- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5328

The Hua Jung ComponentsLtd (GTSM:5328) Share Price Has Gained 121%, So Why Not Pay It Some Attention?

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. Long term Hua Jung Components Co.,Ltd. (GTSM:5328) shareholders would be well aware of this, since the stock is up 121% in five years. It's also good to see the share price up 27% over the last quarter.

View our latest analysis for Hua Jung ComponentsLtd

While Hua Jung ComponentsLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last half decade Hua Jung ComponentsLtd's revenue has actually been trending down at about 8.2% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

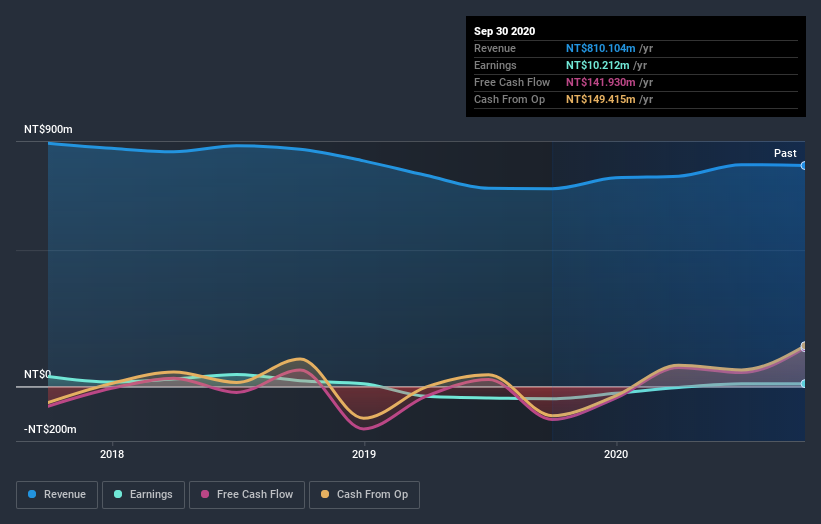

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Hua Jung ComponentsLtd stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Hua Jung ComponentsLtd's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Hua Jung ComponentsLtd's TSR of 129% over the last 5 years is better than the share price return.

A Different Perspective

It's nice to see that Hua Jung ComponentsLtd shareholders have received a total shareholder return of 60% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 18% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Hua Jung ComponentsLtd that you should be aware of before investing here.

We will like Hua Jung ComponentsLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you’re looking to trade Hua Jung ComponentsLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hua Jung ComponentsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:5328

Hua Jung ComponentsLtd

Manufactures and sells film capacitors in Taiwan and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)