- Taiwan

- /

- Tech Hardware

- /

- TWSE:2382

3 Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices reflecting both gains and declines, investors are closely watching economic indicators such as the Chicago PMI and GDP forecasts for signs of future trends. Amidst this backdrop, growth companies with high insider ownership continue to attract attention due to their potential resilience and alignment of interests between management and shareholders. In this context, examining stocks where insiders hold significant stakes can provide insights into companies that might be well-positioned for sustained growth despite market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Ambu (CPSE:AMBU B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ambu A/S is a medical technology company that develops, produces, and sells medical devices to hospitals, clinics, and rescue services worldwide with a market cap of DKK29.30 billion.

Operations: Ambu A/S generates revenue primarily from its Disposable Medical Products segment, which accounts for DKK5.39 billion.

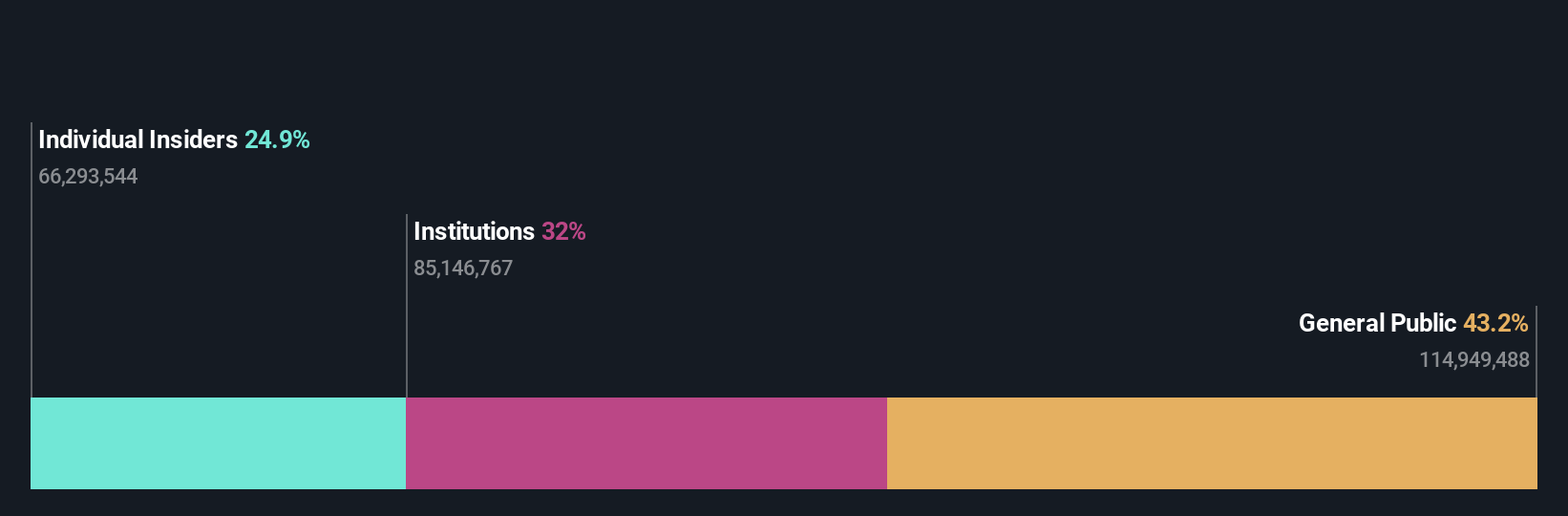

Insider Ownership: 24.9%

Earnings Growth Forecast: 27% p.a.

Ambu's earnings are forecast to grow significantly at 27% annually, outpacing the Danish market. Despite a recent net loss in Q4, full-year sales increased to DKK 5.39 billion from DKK 4.78 billion previously, with net income rising to DKK 235 million. Insider activity shows more buying than selling recently, though not substantial. Ambu's inclusion in the OMX Copenhagen 20 Index and board changes highlight its evolving corporate landscape amidst growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of Ambu.

- Our valuation report here indicates Ambu may be overvalued.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

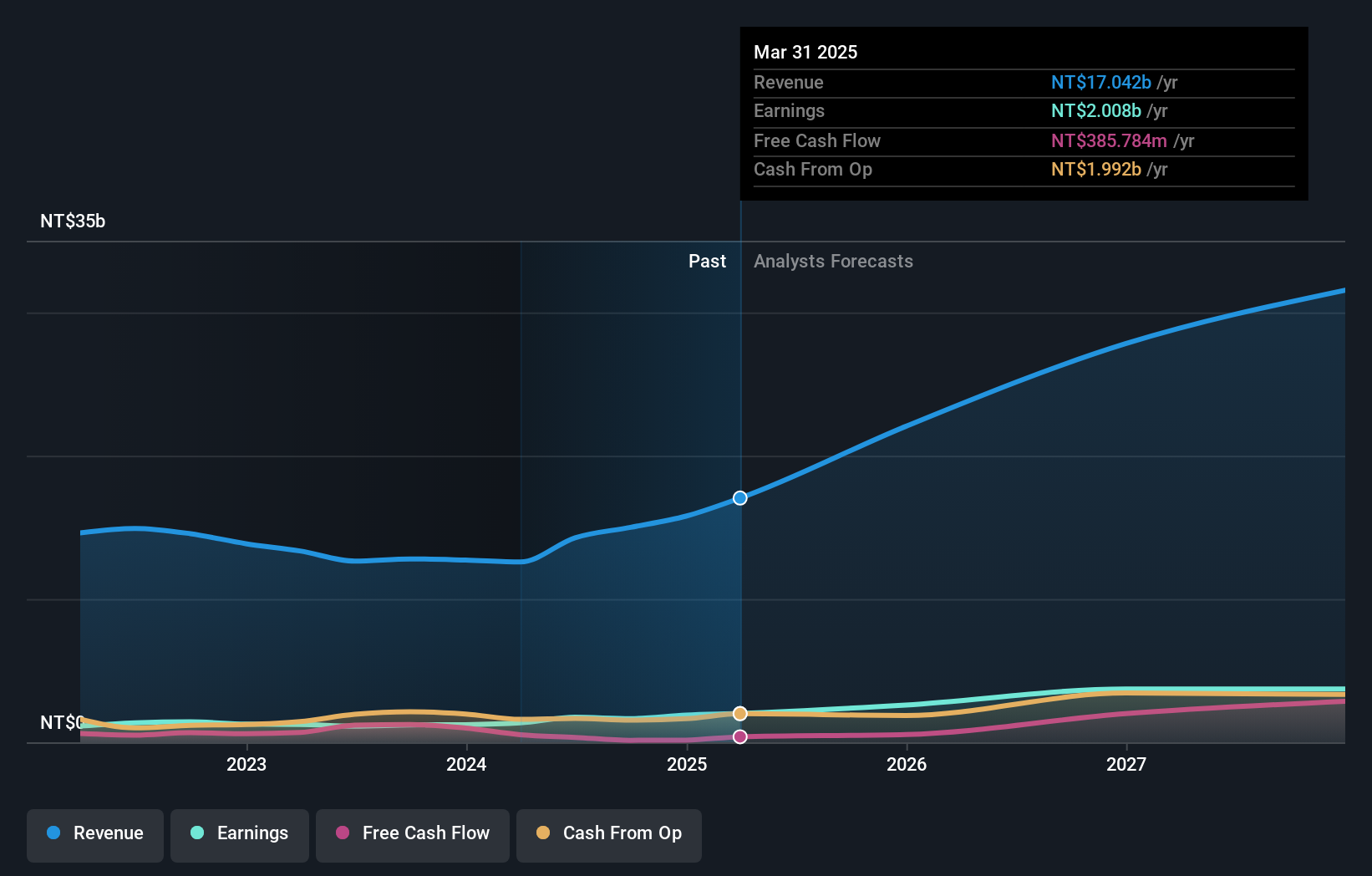

Overview: Auras Technology Co., Ltd. manufactures, processes, and retails electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and internationally with a market cap of NT$63.65 billion.

Operations: The company's revenue segment includes NT$14.99 billion from electronic components and parts.

Insider Ownership: 19.8%

Earnings Growth Forecast: 43.1% p.a.

Auras Technology's revenue is forecast to grow at 28.6% annually, surpassing the Taiwan market's average growth rate. Despite a volatile share price and past shareholder dilution, the company has demonstrated strong earnings growth of 36.1% over the past year. Third-quarter sales increased to TWD 4.22 billion from TWD 3.49 billion a year ago, although net income declined slightly. The company's high expected return on equity of 32.4% indicates robust future profitability potential without recent insider trading activity noted.

- Click to explore a detailed breakdown of our findings in Auras Technology's earnings growth report.

- Our expertly prepared valuation report Auras Technology implies its share price may be lower than expected.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

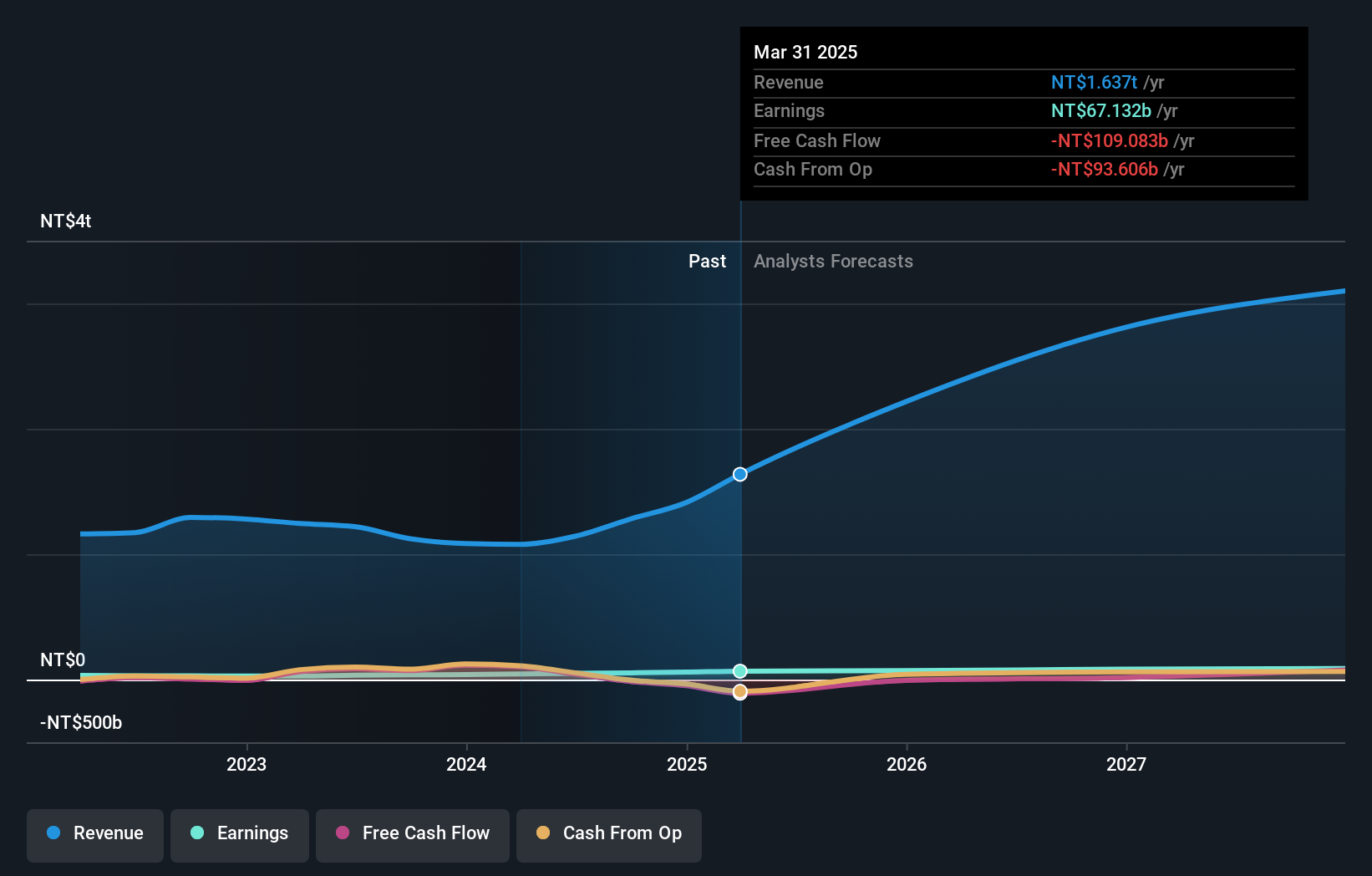

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, Europe, and other international markets, and has a market cap of NT$1.14 trillion.

Operations: The company's revenue from the Electronics Sector amounts to NT$2.78 billion.

Insider Ownership: 13.7%

Earnings Growth Forecast: 19.7% p.a.

Quanta Computer's revenue is projected to grow at 36.8% annually, significantly outpacing the Taiwan market. Recent earnings reports show third-quarter sales rising to TWD 424.55 billion from TWD 286.50 billion a year prior, with net income increasing to TWD 16.63 billion from TWD 12.80 billion, highlighting robust growth despite a dividend not well covered by free cash flows. Analysts agree on a potential stock price increase of 26%, reflecting strong future prospects without recent insider trading activity noted.

- Click here and access our complete growth analysis report to understand the dynamics of Quanta Computer.

- Insights from our recent valuation report point to the potential undervaluation of Quanta Computer shares in the market.

Key Takeaways

- Navigate through the entire inventory of 1492 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Quanta Computer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2382

Quanta Computer

Manufactures, processes, and sells laptop computers and telecommunication products in the United States, Mainland China, the Netherlands, Japan, and internationally.

Very undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives