- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6407

Are Mutual-Tek Industries's (GTSM:6407) Statutory Earnings A Good Guide To Its Underlying Profitability?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Mutual-Tek Industries (GTSM:6407).

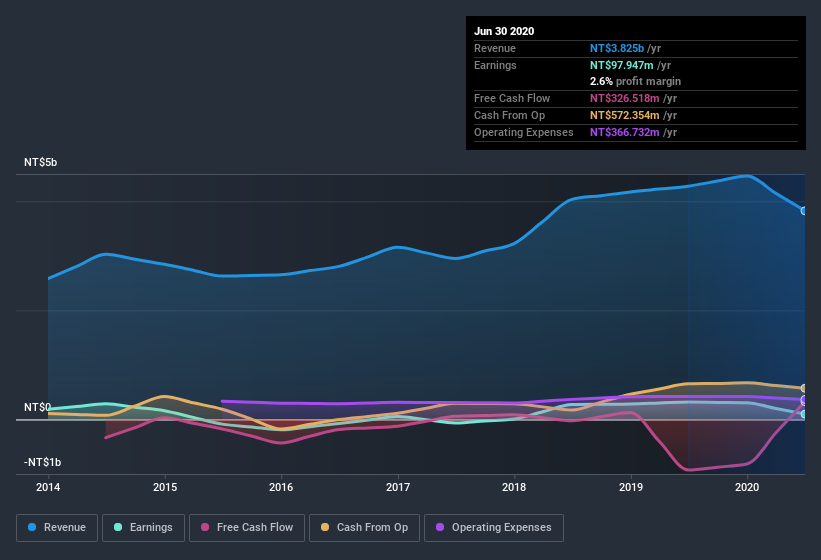

We like the fact that Mutual-Tek Industries made a profit of NT$97.9m on its revenue of NT$3.83b, in the last year. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

Check out our latest analysis for Mutual-Tek Industries

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we'll look at how Mutual-Tek Industries is impacting shareholders by issuing new shares. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Mutual-Tek Industries.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Mutual-Tek Industries issued 18% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Mutual-Tek Industries' EPS by clicking here.

How Is Dilution Impacting Mutual-Tek Industries' Earnings Per Share? (EPS)

Mutual-Tek Industries was losing money three years ago. Even looking at the last year, profit was still down 69%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 71% in the same period. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Mutual-Tek Industries' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Mutual-Tek Industries' Profit Performance

Mutual-Tek Industries issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Mutual-Tek Industries' statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 5 warning signs for Mutual-Tek Industries and you'll want to know about them.

This note has only looked at a single factor that sheds light on the nature of Mutual-Tek Industries' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Mutual-Tek Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6407

Mutual-Tek Industries

Engages in the design, production, and sale of PCBs in Taiwan.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion