- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6227

Macnica Galaxy (GTSM:6227) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Macnica Galaxy Inc. (GTSM:6227) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Macnica Galaxy

What Is Macnica Galaxy's Net Debt?

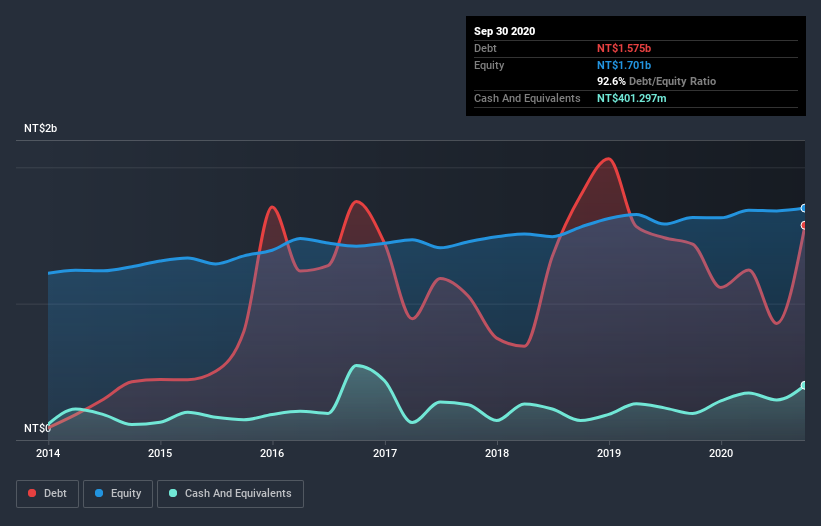

As you can see below, at the end of September 2020, Macnica Galaxy had NT$1.58b of debt, up from NT$1.44b a year ago. Click the image for more detail. However, because it has a cash reserve of NT$401.3m, its net debt is less, at about NT$1.17b.

How Strong Is Macnica Galaxy's Balance Sheet?

According to the last reported balance sheet, Macnica Galaxy had liabilities of NT$3.64b due within 12 months, and liabilities of NT$78.4m due beyond 12 months. Offsetting this, it had NT$401.3m in cash and NT$3.12b in receivables that were due within 12 months. So its liabilities total NT$197.0m more than the combination of its cash and short-term receivables.

Of course, Macnica Galaxy has a market capitalization of NT$2.15b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Strangely Macnica Galaxy has a sky high EBITDA ratio of 5.3, implying high debt, but a strong interest coverage of 14.8. So either it has access to very cheap long term debt or that interest expense is going to grow! Unfortunately, Macnica Galaxy's EBIT flopped 12% over the last four quarters. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Macnica Galaxy will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Macnica Galaxy created free cash flow amounting to 3.7% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Macnica Galaxy's net debt to EBITDA and conversion of EBIT to free cash flow definitely weigh on it, in our esteem. But its interest cover tells a very different story, and suggests some resilience. Taking the abovementioned factors together we do think Macnica Galaxy's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 4 warning signs we've spotted with Macnica Galaxy (including 1 which is shouldn't be ignored) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Macnica Galaxy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6227

Macnica Galaxy

Together with its subisidaries, engages in the agency trading and technical service of semiconductor electronic components in Taiwan, rest of Asia, and internationally.

Acceptable track record with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026