Optimistic Investors Push eCloudvalley Digital Technology Co., Ltd. (TWSE:6689) Shares Up 31% But Growth Is Lacking

eCloudvalley Digital Technology Co., Ltd. (TWSE:6689) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

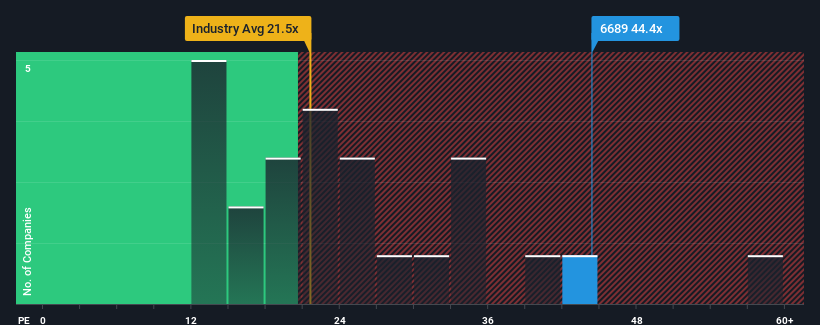

Since its price has surged higher, eCloudvalley Digital Technology's price-to-earnings (or "P/E") ratio of 44.4x might make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 20x and even P/E's below 14x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, eCloudvalley Digital Technology has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for eCloudvalley Digital Technology

How Is eCloudvalley Digital Technology's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like eCloudvalley Digital Technology's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the three analysts watching the company. That's shaping up to be similar to the 25% growth forecast for the broader market.

With this information, we find it interesting that eCloudvalley Digital Technology is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

eCloudvalley Digital Technology's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of eCloudvalley Digital Technology's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for eCloudvalley Digital Technology that you should be aware of.

If you're unsure about the strength of eCloudvalley Digital Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6689

eCloudvalley Digital Technology

eCloudvalley Digital Technology Co., Ltd.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.