CyberLink's (TPE:5203) Returns On Capital Not Reflecting Well On The Business

What underlying fundamental trends can indicate that a company might be in decline? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after glancing at the trends within CyberLink (TPE:5203), we weren't too hopeful.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for CyberLink, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.054 = NT$237m ÷ (NT$5.1b - NT$714m) (Based on the trailing twelve months to December 2020).

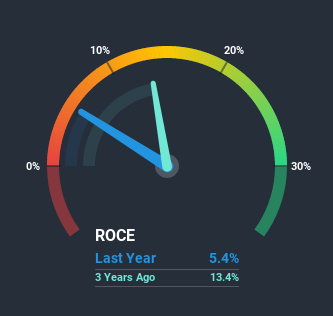

Therefore, CyberLink has an ROCE of 5.4%. Ultimately, that's a low return and it under-performs the Software industry average of 16%.

See our latest analysis for CyberLink

Above you can see how the current ROCE for CyberLink compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering CyberLink here for free.

The Trend Of ROCE

We are a bit worried about the trend of returns on capital at CyberLink. To be more specific, the ROCE was 13% five years ago, but since then it has dropped noticeably. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect CyberLink to turn into a multi-bagger.

Our Take On CyberLink's ROCE

In summary, it's unfortunate that CyberLink is generating lower returns from the same amount of capital. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 65% return. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you'd like to know more about CyberLink, we've spotted 3 warning signs, and 1 of them can't be ignored.

While CyberLink isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade CyberLink, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:5203

CyberLink

A multimedia software and AI facial recognition technology company, develops, designs, and sells video entertainment and media creation software in Taiwan, the United States, Japan, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion