- Taiwan

- /

- Electrical

- /

- TWSE:6781

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. indices closing a strong year despite recent slumps, and economic indicators like the Chicago PMI highlighting contraction in manufacturing, investors are keenly observing opportunities that may arise from these fluctuations. In this environment, identifying stocks that appear to be trading below their estimated value can offer potential avenues for growth, particularly when broader market trends suggest underlying economic challenges and opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.02 | 49.7% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| S Foods (TSE:2292) | ¥2691.00 | ¥5472.35 | 50.8% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Zhende Medical (SHSE:603301) | CN¥21.05 | CN¥41.99 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.03 | CN¥47.76 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.44 | NZ$2.89 | 50.1% |

| LG Energy Solution (KOSE:A373220) | ₩362000.00 | ₩709677.60 | 49% |

Let's explore several standout options from the results in the screener.

Ningbo Orient Wires & CablesLtd (SHSE:603606)

Overview: Ningbo Orient Wires & Cables Co., Ltd. offers land and subsea cable solutions both in China and internationally, with a market capitalization of CN¥36.06 billion.

Operations: The company's revenue segments include land and subsea cable solutions provided both domestically and abroad.

Estimated Discount To Fair Value: 27.8%

Ningbo Orient Wires & Cables Ltd. is trading significantly below its estimated fair value of CNY 74.92, with a current price of CNY 54.08, making it potentially undervalued based on cash flows. The company reported strong financial performance for the nine months ended September 2024, with net income rising to CNY 932.12 million from the previous year’s CNY 821.87 million and earnings per share increasing to CNY 1.36 from CNY 1.2, reflecting robust profit growth prospects above market expectations despite an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Ningbo Orient Wires & CablesLtd's future results.

- Take a closer look at Ningbo Orient Wires & CablesLtd's balance sheet health here in our report.

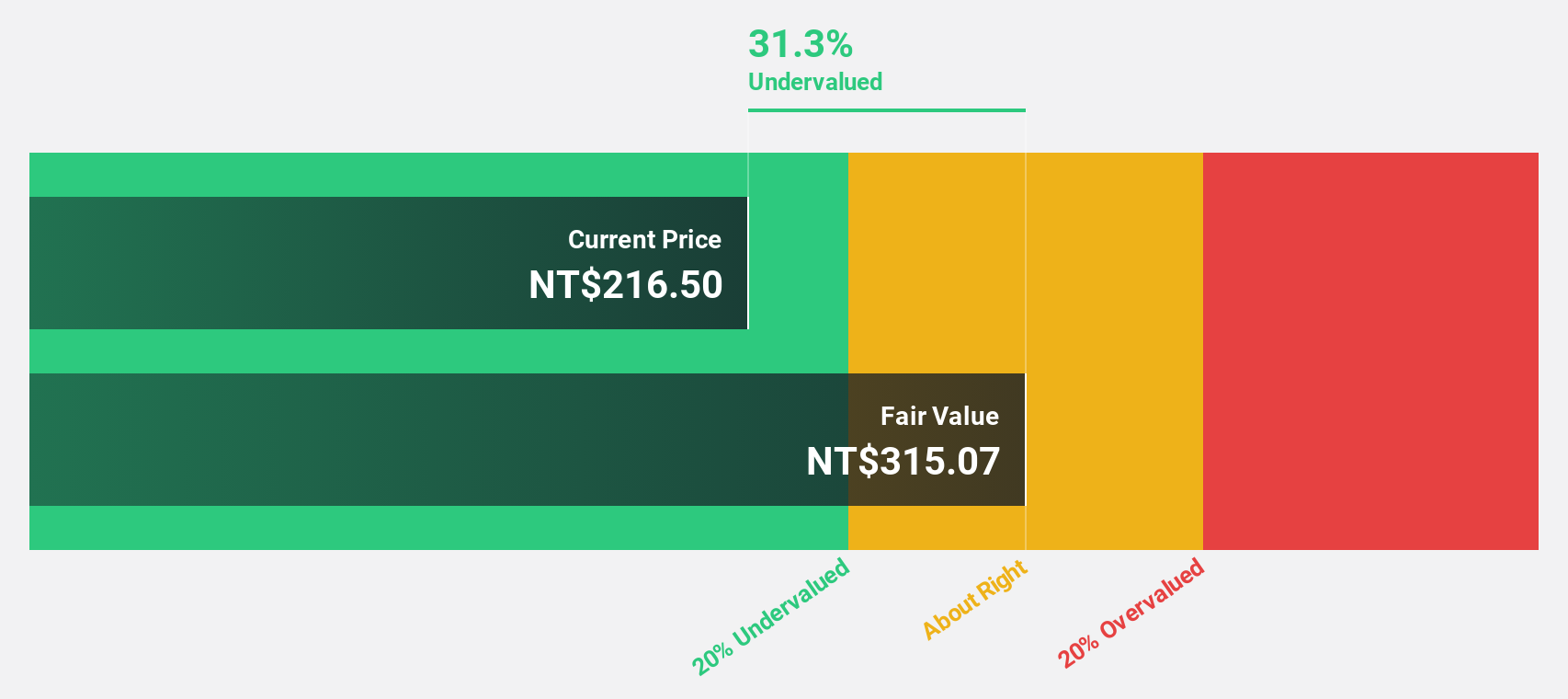

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. researches, develops, manufactures, and sells electronic paper display panels worldwide with a market cap of NT$303.97 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, totaling NT$28.32 billion.

Estimated Discount To Fair Value: 20.3%

E Ink Holdings is trading at NT$274.5, below its estimated fair value of NT$344.5, suggesting it may be undervalued based on cash flows. The company forecasts significant revenue and earnings growth above market averages, with expected annual increases of 29% and 39.8%, respectively. Despite a decline in net income for Q3 2024 to TWD 2,005.43 million from TWD 2,399.97 million the previous year, its long-term growth prospects remain strong due to robust revenue performance and high forecasted return on equity of 25.7%.

- The growth report we've compiled suggests that E Ink Holdings' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' balance sheet health report.

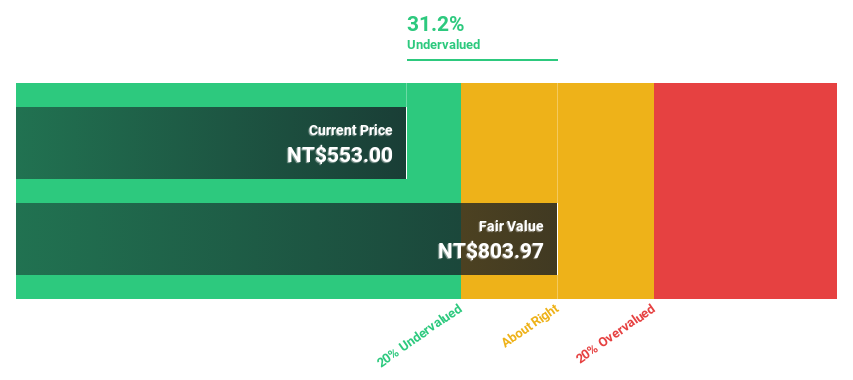

Advanced Energy Solution Holding (TWSE:6781)

Overview: Advanced Energy Solution Holding Co., Ltd. (TWSE:6781) operates in the energy sector and has a market cap of approximately NT$90.54 billion.

Operations: The company generates revenue from its Batteries / Battery Systems segment, amounting to NT$9.33 billion.

Estimated Discount To Fair Value: 16.9%

Advanced Energy Solution Holding is trading at NT$1,165, below its estimated fair value of NT$1,402.69. The company anticipates revenue growth of 24% annually and earnings growth of 32.84%, both surpassing market averages. Despite recent volatility in share price and a slight decline in nine-month net income to TWD 1.44 billion from TWD 1.5 billion last year, the company's strong earnings per share performance and high forecasted return on equity bolster its valuation appeal based on cash flows.

- In light of our recent growth report, it seems possible that Advanced Energy Solution Holding's financial performance will exceed current levels.

- Dive into the specifics of Advanced Energy Solution Holding here with our thorough financial health report.

Key Takeaways

- Explore the 899 names from our Undervalued Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6781

Advanced Energy Solution Holding

Advanced Energy Solution Holding Co., Ltd.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives