- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3323

Is Celxpert Energy (GTSM:3323) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Celxpert Energy Corporation (GTSM:3323) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Celxpert Energy

What Is Celxpert Energy's Debt?

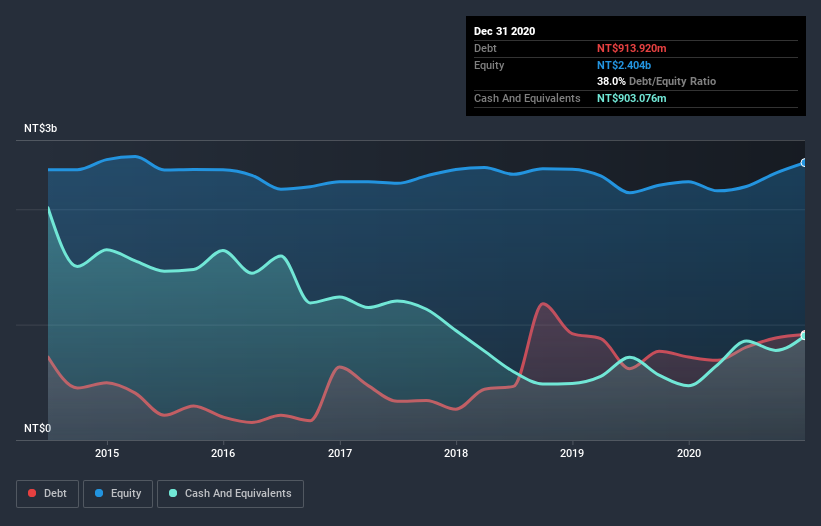

The image below, which you can click on for greater detail, shows that at December 2020 Celxpert Energy had debt of NT$913.9m, up from NT$719.2m in one year. However, it does have NT$903.1m in cash offsetting this, leading to net debt of about NT$10.8m.

A Look At Celxpert Energy's Liabilities

We can see from the most recent balance sheet that Celxpert Energy had liabilities of NT$4.62b falling due within a year, and liabilities of NT$10.6m due beyond that. On the other hand, it had cash of NT$903.1m and NT$3.96b worth of receivables due within a year. So it can boast NT$230.0m more liquid assets than total liabilities.

This surplus suggests that Celxpert Energy has a conservative balance sheet, and could probably eliminate its debt without much difficulty. But either way, Celxpert Energy has virtually no net debt, so it's fair to say it does not have a heavy debt load!

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Celxpert Energy has very modest net debt levels, with net debt at just 0.021 times EBITDA. Humorously, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like an Olympic ice-skater handles a pirouette. Even more impressive was the fact that Celxpert Energy grew its EBIT by 116% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Celxpert Energy's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, Celxpert Energy actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

Happily, Celxpert Energy's impressive interest cover implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Taking all this data into account, it seems to us that Celxpert Energy takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Celxpert Energy you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Celxpert Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3323

Celxpert Energy

Designs, manufactures, processes, trades, and sells lithium-ion battery packs in Taiwan, China, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives