- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6776

Weblink International Inc.'s (GTSM:6776) Stock Been Rising: Are Strong Financials Guiding The Market?

Weblink International's (GTSM:6776) stock up by 9.8% over the past three months. Since the market usually pay for a company’s long-term financial health, we decided to study the company’s fundamentals to see if they could be influencing the market. Specifically, we decided to study Weblink International's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Weblink International

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Weblink International is:

13% = NT$184m ÷ NT$1.5b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.13 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Weblink International's Earnings Growth And 13% ROE

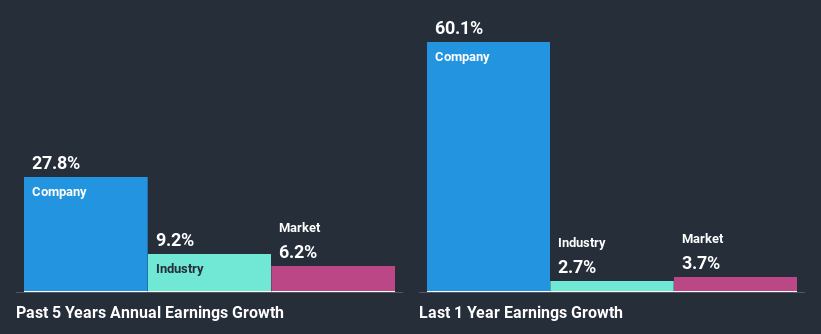

To start with, Weblink International's ROE looks acceptable. On comparing with the average industry ROE of 9.9% the company's ROE looks pretty remarkable. This certainly adds some context to Weblink International's exceptional 28% net income growth seen over the past five years. We believe that there might also be other aspects that are positively influencing the company's earnings growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Weblink International's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 9.2%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Weblink International fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Weblink International Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 82% (implying that it keeps only 18% of profits) for Weblink International suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Summary

Overall, we are quite pleased with Weblink International's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Weblink International's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Weblink International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Weblink International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6776

Weblink International

Distributes and sells software and peripheral products in Taiwan.

Mediocre balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.