- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3652

How Well Is Unitech Electronics (GTSM:3652) Allocating Its Capital?

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after glancing at the trends within Unitech Electronics (GTSM:3652), we weren't too hopeful.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Unitech Electronics, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.013 = NT$15m ÷ (NT$1.6b - NT$473m) (Based on the trailing twelve months to September 2020).

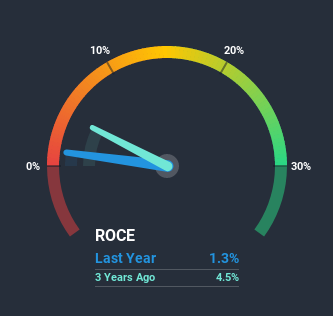

Thus, Unitech Electronics has an ROCE of 1.3%. Ultimately, that's a low return and it under-performs the Electronic industry average of 11%.

See our latest analysis for Unitech Electronics

Historical performance is a great place to start when researching a stock so above you can see the gauge for Unitech Electronics' ROCE against it's prior returns. If you'd like to look at how Unitech Electronics has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

How Are Returns Trending?

We are a bit worried about the trend of returns on capital at Unitech Electronics. Unfortunately the returns on capital have diminished from the 2.0% that they were earning five years ago. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect Unitech Electronics to turn into a multi-bagger.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 45% return. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

On a final note, we found 2 warning signs for Unitech Electronics (1 is significant) you should be aware of.

While Unitech Electronics may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading Unitech Electronics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3652

Unitech Electronics

Engages in the development, manufacture and sale of automatic identification data capture products and related business in Taiwan, rest of Asia, the United States, Europe, and Oceania.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion