- Malaysia

- /

- Construction

- /

- KLSE:BNASTRA

3 High-Growth Stocks With Insider Ownership Expecting Up To 32% Revenue Growth

Reviewed by Simply Wall St

In the midst of economic uncertainty and market volatility, investors are increasingly cautious as they navigate a landscape marked by concerns over a potential slowdown. Despite these challenges, certain high-growth companies with significant insider ownership continue to stand out, demonstrating resilience and promising revenue growth. A good stock in these conditions often combines robust growth prospects with strong insider ownership, signaling confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Cury Construtora e Incorporadora (BOVESPA:CURY3)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cury Construtora e Incorporadora S.A. operates in the real estate business and has a market cap of R$7.12 billion.

Operations: The company generates R$3.40 billion from real estate development.

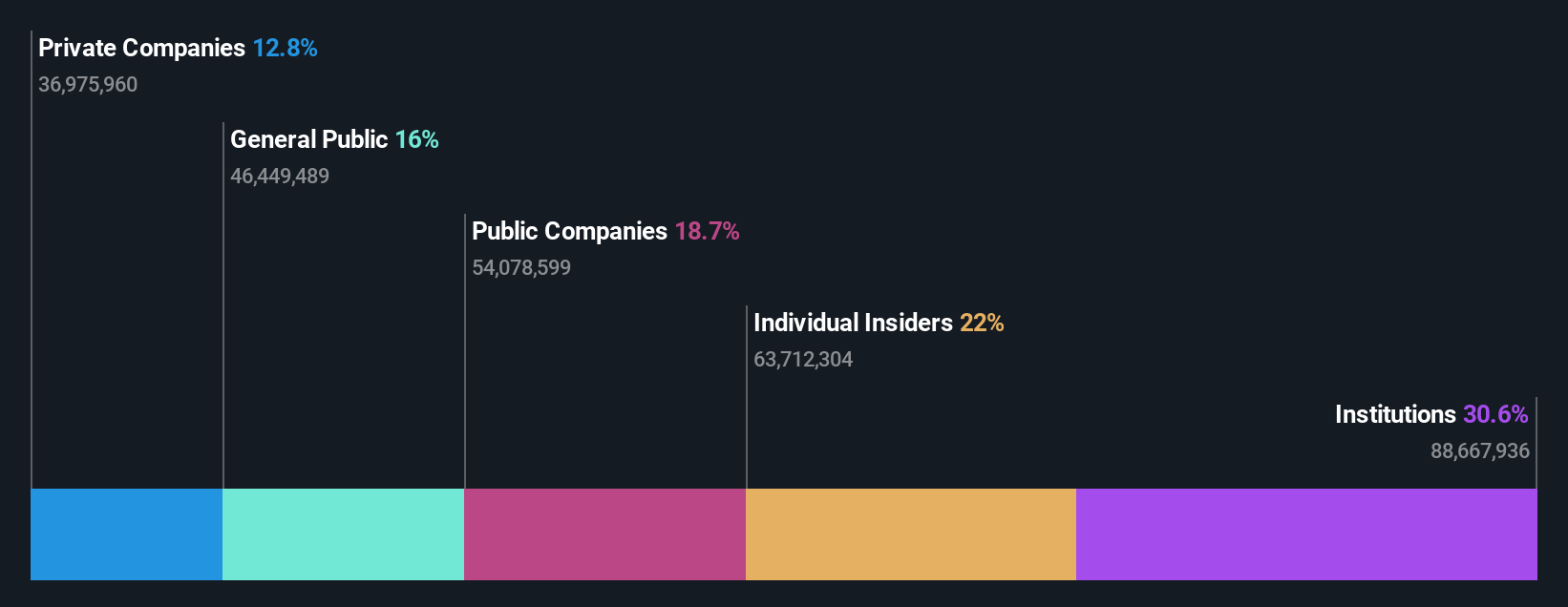

Insider Ownership: 22%

Revenue Growth Forecast: 17.7% p.a.

Cury Construtora e Incorporadora S.A. recently joined the Brazil IBRX Index and reported strong earnings growth for Q2 2024, with net income rising to BRL 172.25 million from BRL 121.37 million a year ago. Despite an unstable dividend track record, its forecasted annual earnings growth of 18% outpaces the Brazilian market average of 14.2%. Additionally, its Return on Equity is projected to be very high at 61.9% in three years.

- Delve into the full analysis future growth report here for a deeper understanding of Cury Construtora e Incorporadora.

- Our expertly prepared valuation report Cury Construtora e Incorporadora implies its share price may be too high.

Binastra Corporation Berhad (KLSE:BNASTRA)

Simply Wall St Growth Rating: ★★★★★★

Overview: Binastra Corporation Berhad (KLSE:BNASTRA) is an investment holding company involved in general contracting and property development in Malaysia, with a market capitalization of MYR1.64 billion.

Operations: Binastra Corporation Berhad generates revenue primarily from its construction segment, which amounted to MYR545.41 million.

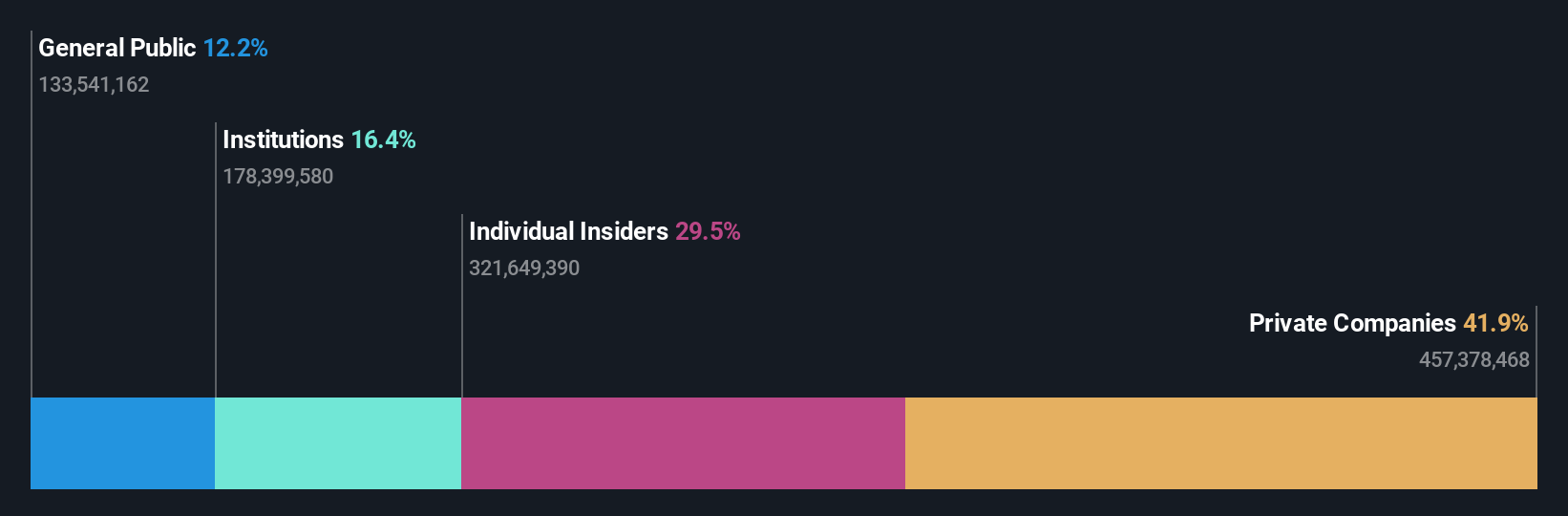

Insider Ownership: 35.7%

Revenue Growth Forecast: 32.9% p.a.

Binastra Corporation Berhad is poised for significant growth, with earnings expected to increase 29.7% annually over the next three years, outpacing the Malaysian market's 10.4%. Recent Q1 2024 results showed a substantial rise in sales to MYR 179.63 million from MYR 59.29 million a year ago and net income jumping to MYR 18.1 million from MYR 5.73 million. Despite past shareholder dilution, the company trades at a significant discount to its estimated fair value and boasts high-quality earnings with strong revenue projections of 32.9% per year.

- Click to explore a detailed breakdown of our findings in Binastra Corporation Berhad's earnings growth report.

- Our valuation report here indicates Binastra Corporation Berhad may be overvalued.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. manufactures, processes, and retails electronic materials and computer heat dissipation modules in China, Taiwan, Korea, Ireland, and internationally with a market cap of NT$50.77 billion.

Operations: Auras Technology's revenue from electronic components and parts is NT$14.27 billion.

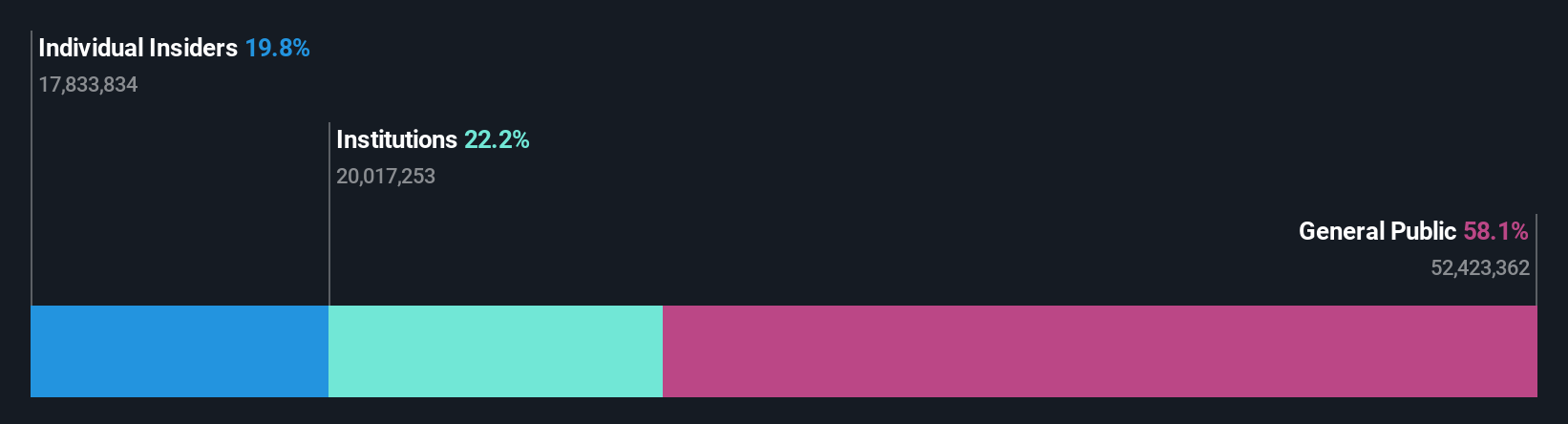

Insider Ownership: 20%

Revenue Growth Forecast: 24.3% p.a.

Auras Technology has shown impressive growth, with earnings rising 54.5% over the past year and forecasted to grow 29.1% annually, outpacing the TW market's 18.2%. Despite recent executive changes and high volatility in share price, Auras reported strong Q2 results with sales of TWD 4.28 billion and net income of TWD 631.98 million. Trading at a discount to its fair value, it remains a compelling growth company with substantial insider ownership and robust revenue projections of 24.3% per year.

- Navigate through the intricacies of Auras Technology with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Auras Technology implies its share price may be lower than expected.

Key Takeaways

- Embark on your investment journey to our 1511 Fast Growing Companies With High Insider Ownership selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Binastra Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:BNASTRA

Binastra Corporation Berhad

An investment holding company, engages in general contractor and property developer, building and civil engineering works in turnkey projects in Malaysia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives