- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8358

High Growth Tech Stocks to Watch in September 2025

Reviewed by Simply Wall St

As global markets reach record highs, buoyed by the Federal Reserve's recent rate cut and promising trade developments between the U.S. and China, small-cap stocks have shown notable sensitivity to these changes with the Russell 2000 Index rallying significantly. In this environment of economic shifts and market optimism, identifying high-growth tech stocks involves looking for companies that can leverage lower borrowing costs to innovate and expand while navigating potential risks in a dynamic global landscape.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc. is a biotechnology company specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of ₩25.25 trillion.

Operations: The company generates revenue primarily from its biotechnology segment, totaling ₩158.06 million. Its focus on developing innovative biotechnological solutions positions it within the specialized fields of long-acting biobetters and antibody-drug conjugates.

Alteogen's recent strides in the biotech sector underscore its potential in high-growth markets, particularly with the European Commission's approval of EYLUXVI®, a biosimilar for Eylea®. This approval marks a significant milestone following robust Phase 3 trials across multiple countries, demonstrating comparable efficacy and safety to the original. With annual revenue growth projected at 56.3% and earnings expected to surge by 65.1%, Alteogen is not only expanding its biosimilar portfolio but also reinforcing its market position through strategic product development and regulatory successes. This trajectory is supported by substantial R&D investments, aligning with industry trends towards innovative biologic treatments that address complex conditions like wAMD and DME, potentially setting new standards in therapeutic care.

- Click here and access our complete health analysis report to understand the dynamics of ALTEOGEN.

Review our historical performance report to gain insights into ALTEOGEN's's past performance.

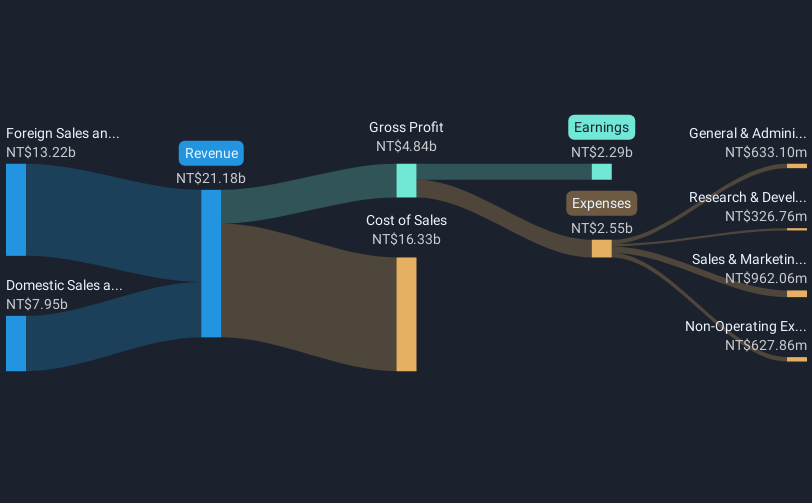

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Taiwan Union Technology Corporation specializes in producing and distributing copper foil substrates, adhesive sheets, and multi-layer laminated boards both domestically and internationally, with a market cap of NT$80.66 billion.

Operations: The company generates revenue through its foreign and domestic sales and manufacturing sectors, with NT$15.98 billion from foreign operations and NT$10.10 billion from domestic activities.

Taiwan Union Technology has demonstrated robust financial performance, with a notable increase in sales to TWD 13.15 billion over six months, marking a significant year-over-year growth. This growth is complemented by an earnings surge of 45.9% over the past year, outpacing the electronic industry's average decline of 1%. The company's commitment to innovation is evident in its R&D strategy, which aligns with its revenue growth projections of 18.7% annually and earnings expected to climb by 31.6% per year. These figures not only reflect Taiwan Union Technology’s strong market position but also underscore its potential to leverage technological advancements for sustained financial health and competitive advantage in a rapidly evolving sector.

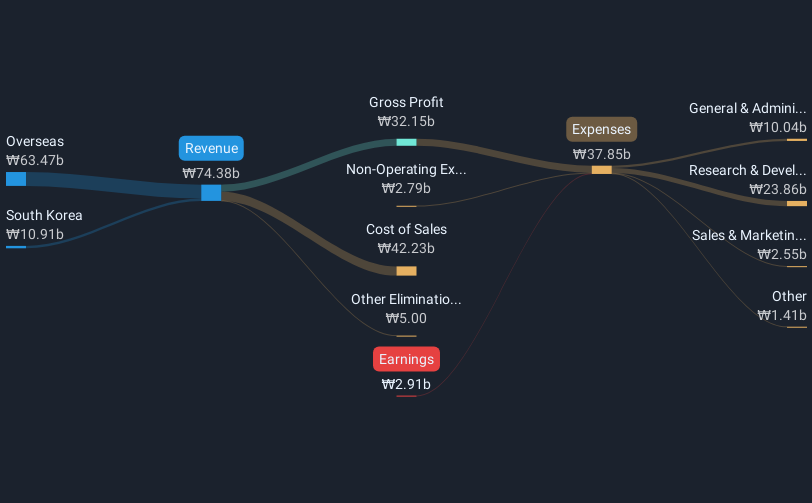

Co-Tech Development (TPEX:8358)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Co-Tech Development Corporation, along with its subsidiaries, specializes in producing and selling copper foil for the printed circuit board industry in Taiwan and China, with a market capitalization of NT$58.18 billion.

Operations: The company generates revenue primarily from the production and sale of copper foil, amounting to NT$7.23 billion.

Co-Tech Development's recent performance underscores its resilience and potential within the tech sector, with a notable revenue increase to TWD 3.73 billion over six months, reflecting a year-over-year growth of 12.3%. This growth trajectory is bolstered by substantial R&D investments, which have consistently aligned with revenue increases, emphasizing the company's commitment to innovation. Despite facing challenges like a decrease in net income from TWD 504.02 million to TWD 431.99 million in the same period, Co-Tech has demonstrated adaptability through strategic board reshuffles and executive changes aimed at strengthening governance and driving future growth strategies. These efforts are pivotal as they lay down a foundation for potentially enhancing operational efficiencies and market competitiveness in an evolving industry landscape.

- Click to explore a detailed breakdown of our findings in Co-Tech Development's health report.

Evaluate Co-Tech Development's historical performance by accessing our past performance report.

Seize The Opportunity

- Click through to start exploring the rest of the 245 Global High Growth Tech and AI Stocks now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8358

Co-Tech Development

Engages in the production and sale of copper foil for printed circuit board industry in Taiwan and China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives