- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3615

Is AimCore Technology (GTSM:3615) Using Debt Sensibly?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, AimCore Technology Co., Ltd (GTSM:3615) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for AimCore Technology

How Much Debt Does AimCore Technology Carry?

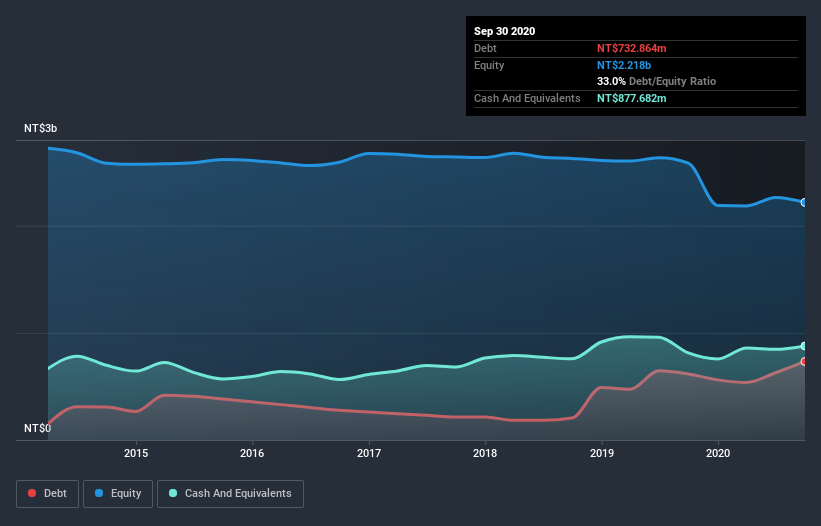

The image below, which you can click on for greater detail, shows that at September 2020 AimCore Technology had debt of NT$732.9m, up from NT$615.8m in one year. But on the other hand it also has NT$877.7m in cash, leading to a NT$144.8m net cash position.

A Look At AimCore Technology's Liabilities

We can see from the most recent balance sheet that AimCore Technology had liabilities of NT$410.7m falling due within a year, and liabilities of NT$490.4m due beyond that. On the other hand, it had cash of NT$877.7m and NT$311.1m worth of receivables due within a year. So it can boast NT$287.7m more liquid assets than total liabilities.

This surplus suggests that AimCore Technology is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, AimCore Technology boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is AimCore Technology's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, AimCore Technology reported revenue of NT$702m, which is a gain of 49%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is AimCore Technology?

Statistically speaking companies that lose money are riskier than those that make money. And in the last year AimCore Technology had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through NT$29m of cash and made a loss of NT$364m. Given it only has net cash of NT$144.8m, the company may need to raise more capital if it doesn't reach break-even soon. AimCore Technology's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for AimCore Technology (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading AimCore Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3615

AimCore Technology

Processes, manufactures, processing, and sales of conductive glass related products in Taiwan and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026