Imagine Owning Apex International Financial Engineering Res. & Tech (GTSM:5210) And Wondering If The 13% Share Price Slide Is Justified

It is doubtless a positive to see that the Apex International Financial Engineering Res. & Tech. Co., Ltd (GTSM:5210) share price has gained some 40% in the last three months. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 13% in that half decade.

View our latest analysis for Apex International Financial Engineering Res. & Tech

Because Apex International Financial Engineering Res. & Tech made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Apex International Financial Engineering Res. & Tech reduced its trailing twelve month revenue by 2.6% for each year. While far from catastrophic that is not good. The stock hasn't done well for shareholders in the last five years, falling 2.7%, annualized. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

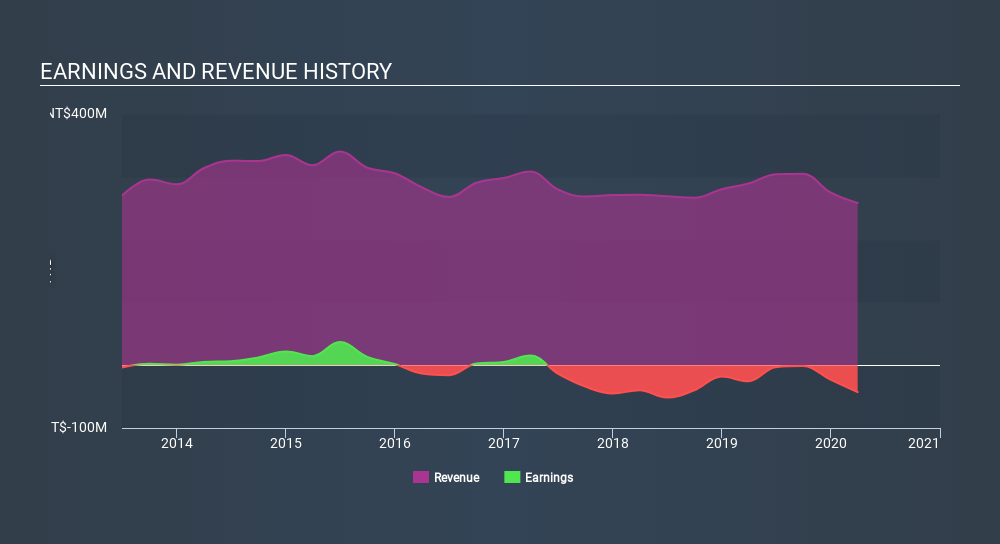

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Apex International Financial Engineering Res. & Tech's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Apex International Financial Engineering Res. & Tech's TSR, which was a 8.1% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 13% in the last year, Apex International Financial Engineering Res. & Tech shareholders lost 2.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Apex International Financial Engineering Res. & Tech better, we need to consider many other factors. For example, we've discovered 3 warning signs for Apex International Financial Engineering Res. & Tech (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TPEX:5210

Apex International Financial Engineering Res. & Tech

Apex International Financial Engineering Res.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives