What underlying fundamental trends can indicate that a company might be in decline? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. So after glancing at the trends within Unitech Electronics (GTSM:3652), we weren't too hopeful.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Unitech Electronics, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.011 = NT$13m ÷ (NT$1.6b - NT$473m) (Based on the trailing twelve months to September 2020).

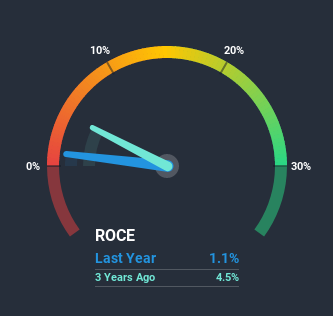

So, Unitech Electronics has an ROCE of 1.1%. Ultimately, that's a low return and it under-performs the Electronic industry average of 10%.

View our latest analysis for Unitech Electronics

Historical performance is a great place to start when researching a stock so above you can see the gauge for Unitech Electronics' ROCE against it's prior returns. If you'd like to look at how Unitech Electronics has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

In terms of Unitech Electronics' historical ROCE movements, the trend doesn't inspire confidence. Unfortunately the returns on capital have diminished from the 2.0% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Unitech Electronics to turn into a multi-bagger.

The Key Takeaway

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Despite the concerning underlying trends, the stock has actually gained 27% over the last five years, so it might be that the investors are expecting the trends to reverse. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

Unitech Electronics does have some risks, we noticed 2 warning signs (and 1 which is significant) we think you should know about.

While Unitech Electronics may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade Unitech Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:3652

Unitech Electronics

Engages in the development, manufacture and sale of automatic identification data capture products and related business in Taiwan, rest of Asia, the United States, Europe, and Oceania.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion