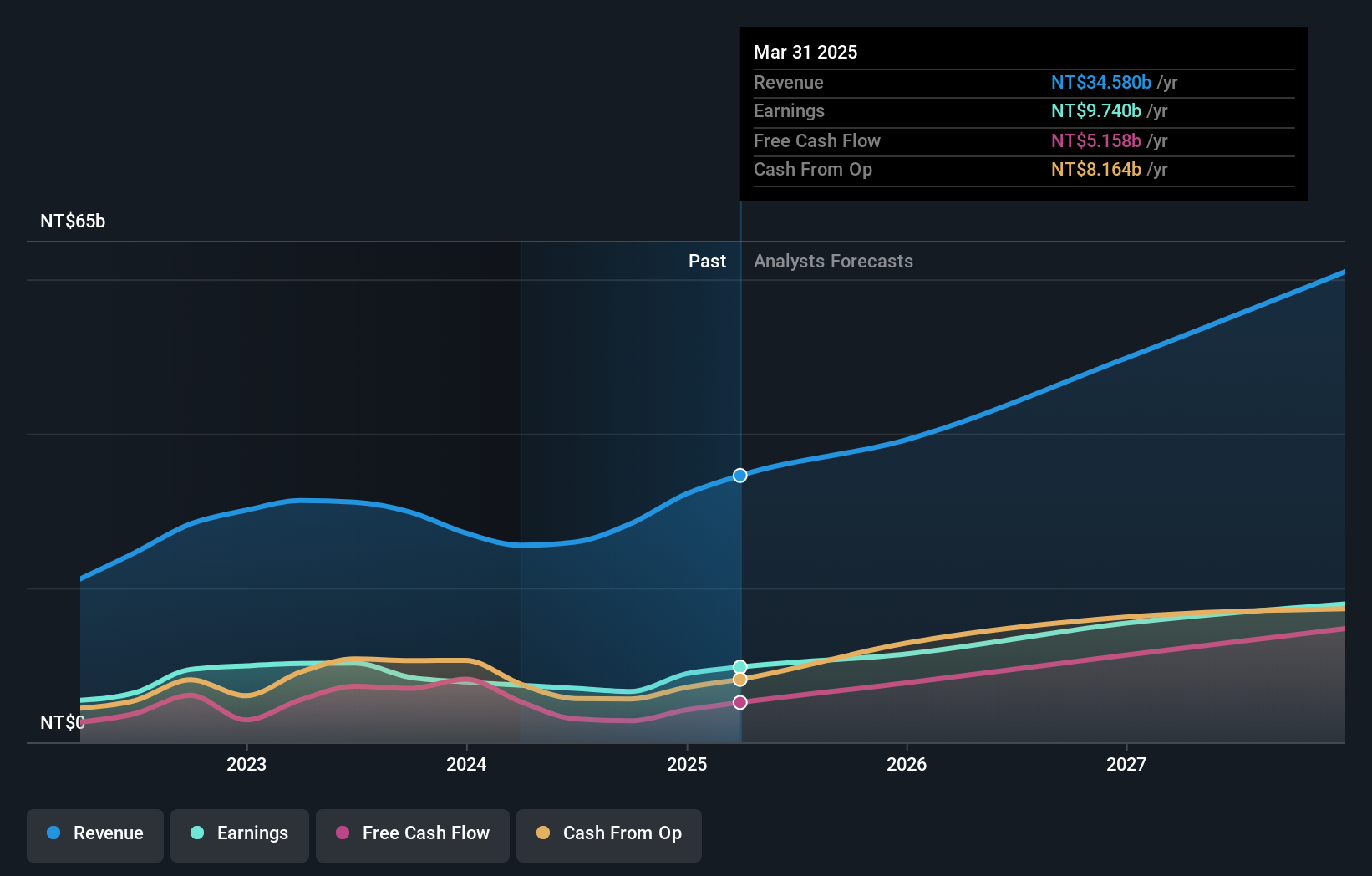

E Ink Holdings, a trailblazer in ePaper technology, recently spotlighted its innovative collaboration with Cream Guitars, showcasing color-changing guitars at NAMM 2025. This partnership not only highlights E Ink's expansion into new markets but also underscores its commitment to sustainability with 60% of its operations powered by renewable energy—a figure set to increase next year. Financially, E Ink reported a robust annual revenue growth of 29%, outpacing the TW market's 11.3%. Despite a slight dip in net income from TWD 2,399.97 million to TWD 2,005.43 million in Q3 year-over-year, the company maintains strong earnings growth projections at 39.8% annually. This performance coupled with strategic innovations positions E Ink favorably within the high-tech sector as it continues to redefine industry standards and consumer expectations.

- Get an in-depth perspective on E Ink Holdings' performance by reading our health report here.

Understand E Ink Holdings' track record by examining our Past report.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★★

Overview: Chenming Electronic Tech. Corp. is an OEM/ODM manufacturer involved in the R&D, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally with a market cap of NT$29.23 billion.

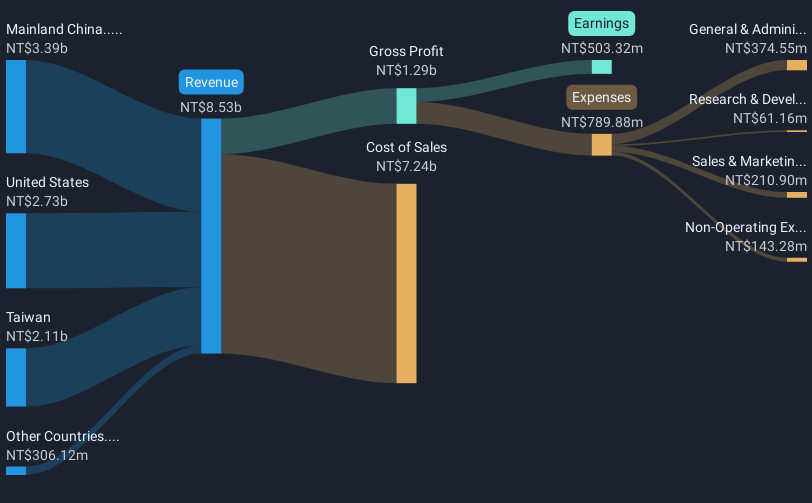

Operations: Chenming Electronic Tech. Corp. generates revenue primarily from the production and sales of computer and mobile device components, amounting to NT$8.53 billion.

Chenming Electronic Tech has demonstrated remarkable financial performance with a surge in quarterly sales to TWD 2.66 billion, up from TWD 1.77 billion year-over-year, and a doubling of net income to TWD 164.48 million. This growth is underscored by an annualized revenue increase of 45.8% and earnings growth of 63.6%, significantly outpacing the broader TW market's averages of 11.3% and 17.5%, respectively. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its rapid growth trajectory in the competitive tech landscape.

- Navigate through the intricacies of Chenming Electronic Tech with our comprehensive health report here.

Evaluate Chenming Electronic Tech's historical performance by accessing our past performance report.

Where To Now?

- Investigate our full lineup of 1231 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade E Ink Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives