Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Connection Technology Systems Inc. (GTSM:3672) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Connection Technology Systems

What Is Connection Technology Systems's Net Debt?

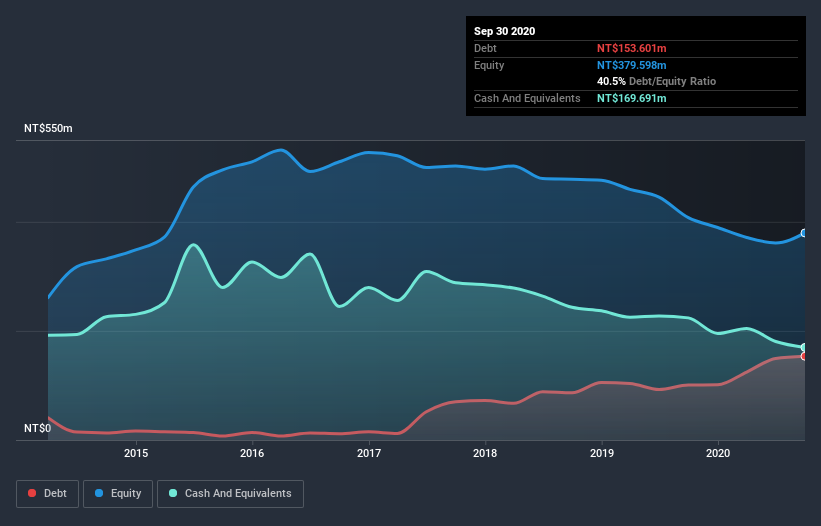

As you can see below, at the end of September 2020, Connection Technology Systems had NT$153.6m of debt, up from NT$100.7m a year ago. Click the image for more detail. But on the other hand it also has NT$169.7m in cash, leading to a NT$16.1m net cash position.

A Look At Connection Technology Systems' Liabilities

The latest balance sheet data shows that Connection Technology Systems had liabilities of NT$264.6m due within a year, and liabilities of NT$35.1m falling due after that. On the other hand, it had cash of NT$169.7m and NT$105.6m worth of receivables due within a year. So it has liabilities totalling NT$24.4m more than its cash and near-term receivables, combined.

Given Connection Technology Systems has a market capitalization of NT$604.2m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Connection Technology Systems also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is Connection Technology Systems's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Connection Technology Systems wasn't profitable at an EBIT level, but managed to grow its revenue by 13%, to NT$726m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Connection Technology Systems?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Connection Technology Systems had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through NT$78m of cash and made a loss of NT$9.9m. Given it only has net cash of NT$16.1m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Connection Technology Systems you should be aware of, and 2 of them are potentially serious.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Connection Technology Systems or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3672

Connection Technology Systems

Designs, manufactures, and provides network solutions.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives