- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5439

Top Three Dividend Stocks For June 2024

Reviewed by Simply Wall St

As global markets navigate through a landscape marked by political turmoil in Europe and mixed economic signals from major economies, investors continue to seek stable returns amidst uncertainty. In this context, dividend stocks emerge as appealing options for those looking to generate steady income from their investments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.49% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.13% | ★★★★★★ |

| Allianz (XTRA:ALV) | 5.40% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.58% | ★★★★★★ |

| Globeride (TSE:7990) | 3.65% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 5.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

| Innotech (TSE:9880) | 4.05% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

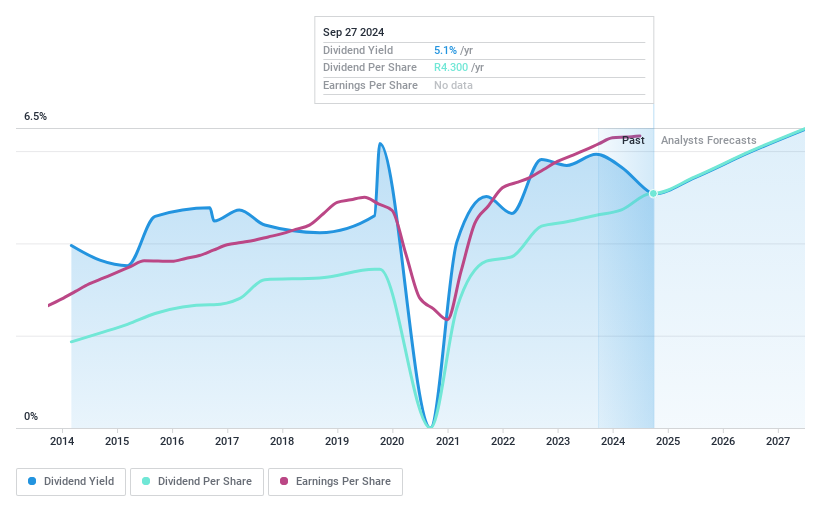

FirstRand (JSE:FSR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FirstRand Limited offers a range of financial products including transactional services, lending, investments, and insurance across multiple regions such as South Africa, other parts of Africa, the UK, Europe, Asia, the US, and Australia; it has a market capitalization of approximately ZAR 395.15 billion.

Operations: FirstRand Limited generates revenue through its Aldermore segment at ZAR 13.24 billion, Wesbank in the Retail and Commercial sector at ZAR 7.12 billion, RMB in the Corporate and Institutional sector at ZAR 24.89 billion, and FNB Rest of Africa in the Retail and Commercial sector at ZAR 10.44 billion.

Dividend Yield: 5.7%

FirstRand has demonstrated a mixed dividend history, with payments showing significant volatility over the past decade. Despite this instability, the dividends are reasonably covered by earnings, with a current payout ratio of 58.3% and similar forecasts for the next three years. However, its dividend yield at 5.67% remains below the top quartile of ZA market payers, which stands at 9.16%. Additionally, concerns about its high bad loans ratio at 4% could impact future financial stability.

- Click here to discover the nuances of FirstRand with our detailed analytical dividend report.

- Our valuation report here indicates FirstRand may be overvalued.

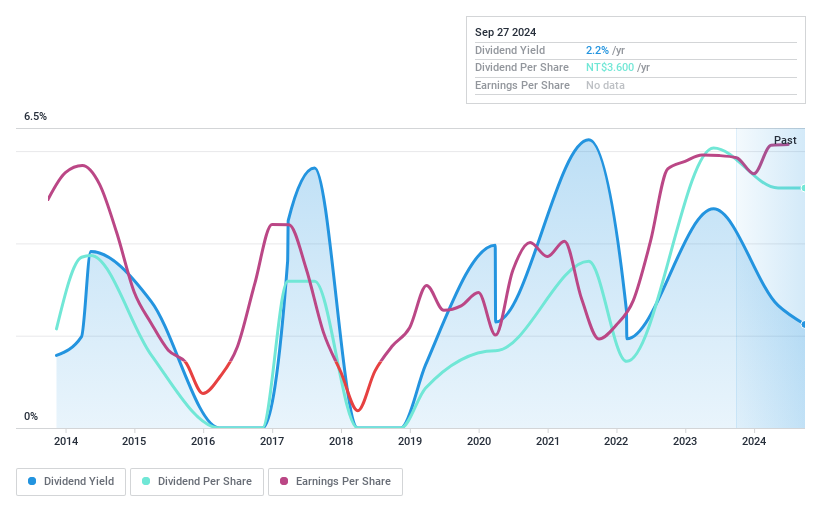

Browave (TPEX:3163)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Browave Corporation specializes in designing, manufacturing, and selling optical fiber communication components, operating both in Taiwan and internationally, with a market capitalization of approximately NT$9.54 billion.

Operations: Browave Corporation generates revenue primarily from its optical communication optical module segment, totaling NT$2.74 billion.

Dividend Yield: 3%

Browave's dividend yield at 3.04% trails behind the top quartile in the TW market, which is 4.23%. The company's dividends, however, are supported by a payout ratio of 55.6% and a cash payout ratio of 59.6%, indicating reasonable coverage by both earnings and cash flow despite a history of volatility in dividend payments over the past decade. Recent financials show significant improvement with net income more than doubling to TWD 135.16 million from TWD 60.46 million year-over-year, although sales slightly decreased to TWD 548.8 million from TWD 588.03 million.

- Dive into the specifics of Browave here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Browave is trading beyond its estimated value.

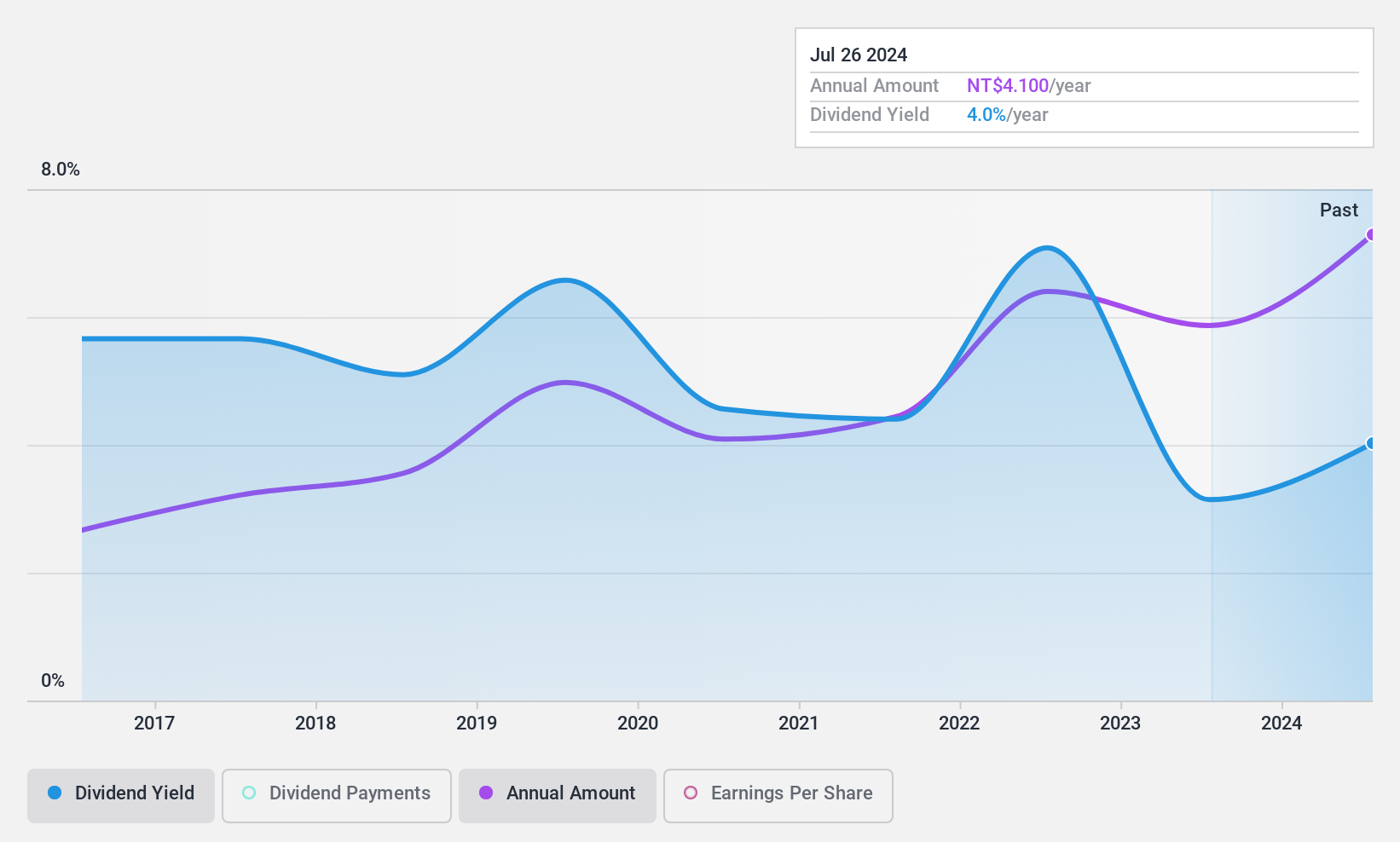

First Hi-tec Enterprise (TPEX:5439)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Hi-tec Enterprise Co., Ltd. specializes in manufacturing and selling printed circuit boards (PCBs) primarily in Taiwan and across Asia, with a market capitalization of NT$9.13 billion.

Operations: First Hi-tec Enterprise Co., Ltd. generates NT$4.26 billion from its core operations in the PCB and computer peripheral equipment sector.

Dividend Yield: 4.2%

First Hi-tec Enterprise has demonstrated a mixed performance in dividend sustainability. While the company's dividends have shown reliability and growth over the past decade, its current payout ratio of 83% and a high cash payout ratio of 177.4% indicate that these payments are not well-supported by earnings or free cash flow. Additionally, its recent financial results reveal a decline in both sales and net income for Q1 2024 compared to the previous year, with sales dropping to TWD 923.98 million from TWD 1,015.41 million and net income decreasing to TWD 100.38 million from TWD 112.34 million, which may further strain its dividend sustainability despite a below-market price-to-earnings ratio of 19.9x.

- Click to explore a detailed breakdown of our findings in First Hi-tec Enterprise's dividend report.

- Our comprehensive valuation report raises the possibility that First Hi-tec Enterprise is priced higher than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 1959 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5439

First Hi-tec Enterprise

Engages in the manufacture and sale of printed circuit boards (PCBs) in Taiwan and rest of Asia.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion