- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6510

Discovering Undiscovered Gems in February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and fluctuating economic indicators, small-cap stocks have experienced mixed performance, with indices like the S&P 600 reflecting these broader market sentiments. Despite challenges such as cooling job growth and potential trade disruptions, opportunities remain for discerning investors to identify promising small-cap companies that demonstrate resilience and potential for growth. In this environment, a good stock often exhibits strong fundamentals and adaptability to changing market conditions—qualities that can position it as an "undiscovered gem" amidst broader economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 3.46% | 13.95% | 11.27% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Chunghwa Precision Test Tech (TPEX:6510)

Simply Wall St Value Rating: ★★★★★★

Overview: Chunghwa Precision Test Tech. Co., Ltd., along with its subsidiaries, specializes in the testing of semiconductor components both in Taiwan and internationally, with a market cap of NT$27.94 billion.

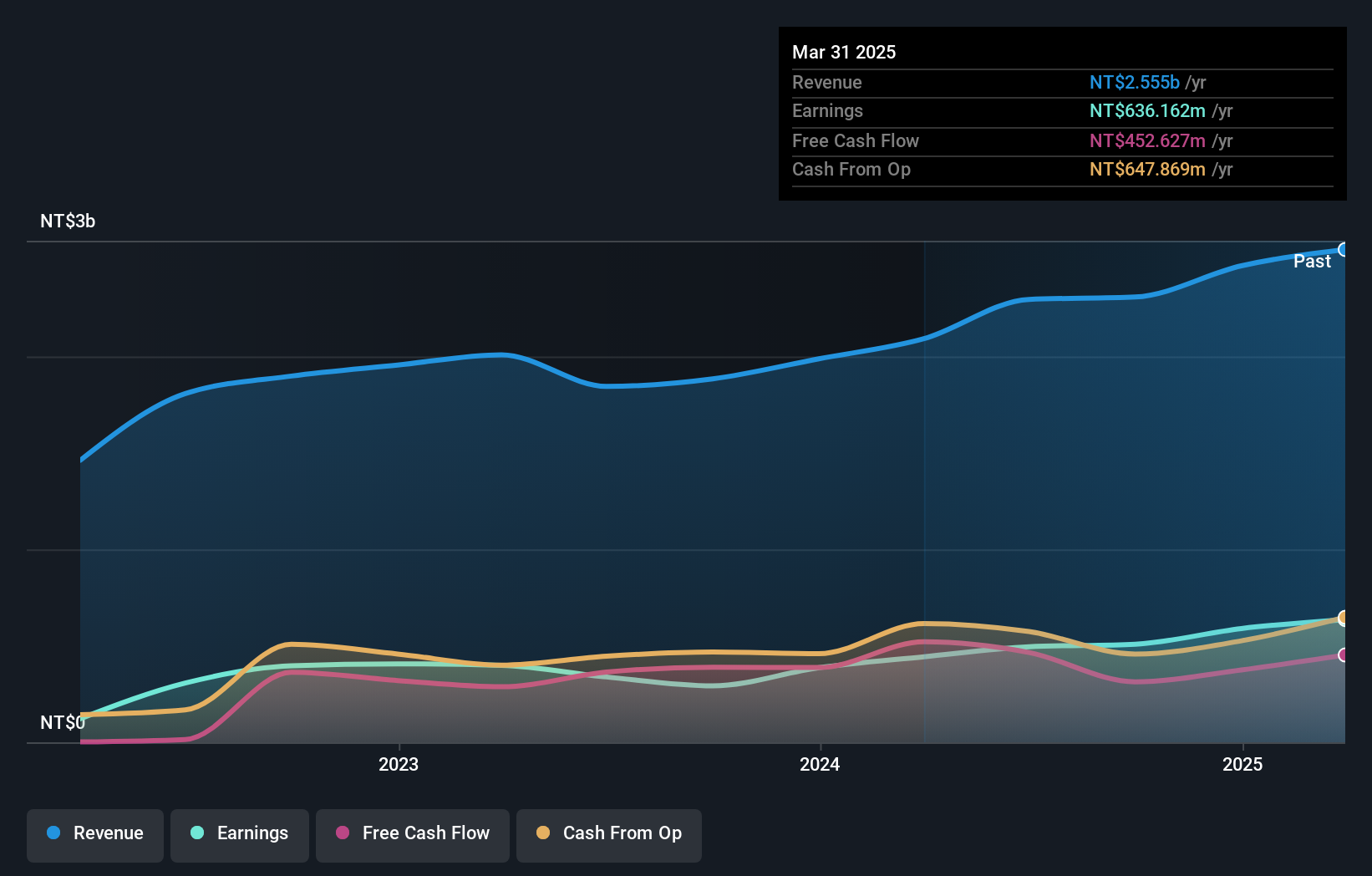

Operations: Chunghwa Precision Test Tech generates revenue primarily from the electronic components and parts segment, amounting to NT$3.60 billion. The company's financial performance is characterized by its focus on semiconductor testing services in various regions.

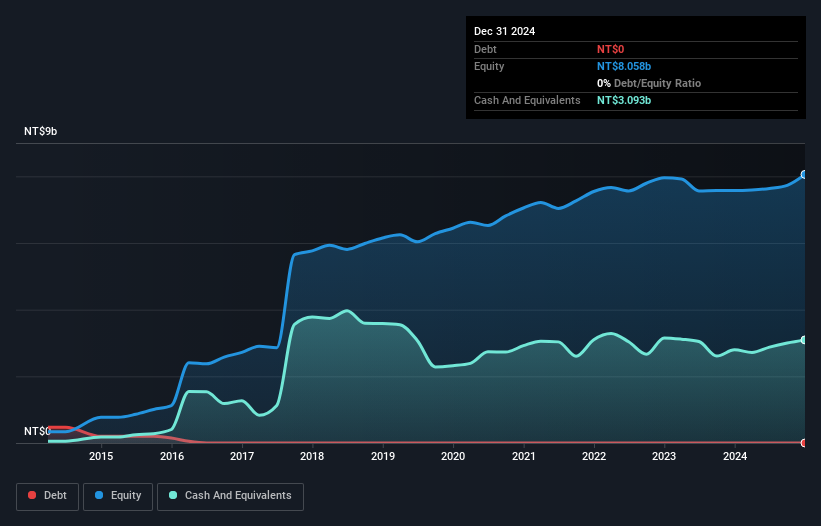

Chunghwa Precision Test Tech, a nimble player in the electronics sector, showcases impressive financial growth with earnings surging 1463.5% over the past year, dwarfing the industry average of 7.8%. The company is debt-free and boasts high-quality earnings, which adds to its financial stability. Recent performance highlights include net income of TWD 509.71 million for 2024 compared to TWD 32.6 million in the previous year and sales reaching TWD 3.60 billion from TWD 2.88 billion a year ago. Despite a volatile share price recently, these figures suggest robust operational health and potential for sustained growth.

Run Long Construction (TWSE:1808)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Run Long Construction Co., Ltd. operates in the construction, sale, and leasing of residential and commercial buildings in Taiwan, with a market capitalization of approximately NT$36.07 billion.

Operations: Run Long Construction derives its revenue primarily from its Construction Industry Department, contributing NT$14.75 billion, while the Construction Division adds NT$4.47 billion to the total.

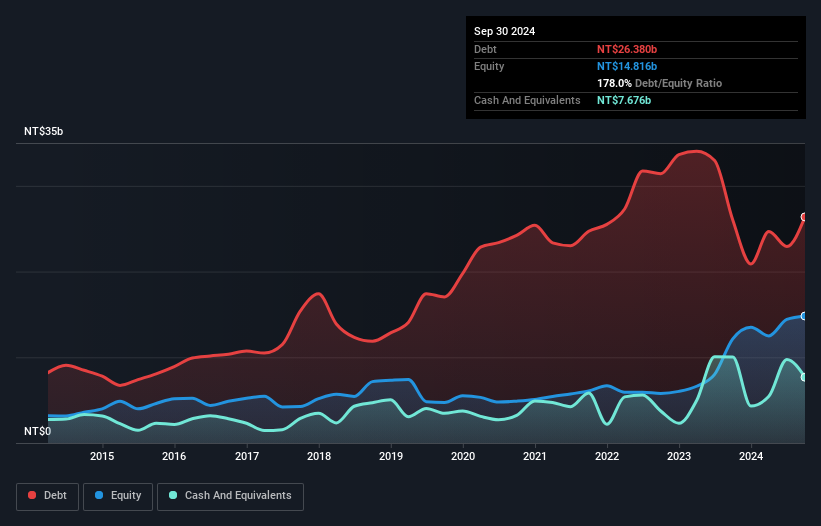

Run Long Construction, a smaller player in the construction sector, has been navigating challenging waters with a recent negative earnings growth of 41.5%, contrasting sharply with the industry average of 9.3%. Despite this, their interest payments are well covered by EBIT at an impressive 140.5 times, indicating robust operational efficiency. The company’s debt to equity ratio has significantly improved from 360% to 178% over five years, although its net debt to equity remains high at 126%. Recent board changes include the resignation of an independent director for personal reasons, potentially impacting governance dynamics moving forward.

- Delve into the full analysis health report here for a deeper understanding of Run Long Construction.

Bonny Worldwide (TWSE:8467)

Simply Wall St Value Rating: ★★★★★★

Overview: Bonny Worldwide Limited, along with its subsidiaries, specializes in the manufacture and sale of OEM and ODM carbon fiber rackets and related sporting goods, with a market cap of NT$12.71 billion.

Operations: The primary revenue stream for Bonny Worldwide Limited comes from the research, development, design, manufacturing, and sales of carbon fiber products, generating NT$2.31 billion.

Bonny Worldwide, a nimble player in its sector, has caught attention with its robust financial health and growth trajectory. Over the past five years, the company reduced its debt to equity ratio from 44.7% to 37.8%, showcasing prudent financial management. Its earnings surged by 74% last year, outpacing the Leisure industry’s -15.6%. With more cash than total debt and positive free cash flow of US$520 million as of March 2024, Bonny seems well-positioned for future endeavors despite recent share price volatility. The company's high-quality earnings further bolster confidence in its operational efficiency and potential growth prospects.

Key Takeaways

- Access the full spectrum of 4699 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6510

Chunghwa Precision Test Tech

Engages in the testing of semiconductor components in Taiwan, Republic of China, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives