- China

- /

- Electronic Equipment and Components

- /

- SZSE:301563

Undiscovered Gems in Asia to Explore This November 2025

Reviewed by Simply Wall St

As global markets grapple with concerns over AI valuations and economic uncertainty, Asia's small-cap landscape presents a unique opportunity for investors seeking growth potential. In this environment, identifying stocks with strong fundamentals and innovative business models can be key to uncovering hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Zhejiang Yayi Metal TechnologyLtd | NA | -8.40% | -44.63% | ★★★★★★ |

| KNJ | 65.48% | 8.93% | 40.98% | ★★★★★☆ |

| Jinsanjiang (Zhaoqing) Silicon Material | 11.75% | 17.91% | -3.17% | ★★★★★☆ |

| CMC | 1.01% | 2.80% | 7.26% | ★★★★★☆ |

| Zhejiang Chinastars New Materials Group | 42.04% | 1.78% | 6.47% | ★★★★★☆ |

| Sichuan Zigong Conveying Machine Group | 54.32% | 21.85% | 16.70% | ★★★★☆☆ |

| Tibet TourismLtd | 21.50% | 10.05% | 27.69% | ★★★★☆☆ |

| Mirai Semiconductors | 46.15% | 10.52% | 56.25% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

ICkey (Shanghai) Internet and TechnologyLtd (SZSE:301563)

Simply Wall St Value Rating: ★★★★★☆

Overview: ICkey (Shanghai) Internet and Technology Co., Ltd. operates in the electronics wholesale industry and has a market capitalization of CN¥11.62 billion.

Operations: ICkey generates revenue primarily through its electronics wholesale segment, amounting to CN¥2.58 billion.

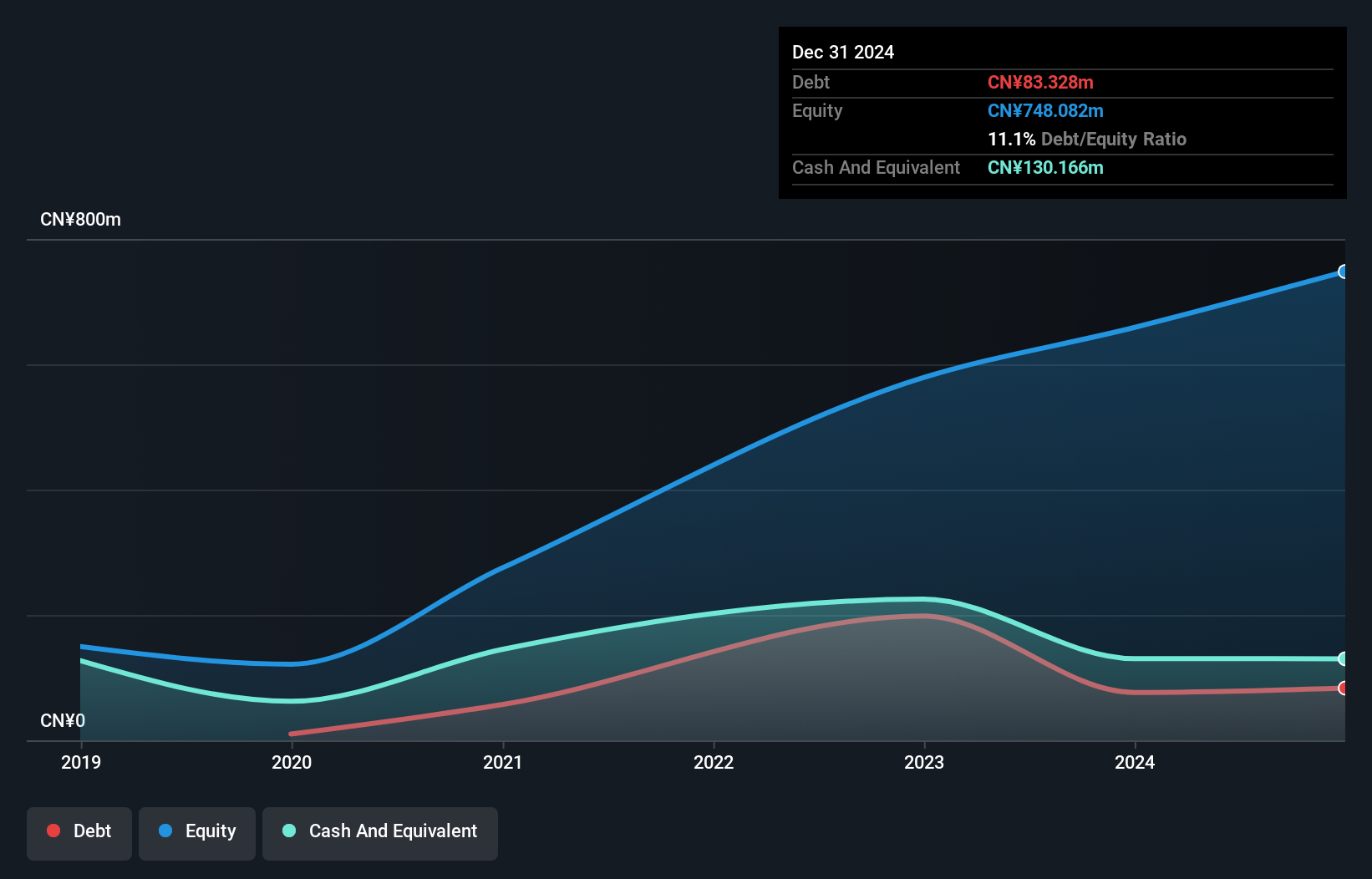

ICkey, a dynamic player in the tech sector, has shown notable growth with earnings climbing 12.3% over the past year, outpacing the electronic industry average of 9%. Despite a volatile share price recently, its financial health appears robust as it holds more cash than total debt and boasts an impressive EBIT interest coverage of 85 times. Recent developments include its IPO raising CNY 439 million and inclusion in key Shenzhen indices. Leadership changes were made with new board members elected at their recent Extraordinary General Meeting, reflecting strategic shifts likely aimed at steering future growth.

Browave (TPEX:3163)

Simply Wall St Value Rating: ★★★★★★

Overview: Browave Corporation designs, manufactures, and sells optical fiber communication components both in Taiwan and internationally, with a market cap of NT$23.32 billion.

Operations: Browave's primary revenue stream comes from its optical communication optical module segment, generating NT$2.08 billion.

Browave, a nimble player in the communications sector, has shown impressive earnings growth of 14.3% over the past year, outpacing the industry's 10.9%. The company is debt-free, a significant shift from five years ago when its debt to equity ratio was 7%, eliminating concerns about interest coverage. Recent financial results highlight robust performance with third-quarter sales at TWD 540.35 million and net income soaring to TWD 223.91 million from TWD 21.75 million last year, reflecting strong operational execution despite share price volatility in recent months and high levels of non-cash earnings contributing to quality past earnings.

Tokuyama (TSE:4043)

Simply Wall St Value Rating: ★★★★★★

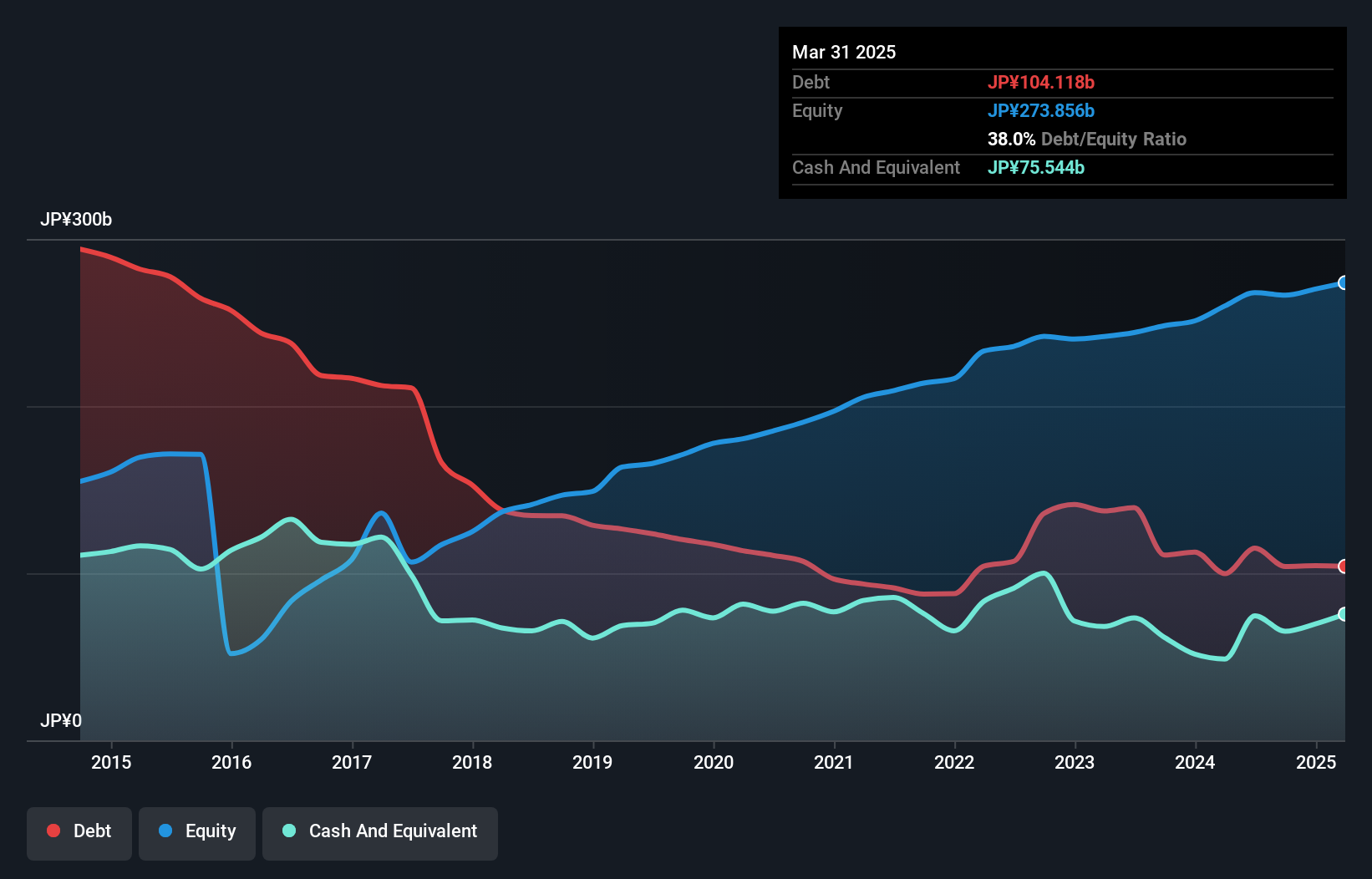

Overview: Tokuyama Corporation is a Japanese company engaged in the production and sale of chemical products, with a market capitalization of ¥296.49 billion.

Operations: Tokuyama Corporation generates revenue primarily from its Chemicals segment, contributing ¥110.05 billion, followed by Electronic & Advanced Materials at ¥89.88 billion and Cement at ¥64.85 billion. The company also has notable income streams from Life Science amounting to ¥41.24 billion and Eco Business bringing in ¥5.95 billion.

Tokuyama, a standout in the chemical sector, showcases solid financials with a net debt to equity ratio of 9.6%, considered satisfactory. The company enjoys high-quality earnings and forecasts an annual earnings growth of 15.07%. Its interest payments are well covered by EBIT at 1255.8 times, indicating robust financial health. Despite its price-to-earnings ratio of 12.4x being below the Japanese market average, Tokuyama's recent dividend increase from JPY 50 to JPY 60 per share reflects confidence in its future prospects and reinforces its appeal as an attractive investment opportunity in Asia's dynamic markets.

- Get an in-depth perspective on Tokuyama's performance by reading our health report here.

Understand Tokuyama's track record by examining our Past report.

Make It Happen

- Unlock our comprehensive list of 2501 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301563

ICkey (Shanghai) Internet and TechnologyLtd

ICkey (Shanghai) Internet and Technology Co.,Ltd.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success