- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3491

Can Universal Microwave Technology, Inc.'s (GTSM:3491) Weak Financials Pull The Plug On The Stock's Current Momentum On Its Share Price?

Universal Microwave Technology (GTSM:3491) has had a great run on the share market with its stock up by a significant 7.6% over the last month. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimatley dictates market outcomes. In this article, we decided to focus on Universal Microwave Technology's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Universal Microwave Technology

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Universal Microwave Technology is:

7.3% = NT$162m ÷ NT$2.2b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.07 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Universal Microwave Technology's Earnings Growth And 7.3% ROE

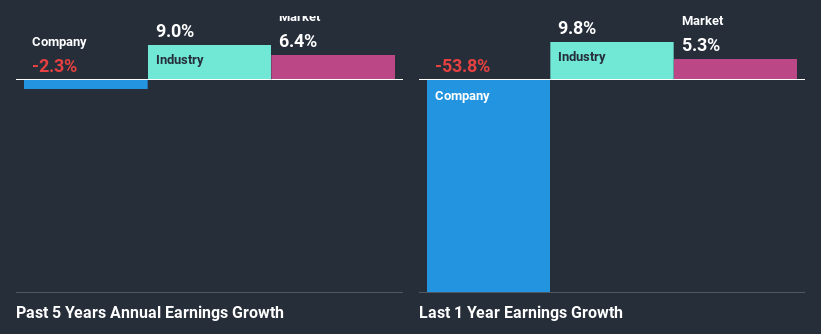

On the face of it, Universal Microwave Technology's ROE is not much to talk about. Next, when compared to the average industry ROE of 10%, the company's ROE leaves us feeling even less enthusiastic. For this reason, Universal Microwave Technology's five year net income decline of 2.3% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

So, as a next step, we compared Universal Microwave Technology's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 9.0% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Universal Microwave Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Universal Microwave Technology Efficiently Re-investing Its Profits?

Universal Microwave Technology's very high three-year median payout ratio of 107% over the last three years suggests that the company is paying its shareholders more than what it is earning and this explains the company's shrinking earnings. Paying a dividend higher than reported profits is not a sustainable move. To know the 2 risks we have identified for Universal Microwave Technology visit our risks dashboard for free.

In addition, Universal Microwave Technology has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning Universal Microwave Technology. The low ROE, combined with the fact that the company is paying out almost if not all, of its profits as dividends, has resulted in the lack or absence of growth in its earnings. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade Universal Microwave Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3491

Universal Microwave Technology

Manufactures and sells electronic components in Taiwan, China, Asia, Europe, the United States, and Oceania.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion