- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

High Growth Tech Stocks Hangzhou Raycloud TechnologyLtd And 2 Others With Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets saw major indexes finish mostly lower, with growth stocks lagging behind value shares. Despite this cautious environment, small-cap stocks showed resilience compared to their larger counterparts, highlighting the potential for high-growth tech companies like Hangzhou Raycloud Technology Ltd to stand out. In such a dynamic market landscape, identifying promising tech stocks often involves looking for those with strong fundamentals and innovative capabilities that can navigate economic uncertainties effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Hangzhou Raycloud TechnologyLtd (SHSE:688365)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Raycloud Technology Co.,Ltd is an e-commerce software and service technology company operating in China and internationally, with a market capitalization of CN¥3.58 billion.

Operations: Raycloud generates revenue primarily from its Internet Software & Services segment, amounting to CN¥476.40 million. The company focuses on providing e-commerce software solutions and services both domestically in China and internationally.

Hangzhou Raycloud TechnologyLtd has shown a promising turnaround, becoming profitable this year with a reported net loss reduction from CN¥91.87 million to CN¥55.74 million in the latest nine-month period. This shift is underscored by an earnings forecast projecting a robust annual growth of 71.3%, significantly outpacing the Chinese market's average of 26.3%. Despite these gains, its revenue growth at 14.7% slightly exceeds the market norm but remains under the high-growth threshold often sought in tech sectors, indicating potential areas for strategic enhancement particularly in R&D where increased expenditure could fuel further innovations and market share expansion.

Jiangsu Smartwin Electronics TechnologyLtd (SZSE:301106)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Smartwin Electronics Technology Co., Ltd. specializes in the development and manufacturing of electronic test and measurement instruments, with a market capitalization of CN¥3.34 billion.

Operations: Smartwin generates revenue primarily from its electronic test and measurement instruments segment, amounting to CN¥758.76 million.

Jiangsu Smartwin Electronics Technology Ltd. has demonstrated robust growth, with a notable increase in revenue from CN¥414.1 million to CN¥602.8 million over the past year, reflecting a 28.8% annual growth rate that surpasses the Chinese market average of 14%. This financial upswing is complemented by an earnings surge of 33.6% per year, outpacing broader market expectations by a significant margin. The company's strategic focus on R&D is evident from its recent earnings report; however, further investment in this area could be key to sustaining its competitive edge and fostering innovation within the tech sector.

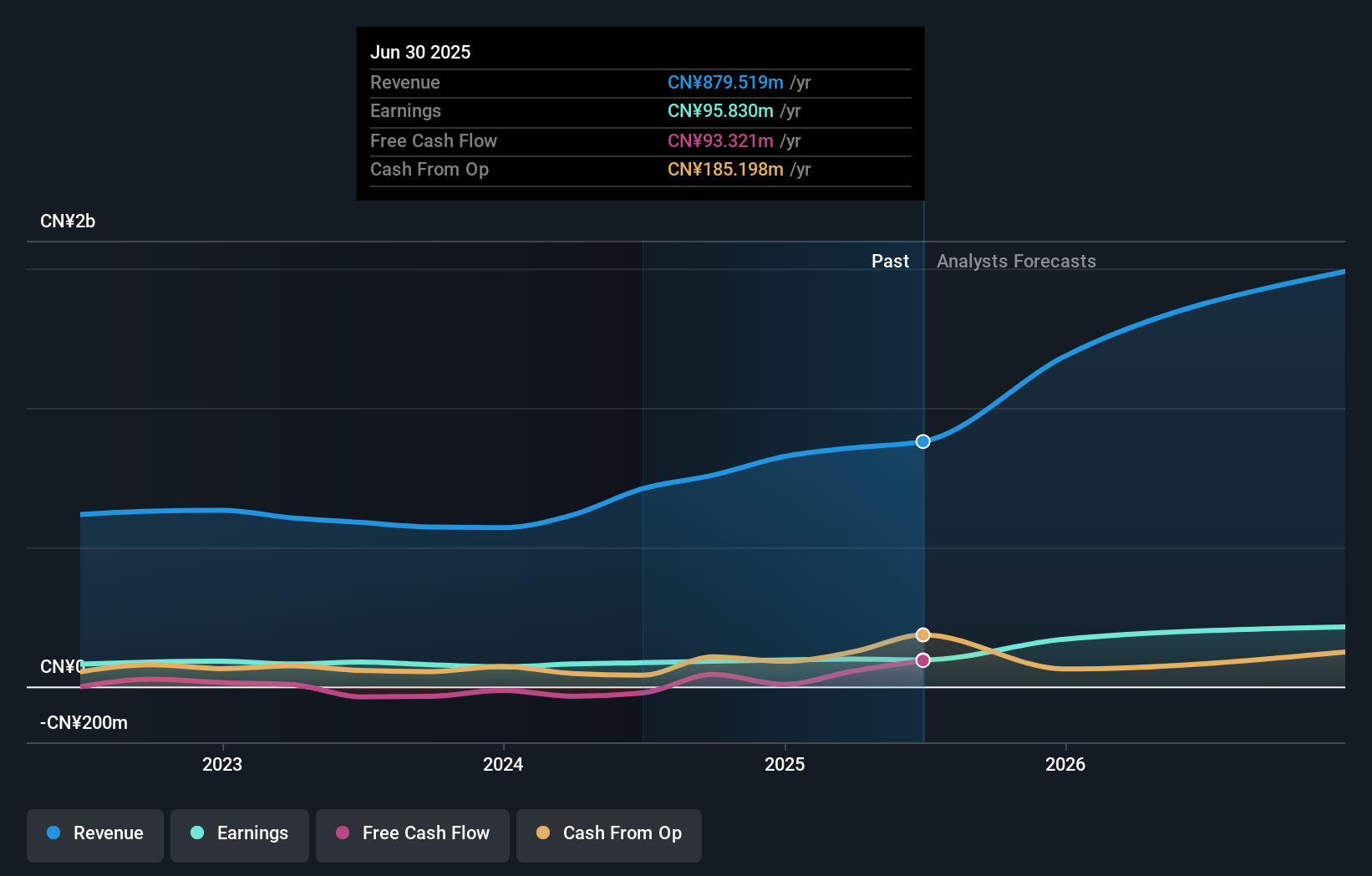

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Taiwan Union Technology Corporation specializes in the production and distribution of copper foil substrates, adhesive sheets, and multi-layer laminated boards both domestically and internationally, with a market capitalization of NT$43.25 billion.

Operations: Taiwan Union Technology focuses on manufacturing and selling copper foil substrates, adhesive sheets, and multi-layer laminated boards across domestic and international markets. The company operates with a market capitalization of NT$43.25 billion.

Taiwan Union Technology has shown a compelling growth trajectory, with its earnings soaring by 217.9% over the past year, significantly outpacing the broader electronics industry's average of 4.8%. This surge is backed by a robust R&D commitment, as evidenced by an increase in R&D expenses which aligns with their revenue growth of 16.8% per annum, surpassing Taiwan's market average of 12.3%. Looking ahead, the company is poised for further expansion with projected earnings growth of 23.6% annually, suggesting a strong potential for continued innovation and market leadership in technology sectors critical to Taiwan's economic fabric.

- Navigate through the intricacies of Taiwan Union Technology with our comprehensive health report here.

Learn about Taiwan Union Technology's historical performance.

Key Takeaways

- Reveal the 1281 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Very undervalued with high growth potential.