Exploring Undiscovered Gems with Potential This December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainty, smaller-cap indexes have faced particular challenges, reflecting broader investor sentiment. Despite these headwinds, opportunities may still exist for discerning investors who seek stocks with strong fundamentals and growth potential in underexplored areas.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Kunshan Kinglai Hygienic MaterialsLtd (SZSE:300260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kunshan Kinglai Hygienic Materials Ltd operates in the hygienic materials industry and has a market capitalization of CN¥11.43 billion.

Operations: Kinglai generates revenue primarily from its hygienic materials segment. The company's gross profit margin has shown a notable trend, reaching 40% in the latest reporting period.

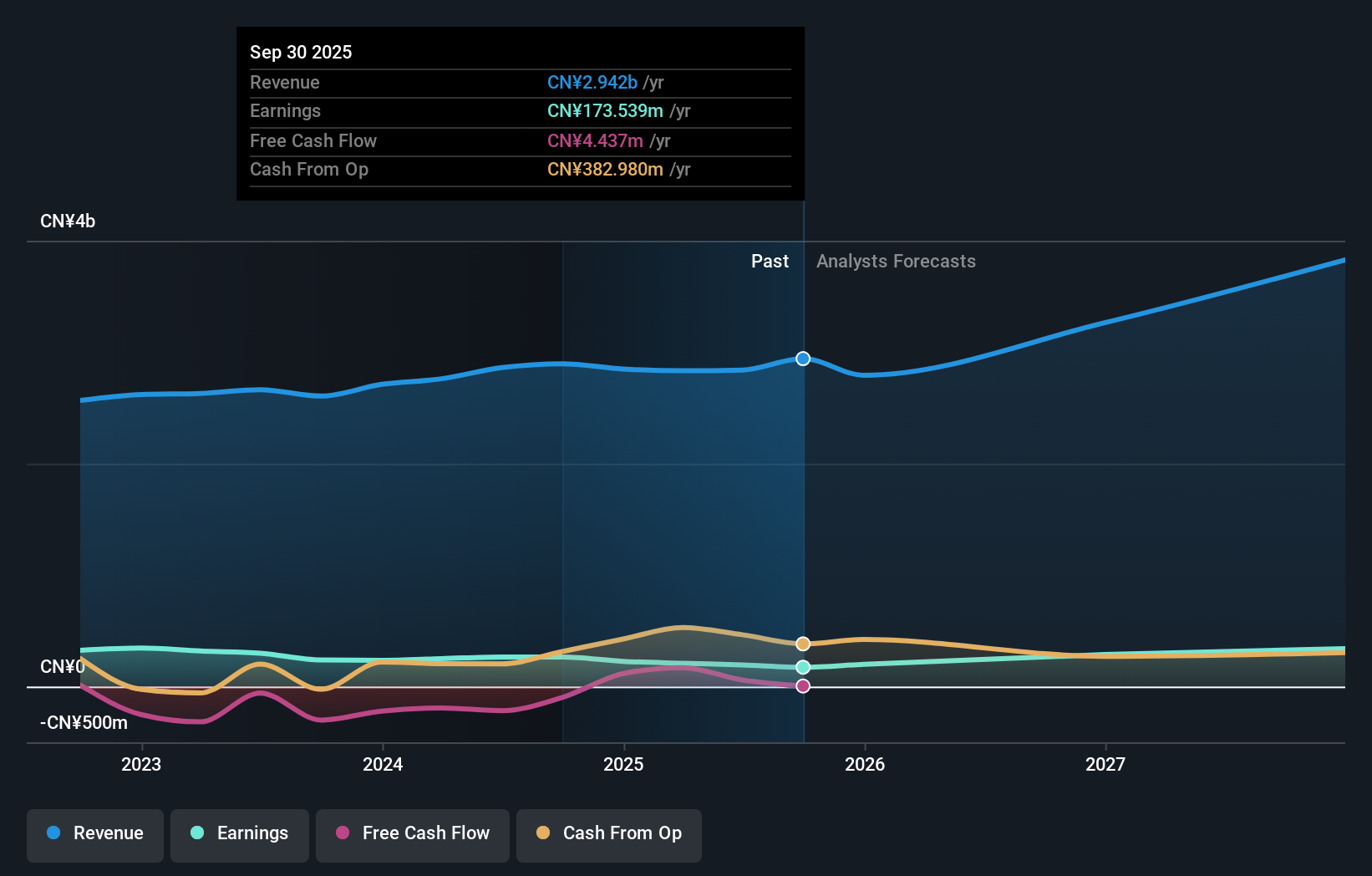

Kunshan Kinglai, a niche player in the hygienic materials sector, has shown robust earnings growth of 11.6% over the past year, outpacing the Machinery industry's -0.2%. With net income rising to CNY 198.03 million from CNY 168.35 million last year and basic earnings per share increasing to CNY 0.4856, financial performance is promising despite a high net debt to equity ratio of 59.8%. The company enjoys strong interest coverage with EBIT covering interest payments by 7.4 times but faces challenges with free cash flow remaining negative and debt not well covered by operating cash flow.

Quanta Storage (TPEX:6188)

Simply Wall St Value Rating: ★★★★★★

Overview: Quanta Storage Inc. engages in the research, development, production, and sale of data storage and processing equipment, electronic components, optical instruments, and industrial robots across various international markets including Mainland China and the United States; it has a market cap of NT$30.20 billion.

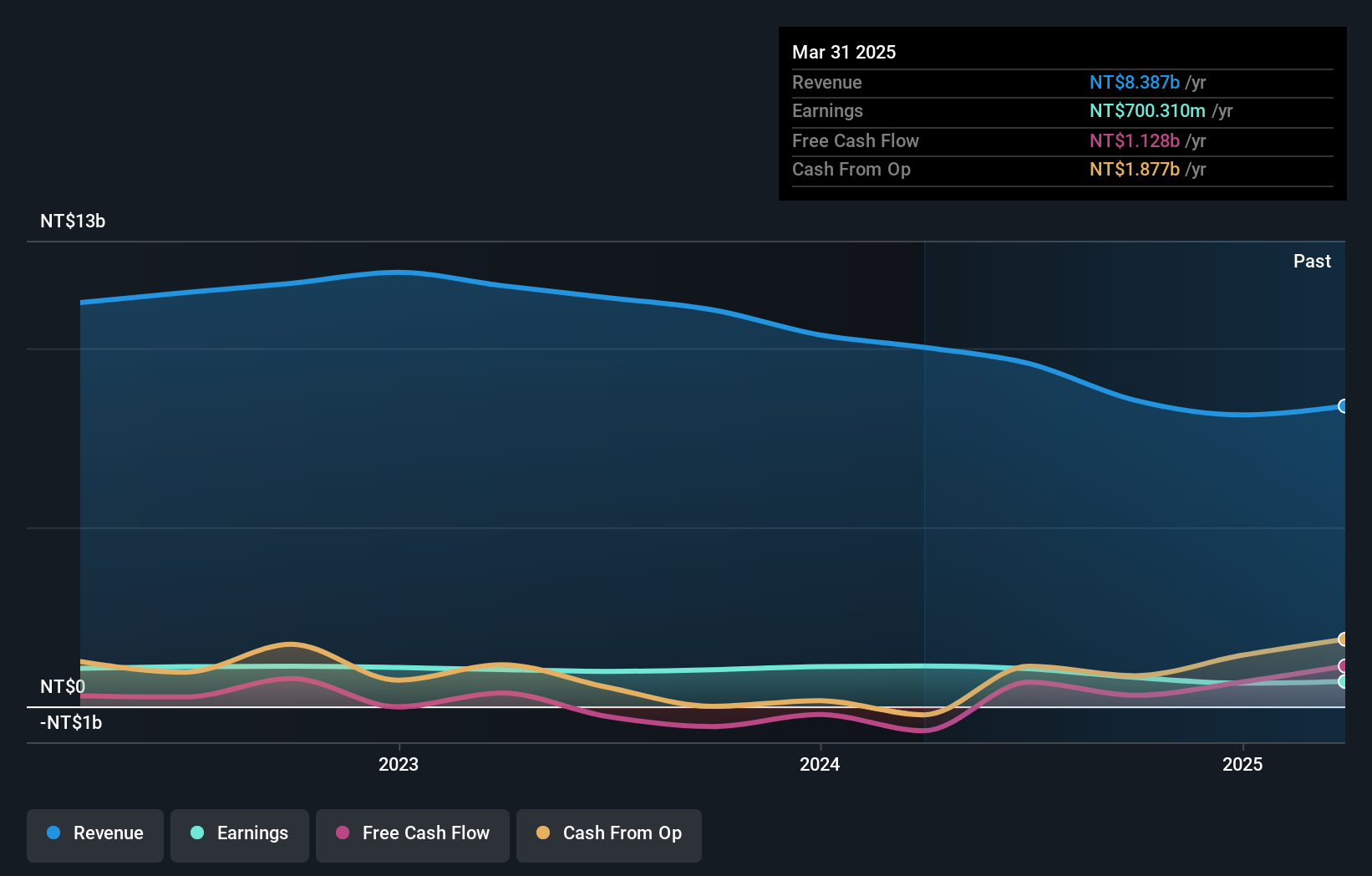

Operations: Quanta Storage generates revenue primarily from its Taiwan Center, contributing NT$8.50 billion, followed by the Southeast Asia Center and the Center in Mainland China with NT$3.45 billion and NT$3.25 billion, respectively.

Quanta Storage, a small cap player in the tech sector, is navigating challenging waters. Despite being debt-free and boasting high-quality past earnings, its recent performance shows negative earnings growth of 21%, contrasting sharply with the industry average of 11.4%. The company reported third-quarter sales at TWD 1.70 billion, down from TWD 2.72 billion last year, with net income also dipping to TWD 102 million from TWD 342 million. Over nine months, sales totaled TWD 5.77 billion versus last year's TWD 7.60 billion, indicating potential headwinds in maintaining profitability amidst industry pressures.

- Unlock comprehensive insights into our analysis of Quanta Storage stock in this health report.

Examine Quanta Storage's past performance report to understand how it has performed in the past.

Apex Dynamics (TWSE:4583)

Simply Wall St Value Rating: ★★★★★★

Overview: Apex Dynamics, Inc. specializes in the production and sale of robots for plastics injection molding machines across Taiwan and various international markets, with a market capitalization of NT$64.94 billion.

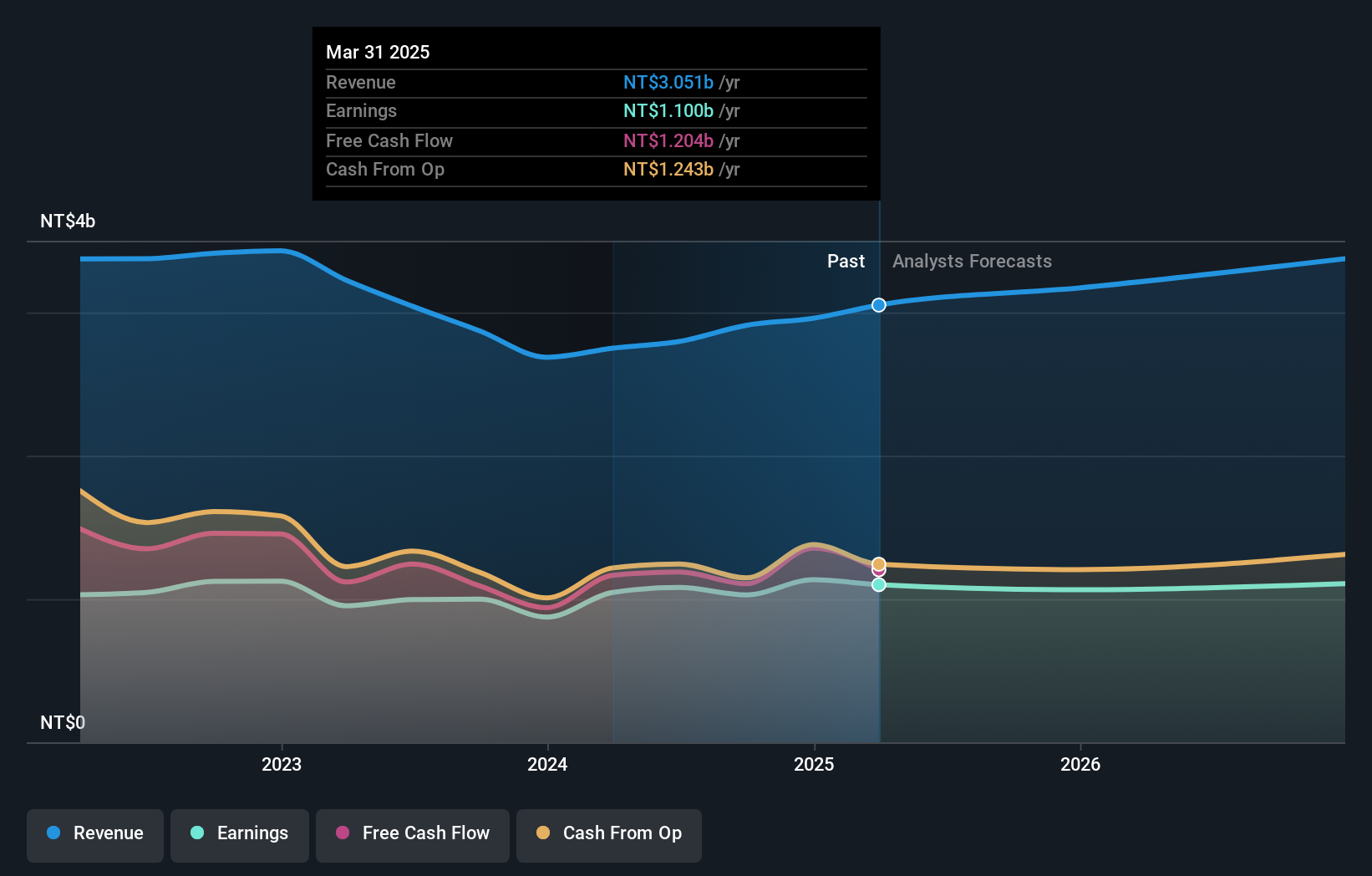

Operations: Apex Dynamics generates revenue primarily from its Precision Machinery Department, contributing NT$2.34 billion, alongside a smaller contribution from the Hospitality Service Segment at NT$571.76 million.

Apex Dynamics, a small player in the machinery sector, has shown consistent earnings growth of 10.5% annually over the past five years. Despite its debt-free status and high-quality earnings, recent performance reveals some challenges. The company reported third-quarter sales of TWD 758.75 million, up from TWD 646.27 million last year, yet net income fell to TWD 251.63 million from TWD 303.49 million previously due to increased expenses or other operational factors likely impacting profitability. Basic EPS dropped to TWD 3.14 from TWD 3.79 a year ago, suggesting room for improvement in cost management or revenue generation strategies moving forward.

- Get an in-depth perspective on Apex Dynamics' performance by reading our health report here.

Gain insights into Apex Dynamics' past trends and performance with our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 4624 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kunshan Kinglai Hygienic MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300260

Kunshan Kinglai Hygienic MaterialsLtd

Kunshan Kinglai Hygienic Materials Co.,Ltd.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026