- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3357

TAI-TECH Advanced Electronics (GTSM:3357) Seems To Use Debt Quite Sensibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that TAI-TECH Advanced Electronics Co., Ltd. (GTSM:3357) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for TAI-TECH Advanced Electronics

What Is TAI-TECH Advanced Electronics's Debt?

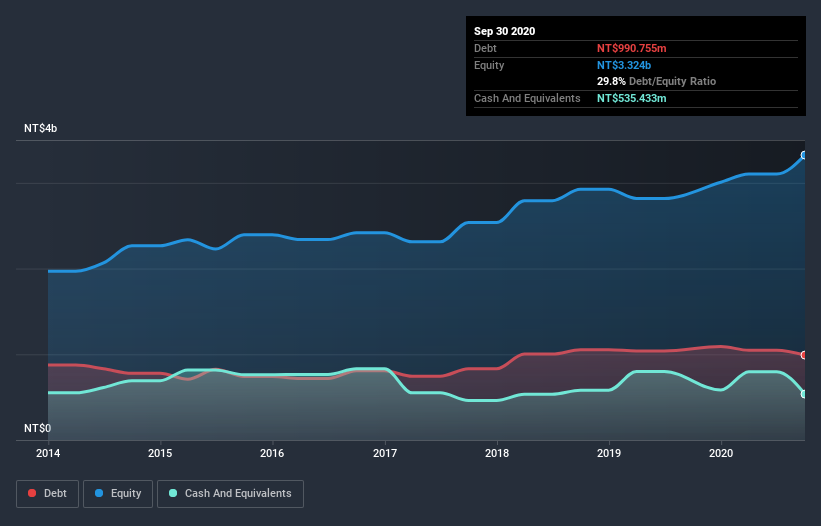

You can click the graphic below for the historical numbers, but it shows that TAI-TECH Advanced Electronics had NT$990.8m of debt in September 2020, down from NT$1.09b, one year before. However, it also had NT$535.4m in cash, and so its net debt is NT$455.3m.

How Healthy Is TAI-TECH Advanced Electronics's Balance Sheet?

We can see from the most recent balance sheet that TAI-TECH Advanced Electronics had liabilities of NT$1.95b falling due within a year, and liabilities of NT$459.2m due beyond that. On the other hand, it had cash of NT$535.4m and NT$1.84b worth of receivables due within a year. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that TAI-TECH Advanced Electronics's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the NT$8.25b company is short on cash, but still worth keeping an eye on the balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

TAI-TECH Advanced Electronics has a low debt to EBITDA ratio of only 0.40. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. In addition to that, we're happy to report that TAI-TECH Advanced Electronics has boosted its EBIT by 77%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since TAI-TECH Advanced Electronics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, TAI-TECH Advanced Electronics reported free cash flow worth 17% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

The good news is that TAI-TECH Advanced Electronics's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its conversion of EBIT to free cash flow. Looking at the bigger picture, we think TAI-TECH Advanced Electronics's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - TAI-TECH Advanced Electronics has 1 warning sign we think you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade TAI-TECH Advanced Electronics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TAI-TECH Advanced Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:3357

TAI-TECH Advanced Electronics

Develops, manufactures, and sells magnetic materials and inductive components in Taiwan.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026