Amidst a backdrop of record highs in the S&P 500 and Nasdaq Composite, fueled by easing geopolitical tensions and positive trade developments, global markets have shown resilience despite rising inflationary pressures. As investors navigate this dynamic landscape, identifying high-growth tech stocks with strong global potential can be pivotal, particularly those that demonstrate robust innovation and adaptability to capitalize on emerging opportunities within the evolving economic environment.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

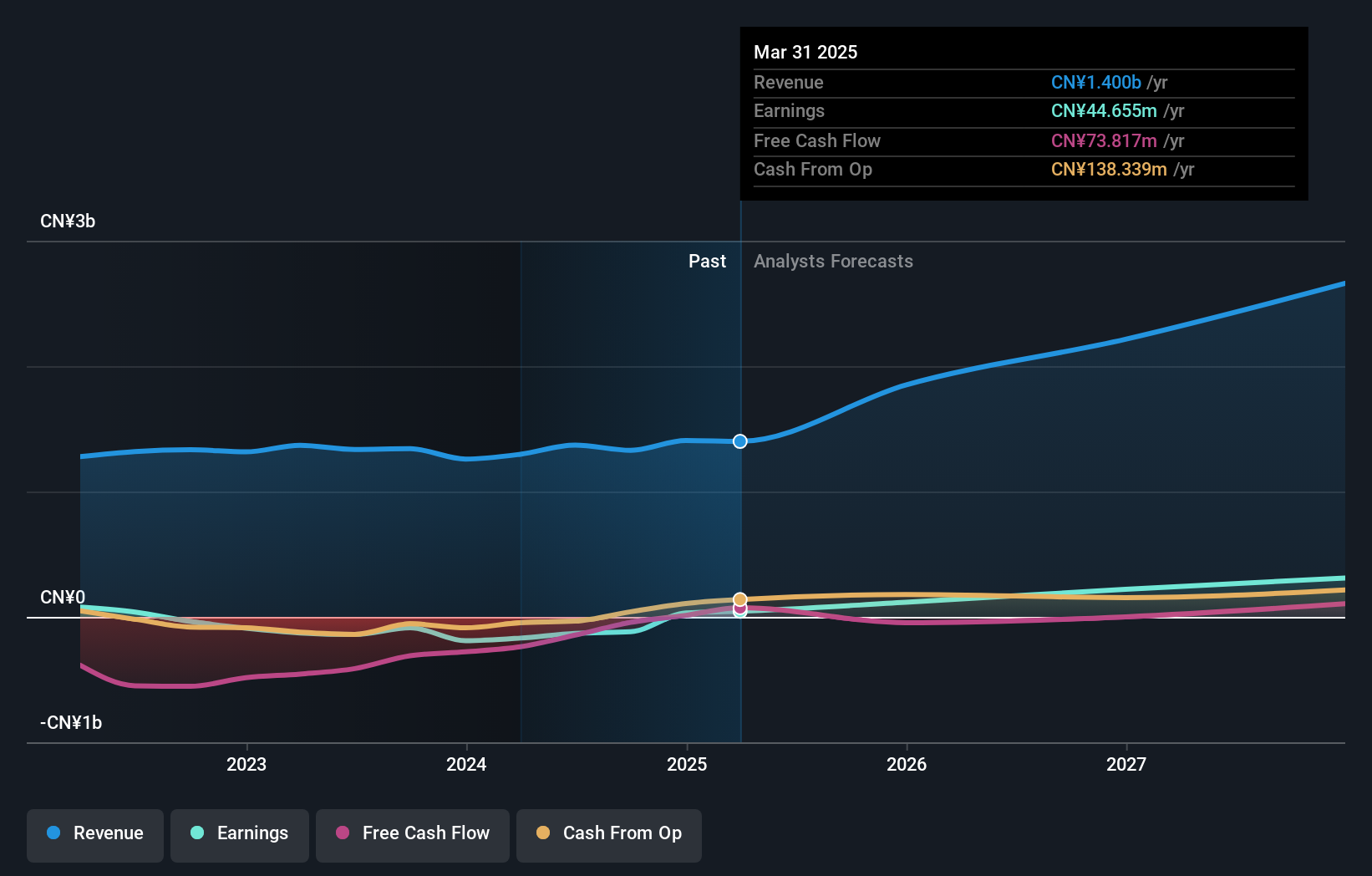

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥8.74 billion.

Operations: The company generates revenue primarily from pharmaceutical manufacturing, amounting to CN¥1.40 billion.

Kexing Biopharm's recent FDA approval for its innovative cancer cachexia treatment, GB18, underscores its commitment to addressing significant unmet medical needs. With an annualized revenue growth of 21.9% and earnings growth soaring at 56.4%, the company is strategically positioned in a high-potential market segment. The robust investment in R&D, evidenced by substantial expenditure figures relative to revenue (specific figures not provided), fuels its pipeline development and innovation capabilities. This strategic focus not only enhances Kexing's market presence but also solidifies its role in pioneering treatments for complex medical conditions, setting a progressive trajectory in the biopharmaceutical sector.

- Get an in-depth perspective on Kexing Biopharm's performance by reading our health report here.

Evaluate Kexing Biopharm's historical performance by accessing our past performance report.

First Hi-tec Enterprise (TPEX:5439)

Simply Wall St Growth Rating: ★★★★★☆

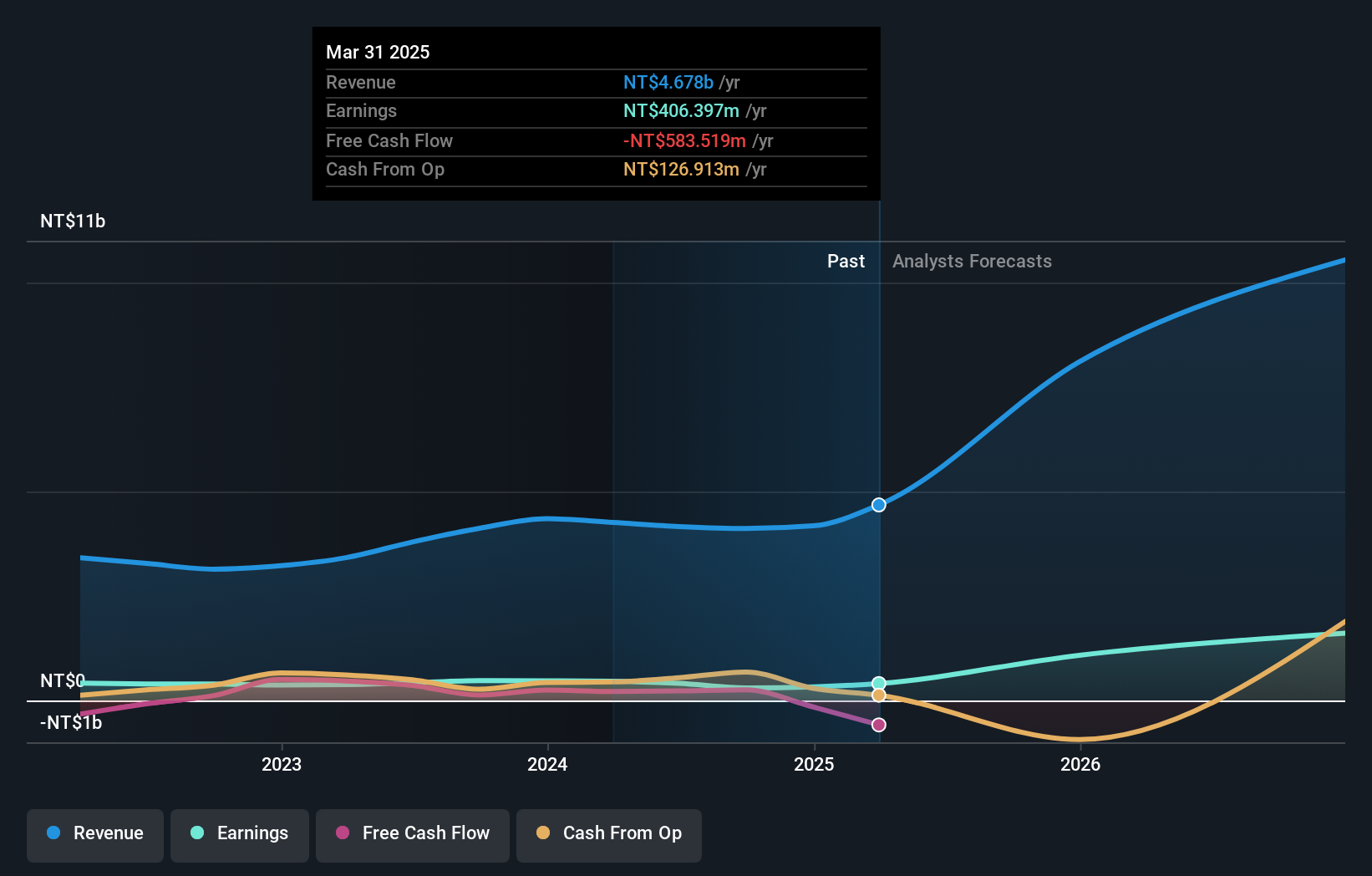

Overview: First Hi-tec Enterprise Co., Ltd. specializes in the manufacture and sale of printed circuit boards (PCBs) across Taiwan and Asia, with a market capitalization of NT$22.69 billion.

Operations: The company generates revenue primarily from the manufacture and sale of printed circuit boards and computer peripheral equipment, amounting to NT$4.68 billion.

First Hi-tec Enterprise has demonstrated robust growth with a 42.4% annual increase in revenue and an impressive 65.7% surge in earnings, outpacing the broader TW market significantly. The company's commitment to innovation is evident from its R&D spending, which has grown consistently, underpinning its future prospects in the tech industry. Recent strategic changes, including amendments to corporate bylaws and executive shifts, suggest a proactive approach to governance and operational efficiency that could further enhance its market position.

Flexium Interconnect (TWSE:6269)

Simply Wall St Growth Rating: ★★★★☆☆

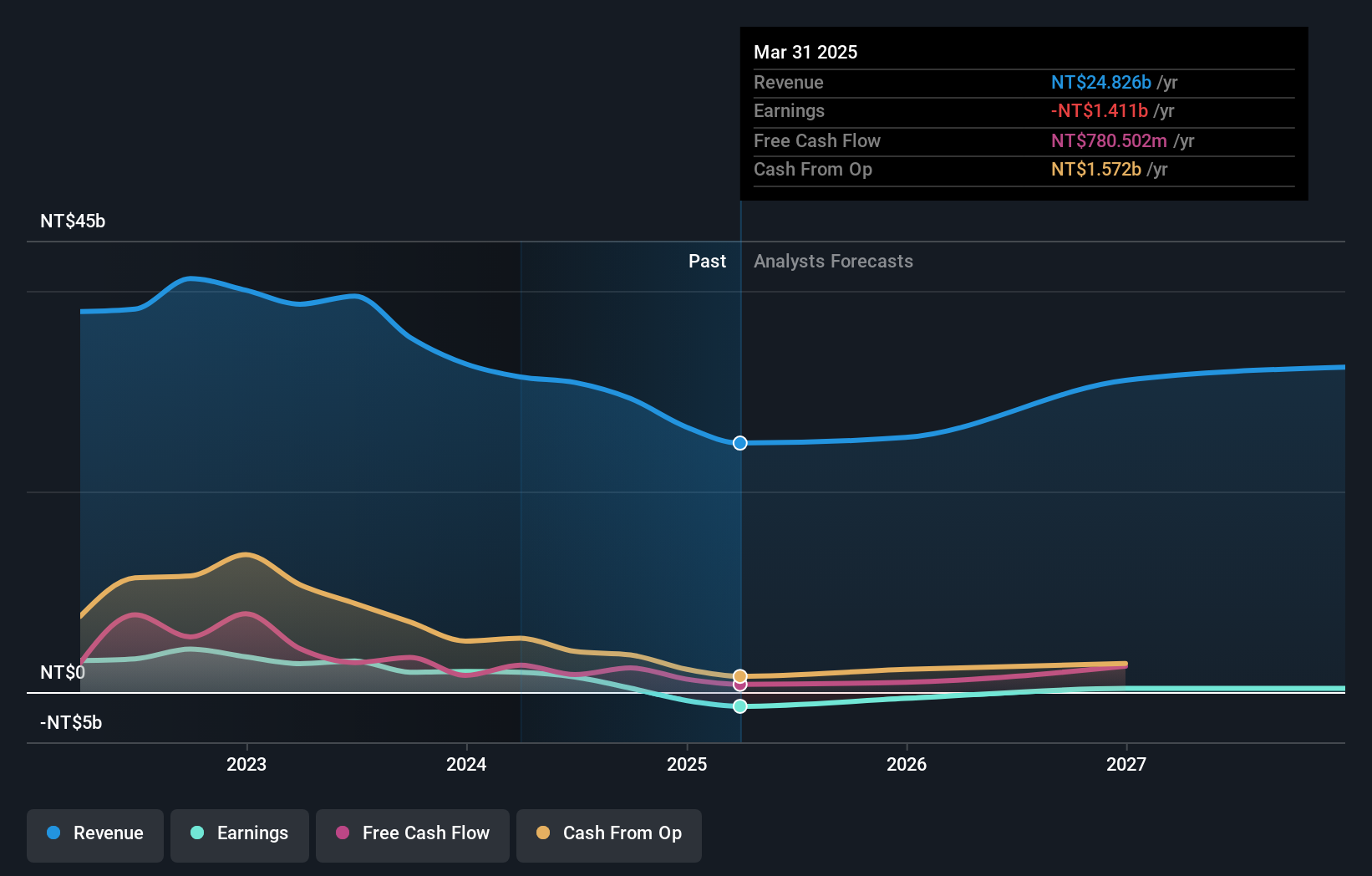

Overview: Flexium Interconnect, Inc. is involved in the design, development, manufacture, and sale of flexible printed circuit boards across Taiwan, China, other parts of Asia, Europe, and the Americas with a market capitalization of NT$19.58 billion.

Operations: Flexium Interconnect, Inc., along with its subsidiaries, focuses on the flexible printed circuit board segment, generating NT$49.06 billion in revenue. The company operates across Taiwan, China, other parts of Asia, Europe, and the Americas.

Flexium Interconnect's recent strategic maneuvers, including a share repurchase program and executive board changes, underscore its proactive stance in governance and capital management. With an 11.5% annual revenue growth outpacing the TW market's 9.8%, Flexium is positioning itself for profitability within three years amidst challenging market conditions where it reported a net loss of TWD 566.87 million in Q1 2025 compared to a net income the previous year. These developments, coupled with amendments to corporate bylaws, indicate Flexium's commitment to refining its operational framework and enhancing shareholder value as it navigates through its current unprofitable phase.

- Unlock comprehensive insights into our analysis of Flexium Interconnect stock in this health report.

Gain insights into Flexium Interconnect's past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 750 Global High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kexing Biopharm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688136

Kexing Biopharm

A biopharmaceutical company, engages in the research and development, production, and sale of recombinant protein drugs and microecological preparations in China, the European Union, Brazil, the Philippines, and Indonesia.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives