- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3498

Should Usun Technology (GTSM:3498) Be Disappointed With Their 66% Profit?

Passive investing in index funds can generate returns that roughly match the overall market. But you can significantly boost your returns by picking above-average stocks. For example, the Usun Technology Co., Ltd. (GTSM:3498) share price is up 66% in the last year, clearly besting the market return of around 22% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! On the other hand, longer term shareholders have had a tougher run, with the stock falling 43% in three years.

Check out our latest analysis for Usun Technology

Given that Usun Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year Usun Technology saw its revenue grow by 6.6%. That's not a very high growth rate considering it doesn't make profits. In keeping with the revenue growth, the share price gained 66% in that time. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

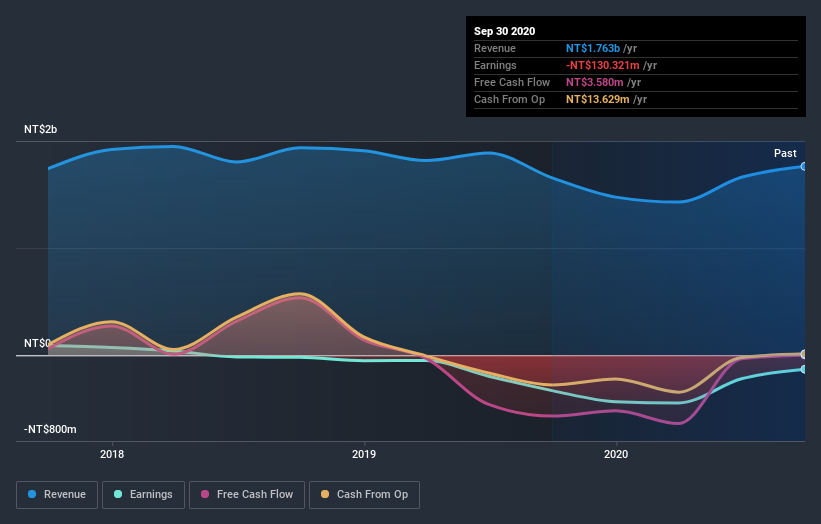

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Usun Technology's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Usun Technology shareholders have received a total shareholder return of 66% over one year. That certainly beats the loss of about 6% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Usun Technology better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Usun Technology you should be aware of, and 1 of them doesn't sit too well with us.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

When trading Usun Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3498

Usun Technology

Designs, produces, and maintains automation equipment in Taiwan, China, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives