- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6218

Is Hauman Technologies Corp.'s (GTSM:6218) Recent Performancer Underpinned By Weak Financials?

Hauman Technologies (GTSM:6218) has had a rough month with its share price down 1.6%. Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. In this article, we decided to focus on Hauman Technologies' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Hauman Technologies

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Hauman Technologies is:

6.5% = NT$65m ÷ NT$997m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.07.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Hauman Technologies' Earnings Growth And 6.5% ROE

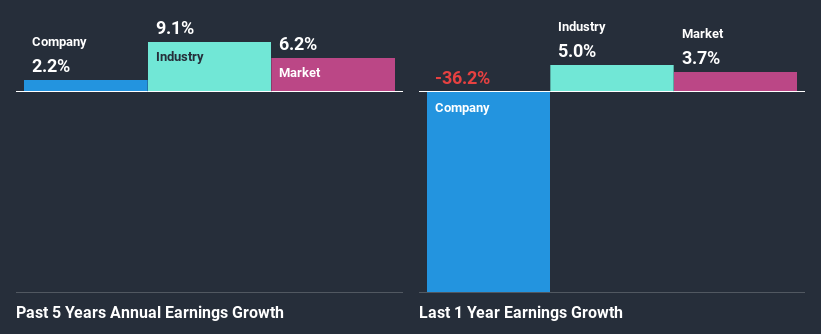

On the face of it, Hauman Technologies' ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 9.9% either. Thus, the low net income growth of 2.2% seen by Hauman Technologies over the past five years could probably be the result of the low ROE.

Next, on comparing with the industry net income growth, we found that Hauman Technologies' reported growth was lower than the industry growth of 9.1% in the same period, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Hauman Technologies''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Hauman Technologies Efficiently Re-investing Its Profits?

Hauman Technologies has a three-year median payout ratio of 96% (implying that it keeps only 4.4% of its profits), meaning that it pays out most of its profits to shareholders as dividends, and as a result, the company has seen low earnings growth.

Additionally, Hauman Technologies has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

Overall, we would be extremely cautious before making any decision on Hauman Technologies. Specifically, it has shown quite an unsatisfactory performance as far as earnings growth is concerned, and a poor ROE and an equally poor rate of reinvestment seem to be the reason behind this inadequate performance. In brief, we think the company is risky and investors should think twice before making any final judgement on this company. Our risks dashboard would have the 2 risks we have identified for Hauman Technologies.

If you’re looking to trade Hauman Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hauman Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6218

Hauman Technologies

Engages in the development of products and solutions for semiconductor and information technology network sectors in Taiwan and China.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.