- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6274

High Growth Tech And These 3 Promising Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices like the S&P 500 and Nasdaq Composite reflecting strong annual gains despite recent fluctuations, investors are closely watching economic indicators such as the Chicago PMI and GDP forecasts for signs of future trends. In this environment, identifying promising stocks in high-growth sectors like technology requires careful consideration of factors such as innovation potential, adaptability to market changes, and resilience amidst broader economic shifts.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.09% | 45.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Cicor Technologies (SWX:CICN)

Simply Wall St Growth Rating: ★★★★☆☆

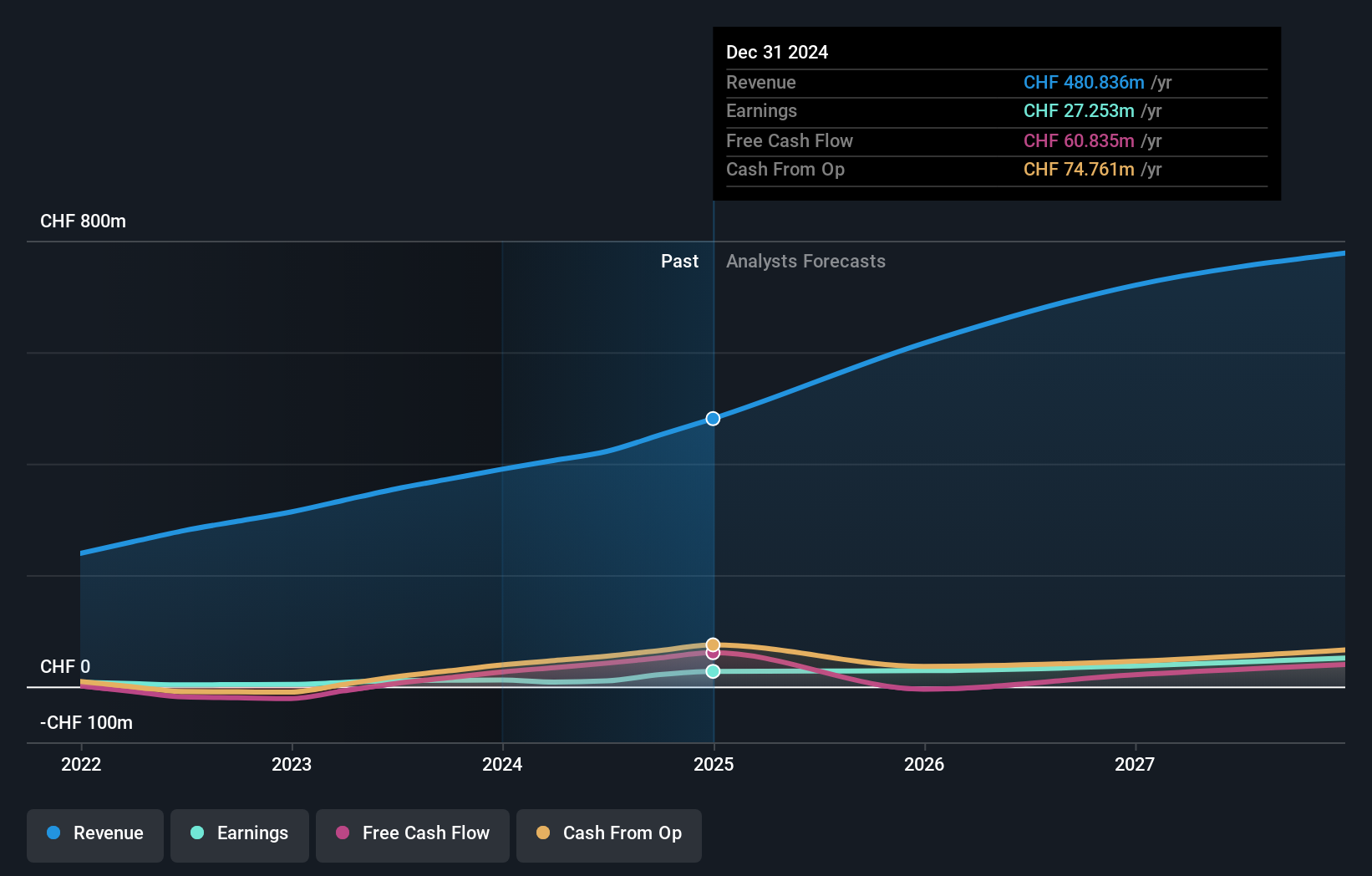

Overview: Cicor Technologies Ltd. is a global company that develops and manufactures electronic components, devices, and systems, with a market capitalization of CHF254.78 million.

Operations: Cicor Technologies Ltd. operates through two main divisions: Advanced Substrates (AS) and Electronic Manufacturing Services (EMS), generating revenues of CHF46.24 million and CHF377.46 million, respectively. The EMS division is the primary revenue driver for the company, contributing significantly more than the AS division.

Cicor Technologies, amid a challenging market backdrop, has demonstrated resilience with a revenue growth forecast of 6.6% per year, outpacing the Swiss market's 4.2%. This growth is underpinned by significant R&D investments aimed at driving innovation in electronic components—a sector critical to tech advancements globally. Despite recent downward revisions in sales guidance for 2024 to CHF 470-490 million from an earlier range up to CHF 510 million, Cicor's strategic emphasis on mergers and acquisitions signals a robust approach to scaling operations and enhancing its market footprint. Moreover, the company's earnings are expected to surge by an impressive 28.3% annually, suggesting strong underlying profitability and operational efficiency that could position Cicor favorably for future industry shifts.

- Delve into the full analysis health report here for a deeper understanding of Cicor Technologies.

Understand Cicor Technologies' track record by examining our Past report.

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★☆

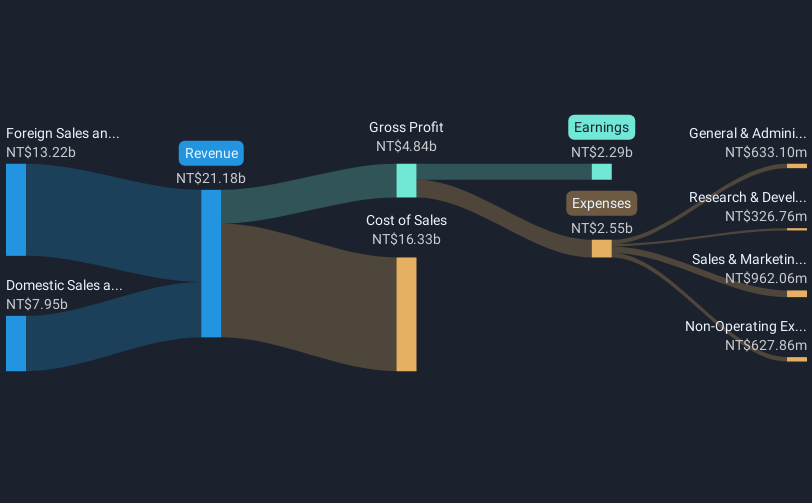

Overview: Taiwan Union Technology Corporation specializes in producing and distributing copper foil substrates, adhesive sheets, and multi-layer laminated boards both domestically and internationally, with a market cap of NT$47.69 billion.

Operations: The company generates revenue primarily through its foreign sales and manufacturing sector, which contributes NT$13.22 billion, while the domestic sector adds NT$7.95 billion. The focus on international markets indicates a significant portion of its business operations are outside Taiwan.

Taiwan Union Technology has shown remarkable performance, with its third-quarter sales surging to TWD 6.62 billion from TWD 4.18 billion year-over-year, reflecting a robust annualized revenue growth of 16.9%. This growth trajectory is bolstered by earnings which skyrocketed by 217.9% over the past year, significantly outpacing the broader electronic industry's growth rate. The company's commitment to innovation is evident in its strategic R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape. With earnings projected to grow by 23.6% annually and a high Return on Equity forecast at 24.5% in three years, Taiwan Union Technology is well-positioned to capitalize on industry trends and expand its market presence further.

AT & S Austria Technologie & Systemtechnik (WBAG:ATS)

Simply Wall St Growth Rating: ★★★★☆☆

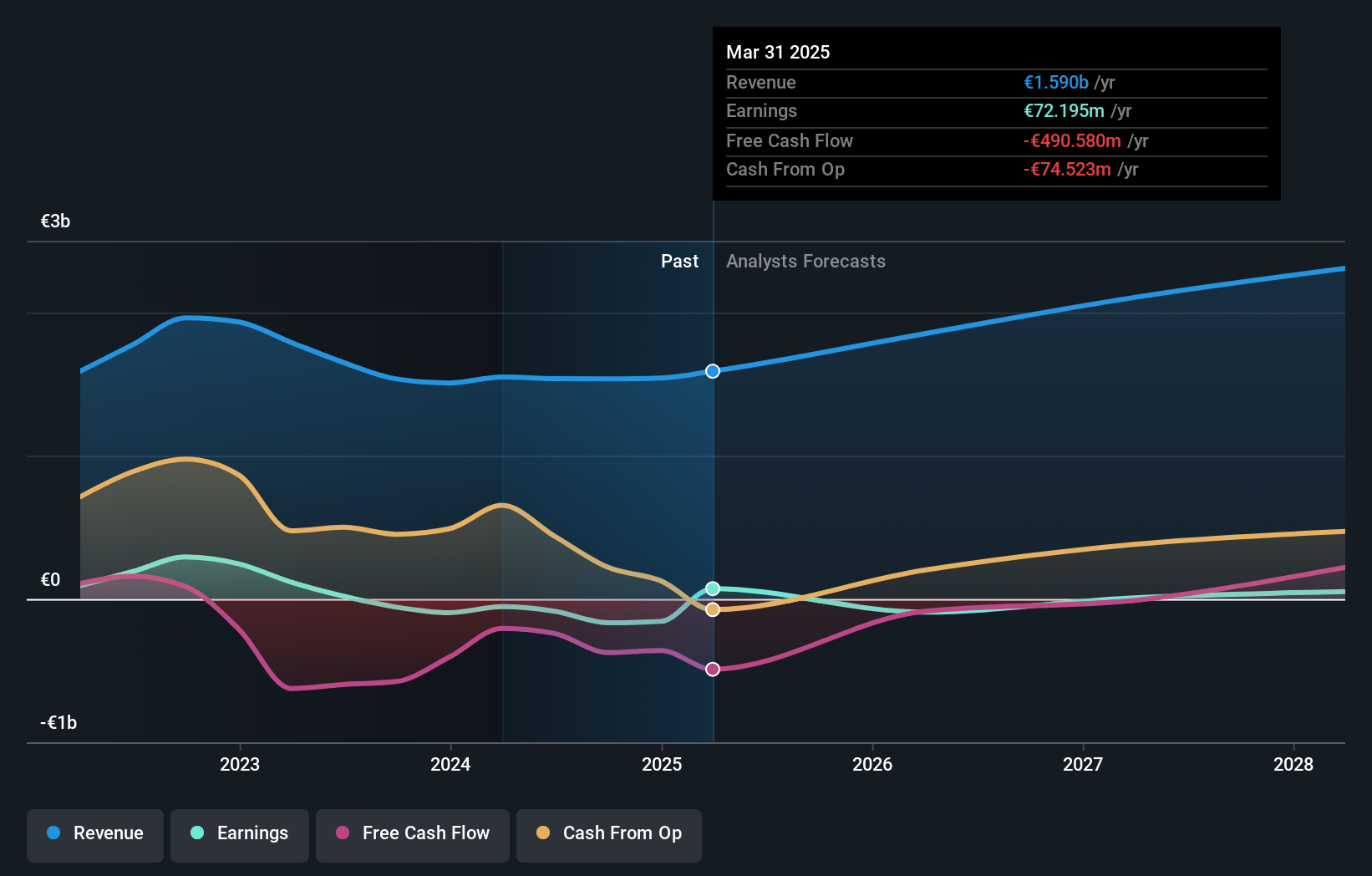

Overview: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, along with its subsidiaries, is engaged in the manufacturing and distribution of printed circuit boards across various regions including Austria, Germany, Europe, China, Asia, and the Americas with a market capitalization of €516.32 million.

Operations: AT & S generates revenue primarily from its Microelectronics (BU ME) and Electronics Solutions (BU ES) segments, with BU ES contributing €965.88 million. The company's market presence spans Austria, Germany, Europe, China, Asia, and the Americas.

AT&S Austria Technologie & Systemtechnik is navigating a challenging landscape with its recent earnings revision for FY 2026-27, projecting revenues between €2.1 billion and €2.4 billion, a reduction from the previously expected €3.0 billion. Despite these hurdles, the company's R&D commitment remains robust, crucial for maintaining competitiveness in the fast-evolving tech industry where innovation leads market trends. Notably, AT&S's revenue growth forecast at 17.8% annually outpaces the Austrian market significantly (0.7% per year), underscoring its potential to recover and expand in its sector despite current setbacks and a highly volatile share price over the past three months.

Seize The Opportunity

- Reveal the 1267 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Union Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6274

Taiwan Union Technology

Engages in the manufacture and sale of copper foil substrates, adhesive sheets, and multi-layer laminated boards in Taiwan and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives