- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3512

Does Huang Long DevelopmentLtd's (GTSM:3512) Statutory Profit Adequately Reflect Its Underlying Profit?

Broadly speaking, profitable businesses are less risky than unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Huang Long DevelopmentLtd's (GTSM:3512) statutory profits are a good guide to its underlying earnings.

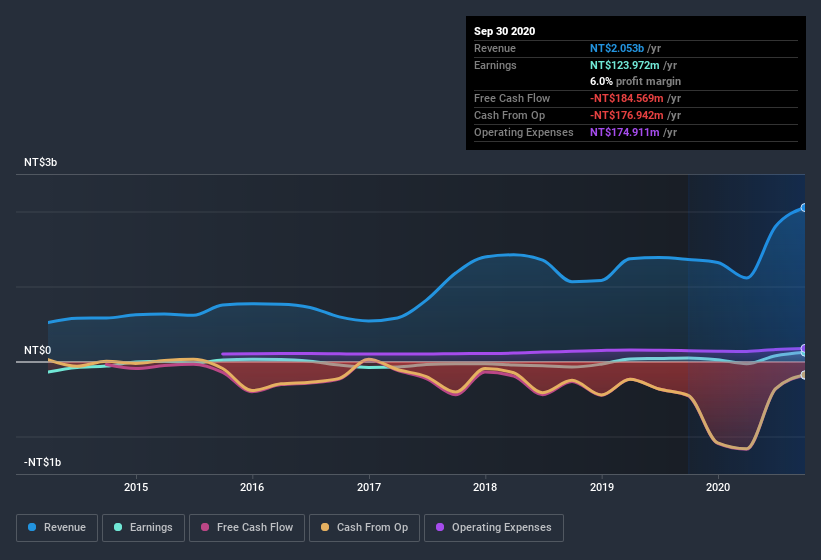

While Huang Long DevelopmentLtd was able to generate revenue of NT$2.05b in the last twelve months, we think its profit result of NT$124.0m was more important. The good news is that the company managed to grow its revenue over the last three years, and also move from loss-making to profitable.

View our latest analysis for Huang Long DevelopmentLtd

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. In this article we'll look at how Huang Long DevelopmentLtd is impacting shareholders by issuing new shares. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Huang Long DevelopmentLtd.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Huang Long DevelopmentLtd issued 18% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Huang Long DevelopmentLtd's historical EPS growth by clicking on this link.

A Look At The Impact Of Huang Long DevelopmentLtd's Dilution on Its Earnings Per Share (EPS).

Three years ago, Huang Long DevelopmentLtd lost money. The good news is that profit was up 159% in the last twelve months. But EPS was less impressive, up only 148% in that time. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Huang Long DevelopmentLtd can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Huang Long DevelopmentLtd's Profit Performance

Each Huang Long DevelopmentLtd share now gets a meaningfully smaller slice of its overall profit, due to dilution of existing shareholders. Therefore, it seems possible to us that Huang Long DevelopmentLtd's true underlying earnings power is actually less than its statutory profit. But the happy news is that, while acknowledging we have to look beyond the statutory numbers, those numbers are still improving, with EPS growing at a very high rate over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Case in point: We've spotted 3 warning signs for Huang Long DevelopmentLtd you should be mindful of and 1 of them doesn't sit too well with us.

Today we've zoomed in on a single data point to better understand the nature of Huang Long DevelopmentLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade Huang Long DevelopmentLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huang Long DevelopmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3512

Huang Long DevelopmentLtd

Produces and sells of electronic components and heatsinks in Taiwan, Mainland China, and internationally.

Medium-low risk with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)