- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3323

Celxpert Energy (GTSM:3323) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Celxpert Energy Corporation (GTSM:3323) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Celxpert Energy

How Much Debt Does Celxpert Energy Carry?

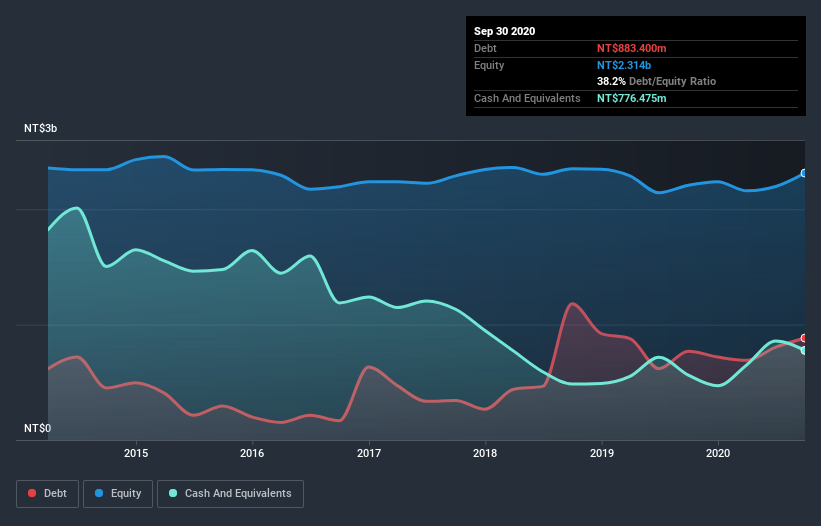

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Celxpert Energy had NT$883.4m of debt, an increase on NT$769.5m, over one year. On the flip side, it has NT$776.5m in cash leading to net debt of about NT$106.9m.

A Look At Celxpert Energy's Liabilities

According to the last reported balance sheet, Celxpert Energy had liabilities of NT$4.62b due within 12 months, and liabilities of NT$3.68m due beyond 12 months. Offsetting this, it had NT$776.5m in cash and NT$3.99b in receivables that were due within 12 months. So it actually has NT$145.9m more liquid assets than total liabilities.

This short term liquidity is a sign that Celxpert Energy could probably pay off its debt with ease, as its balance sheet is far from stretched.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Celxpert Energy has net debt of just 0.23 times EBITDA, suggesting it could ramp leverage without breaking a sweat. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. Even more impressive was the fact that Celxpert Energy grew its EBIT by 151% over twelve months. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But it is Celxpert Energy's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Celxpert Energy burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

The good news is that Celxpert Energy's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Taking all this data into account, it seems to us that Celxpert Energy takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Celxpert Energy has 1 warning sign we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Celxpert Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:3323

Celxpert Energy

Designs, manufactures, processes, trades, and sells lithium-ion battery packs in Taiwan, China, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives