- China

- /

- Communications

- /

- SHSE:688418

High Growth Tech Stocks To Explore In January 2025

Reviewed by Simply Wall St

As global markets continue to climb toward record highs, driven by optimism surrounding U.S. trade policies and a surge in AI-related investments, investors are keenly observing the performance of growth stocks, which have recently outpaced their value counterparts. In this dynamic environment, identifying high-growth tech stocks involves looking at companies with strong innovation potential and adaptability to capitalize on emerging trends such as artificial intelligence and evolving trade landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genew Technologies Co., Ltd. focuses on the research, development, production, and sale of communication and network products globally, with a market cap of CN¥6.12 billion.

Operations: Genew Technologies Co., Ltd. specializes in the development, production, and sale of communication and network products on an international scale. The company generates revenue through these core activities, focusing on innovative solutions to meet global market demands.

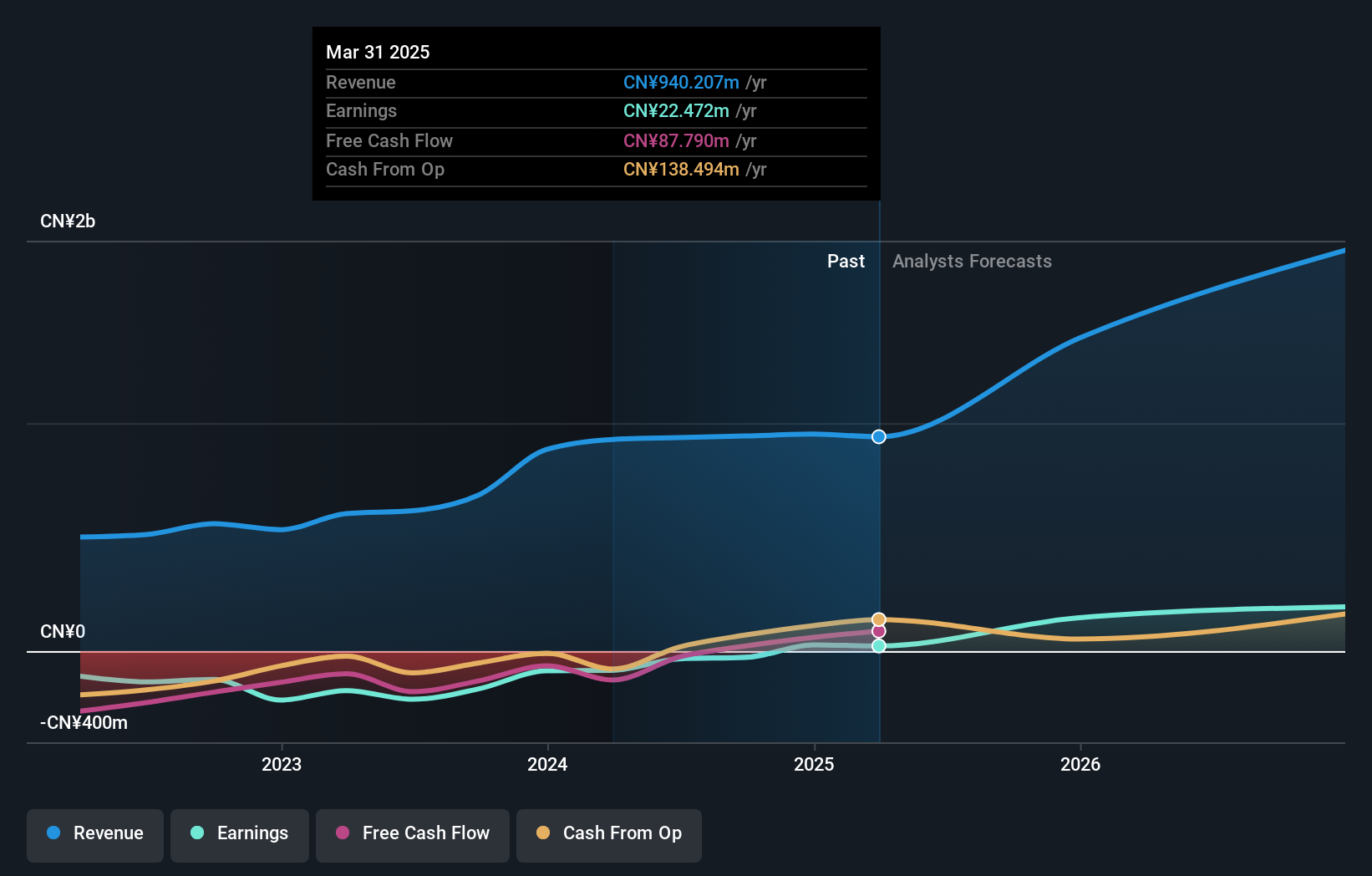

Genew TechnologiesLtd. has demonstrated a notable turnaround, transitioning from a net loss to reporting net income of CNY 16.61 million within nine months, a stark contrast to the previous year's CNY 42.09 million loss. This shift is underscored by a robust annual revenue growth rate of 30.5%, significantly outpacing the broader Chinese market's growth rate of 13.3%. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape. Despite current unprofitability and market volatility, Genew is poised for profitability with an expected earnings growth of 98.87% annually over the next three years, suggesting potential for substantial financial improvement and industry impact.

- Delve into the full analysis health report here for a deeper understanding of Genew TechnologiesLtd.

Chengdu Spaceon Electronics (SZSE:002935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Spaceon Electronics Co., Ltd. specializes in the research, design, production, and sale of time-frequency and satellite application products globally with a market cap of CN¥6.44 billion.

Operations: Chengdu Spaceon Electronics focuses on the development and sale of time-frequency and satellite application products, generating revenue primarily from the computer, communications, and electronic equipment manufacturing sector, which amounts to CN¥1.04 billion.

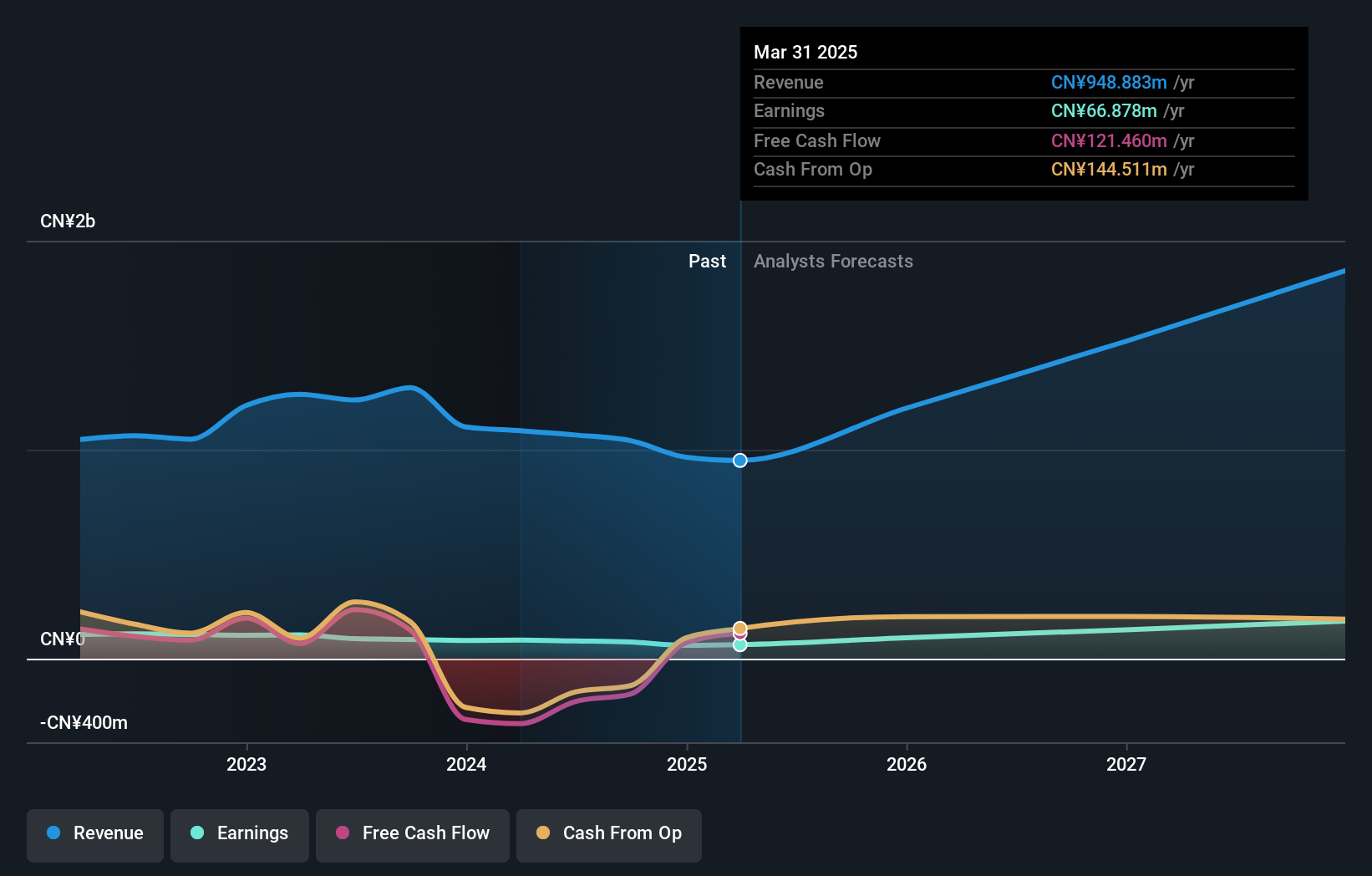

Chengdu Spaceon Electronics, amidst a dynamic tech landscape, has showcased robust growth with a notable 27.7% increase in annual revenue, outstripping the broader Chinese market's expansion of 13.3%. This growth is underpinned by an aggressive R&D strategy where expenses have surged to support innovation—key for maintaining competitive advantage. The company recently emphasized this commitment at their extraordinary shareholders meeting, focusing on strategic initiatives like stock repurchases and audit firm reappointments. With earnings expected to climb by 37% annually, Chengdu Spaceon is positioning itself as a formidable contender in high-tech sectors despite current market challenges.

- Navigate through the intricacies of Chengdu Spaceon Electronics with our comprehensive health report here.

Understand Chengdu Spaceon Electronics' track record by examining our Past report.

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chunghwa Precision Test Tech. Co., Ltd., along with its subsidiaries, specializes in the testing of semiconductor components both in Taiwan and internationally, with a market cap of NT$26.49 billion.

Operations: The company focuses on the semiconductor testing sector, generating revenue primarily from electronic components and parts, amounting to NT$3.09 billion.

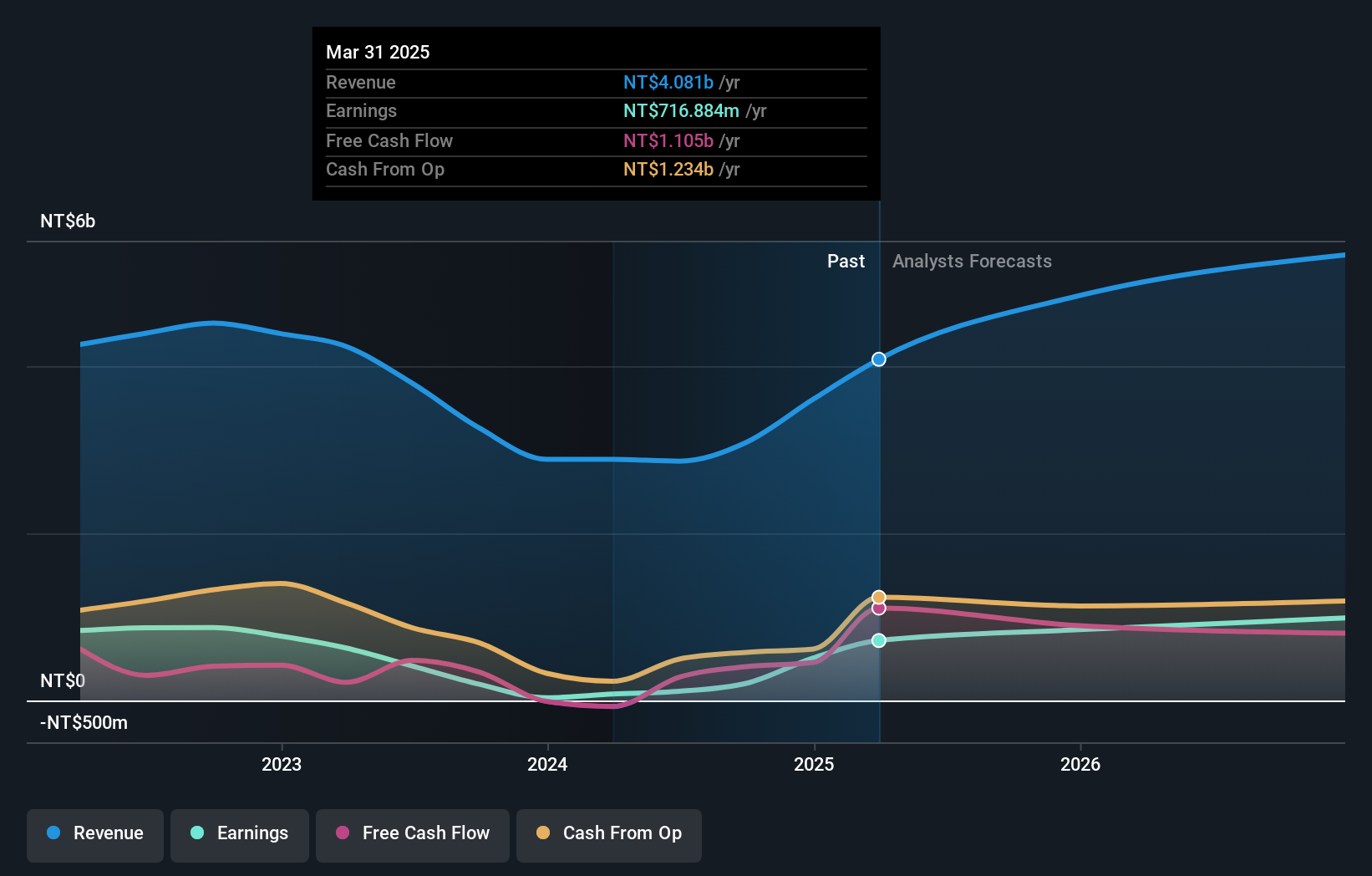

Chunghwa Precision Test Tech has demonstrated a strong trajectory in the tech sector, with anticipated revenue and earnings growth rates of 23.3% and 52.8% per year, respectively, outpacing the Taiwan market averages of 11.3% and 17.4%. This growth is fueled by strategic R&D investments which have been pivotal in maintaining its competitive edge within the high-tech testing solutions arena. Despite a highly volatile share price in recent months, the company's robust financial performance and aggressive innovation efforts were highlighted during their presentation at Citi's 2024 Taiwan Corporate Day, signaling ongoing commitment to expanding its market footprint.

Turning Ideas Into Actions

- Investigate our full lineup of 1231 High Growth Tech and AI Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Genew TechnologiesLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688418

Genew TechnologiesLtd

Engages in the research and development, production, and sale of communication and network products worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives