- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:5248

Are Pixon Technologies's (GTSM:5248) Statutory Earnings A Good Reflection Of Its Earnings Potential?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Pixon Technologies (GTSM:5248).

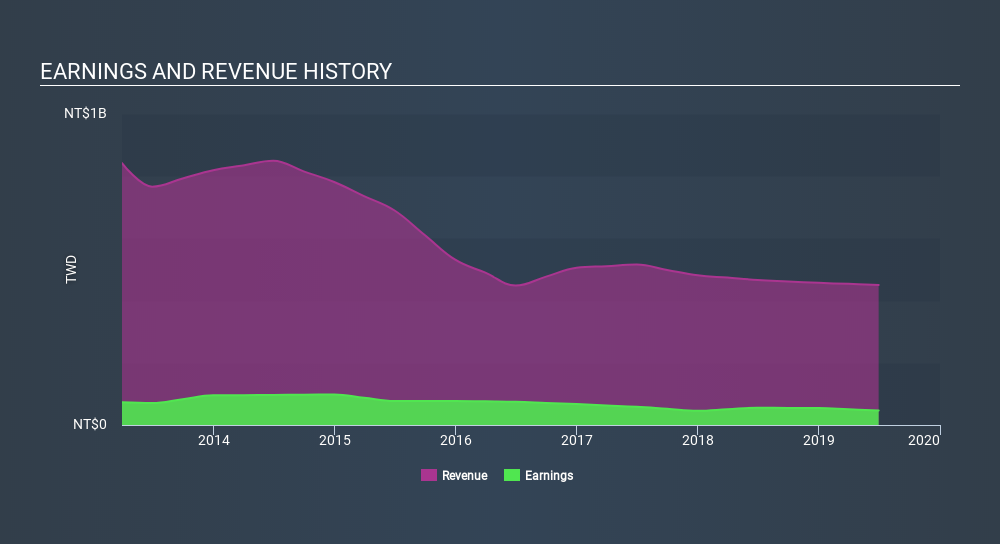

While Pixon Technologies was able to generate revenue of NT$450.5m in the last twelve months, we think its profit result of NT$46.4m was more important. The chart below shows that revenue has been flat over the last three years, while profit has actually declined.

See our latest analysis for Pixon Technologies

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. So today we'll look at what Pixon Technologies's cashflow tells us about the quality of its earnings. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Pixon Technologies.

Examining Cashflow Against Pixon Technologies's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to June 2019, Pixon Technologies recorded an accrual ratio of 0.24. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Even though it reported a profit of NT$46.4m, a look at free cash flow indicates it actually burnt through NT$39m in the last year. Unfortunately, we don't have data on Pixon Technologies's free cash flow for the prior year; that's not necessarily a bad thing, though we do generally prefer to be able to see a bit of a company's history.

Our Take On Pixon Technologies's Profit Performance

Pixon Technologies didn't convert much of its profit to free cahs flow in the last year, which some investors may consider rather suboptimal. Therefore, it seems possible to us that Pixon Technologies's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. You can seeour latest analysis on Pixon Technologies's balance sheet health here.

This note has only looked at a single factor that sheds light on the nature of Pixon Technologies's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TPEX:5248

Pixon Technologies

Manufactures and sells imaging and optical components for makers in communications, computers, and consumer electronics field in Taiwan and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives