- Taiwan

- /

- Semiconductors

- /

- TWSE:8271

Apacer Technology Inc. (TWSE:8271) Shares Fly 27% But Investors Aren't Buying For Growth

Apacer Technology Inc. (TWSE:8271) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 52%.

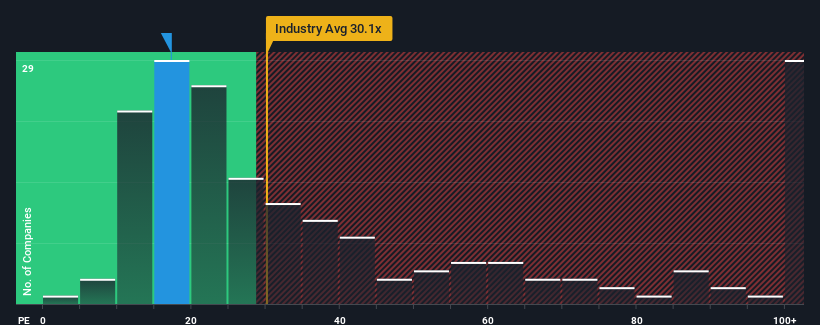

In spite of the firm bounce in price, Apacer Technology's price-to-earnings (or "P/E") ratio of 17.2x might still make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 22x and even P/E's above 38x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Apacer Technology's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Apacer Technology

What Are Growth Metrics Telling Us About The Low P/E?

Apacer Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 26% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Apacer Technology is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Apacer Technology's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Apacer Technology revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Apacer Technology, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8271

Apacer Technology

Researches, designs, develops, manufactures, processes, maintains, and sells memory modules and storage memory devices in Hong Kong, Taiwan, Mainland China, the Americas, Japan, and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives