- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6284

These 4 Measures Indicate That INPAQ Technology (GTSM:6284) Is Using Debt Reasonably Well

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that INPAQ Technology Co., Ltd. (GTSM:6284) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for INPAQ Technology

How Much Debt Does INPAQ Technology Carry?

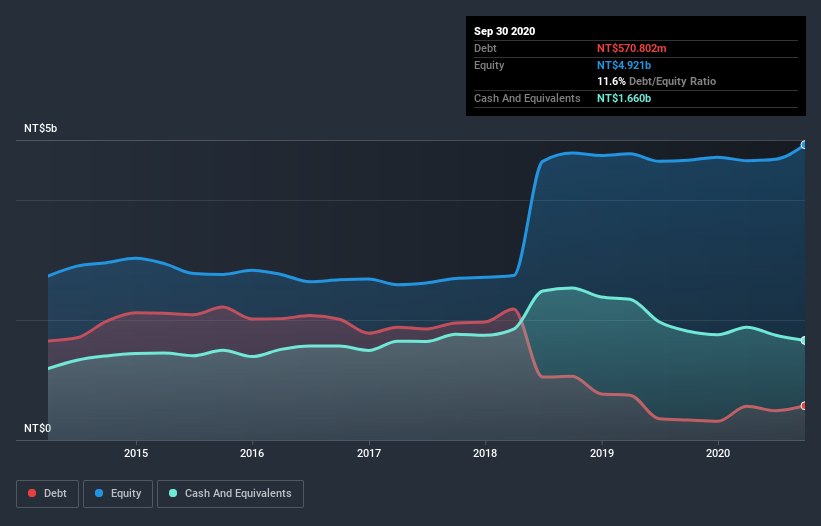

As you can see below, at the end of September 2020, INPAQ Technology had NT$570.8m of debt, up from NT$333.2m a year ago. Click the image for more detail. But on the other hand it also has NT$1.66b in cash, leading to a NT$1.09b net cash position.

A Look At INPAQ Technology's Liabilities

According to the last reported balance sheet, INPAQ Technology had liabilities of NT$1.84b due within 12 months, and liabilities of NT$544.2m due beyond 12 months. Offsetting these obligations, it had cash of NT$1.66b as well as receivables valued at NT$1.97b due within 12 months. So it can boast NT$1.24b more liquid assets than total liabilities.

This short term liquidity is a sign that INPAQ Technology could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, INPAQ Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that INPAQ Technology grew its EBIT by 153% over twelve months. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But it is INPAQ Technology's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While INPAQ Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, INPAQ Technology recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that INPAQ Technology has net cash of NT$1.09b, as well as more liquid assets than liabilities. And we liked the look of last year's 153% year-on-year EBIT growth. So is INPAQ Technology's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 1 warning sign for INPAQ Technology that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading INPAQ Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6284

INPAQ Technology

Provides circuit protection components and antenna products for computing, communication, consumer electronics, and automotive electronics primarily in Taiwan, China, Hong Kong, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026