- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6217

C.C.P. Contact Probes (GTSM:6217) Has Compensated Shareholders With A 5.4% Return On Their Investment

The main aim of stock picking is to find the market-beating stocks. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in C.C.P. Contact Probes Co., Ltd. (GTSM:6217), since the last five years saw the share price fall 15%. More recently, the share price has dropped a further 13% in a month.

View our latest analysis for C.C.P. Contact Probes

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

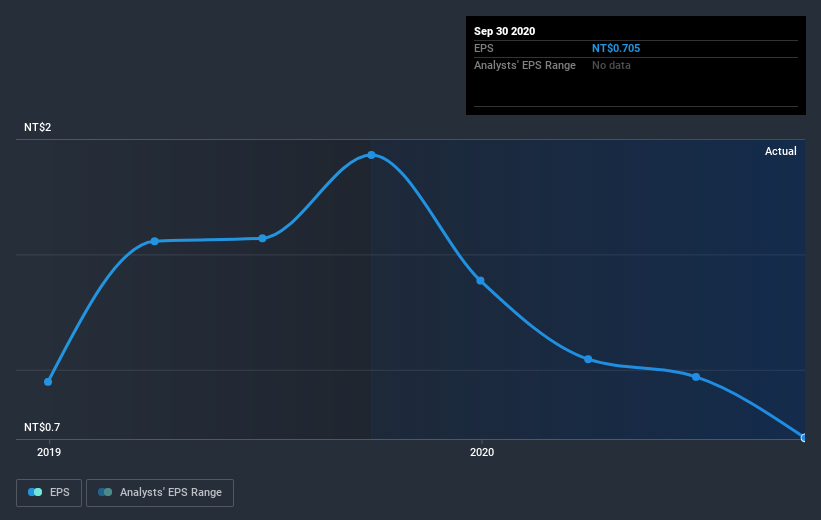

Looking back five years, both C.C.P. Contact Probes' share price and EPS declined; the latter at a rate of 28% per year. The share price decline of 3% per year isn't as bad as the EPS decline. So investors might expect EPS to bounce back -- or they may have previously foreseen the EPS decline. With a P/E ratio of 48.22, it's fair to say the market sees a brighter future for the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on C.C.P. Contact Probes' earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for C.C.P. Contact Probes the TSR over the last 5 years was 5.4%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

C.C.P. Contact Probes shareholders gained a total return of 10% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 1.1% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand C.C.P. Contact Probes better, we need to consider many other factors. Take risks, for example - C.C.P. Contact Probes has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade C.C.P. Contact Probes, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6217

C.C.P. Contact Probes

Engages in the manufacturing, processing, purchasing and selling, and import and export of contact probes and testing devices in Taiwan, China, the United States, and internationally.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026