- Taiwan

- /

- Semiconductors

- /

- TWSE:8261

Top Dividend Stocks In Global For September 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by weaker-than-expected U.S. labor data and shifting interest rate expectations, investors are keenly observing economic indicators for signs of stability or further volatility. In this environment, dividend stocks can offer a measure of resilience and income potential, making them an attractive option for those looking to balance growth with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.64% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.29% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.90% | ★★★★★★ |

| NCD (TSE:4783) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.10% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Daicel (TSE:4202) | 4.27% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

Click here to see the full list of 1308 stocks from our Top Global Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

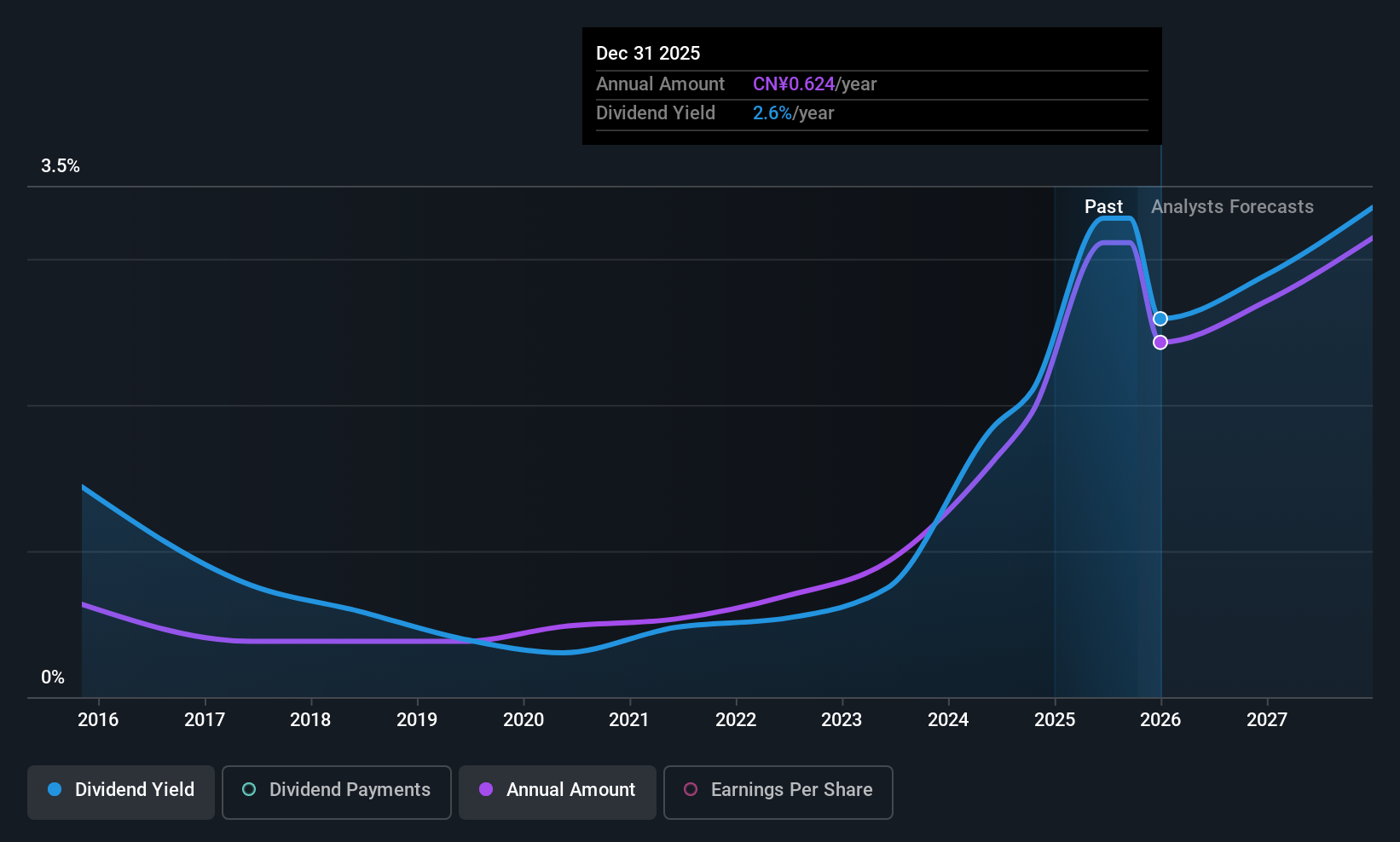

Yifeng Pharmacy Chain (SHSE:603939)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yifeng Pharmacy Chain Co., Ltd. operates in the retail business of pharmaceutical products in China with a market cap of CN¥30.15 billion.

Operations: Yifeng Pharmacy Chain Co., Ltd. generates its revenue primarily from the retail sale of pharmaceutical products in China.

Dividend Yield: 3.1%

Yifeng Pharmacy Chain's dividend payments have been volatile over the past decade, though they are well covered by both earnings (52.6% payout ratio) and cash flows (28.3% cash payout ratio). The dividend yield of 3.06% ranks in the top 25% of CN market payers, despite an unstable track record. Recent financials show improved net income at CNY 880.05 million for H1 2025, although sales slightly declined year-over-year to CNY 11.72 billion.

- Click here to discover the nuances of Yifeng Pharmacy Chain with our detailed analytical dividend report.

- Our expertly prepared valuation report Yifeng Pharmacy Chain implies its share price may be lower than expected.

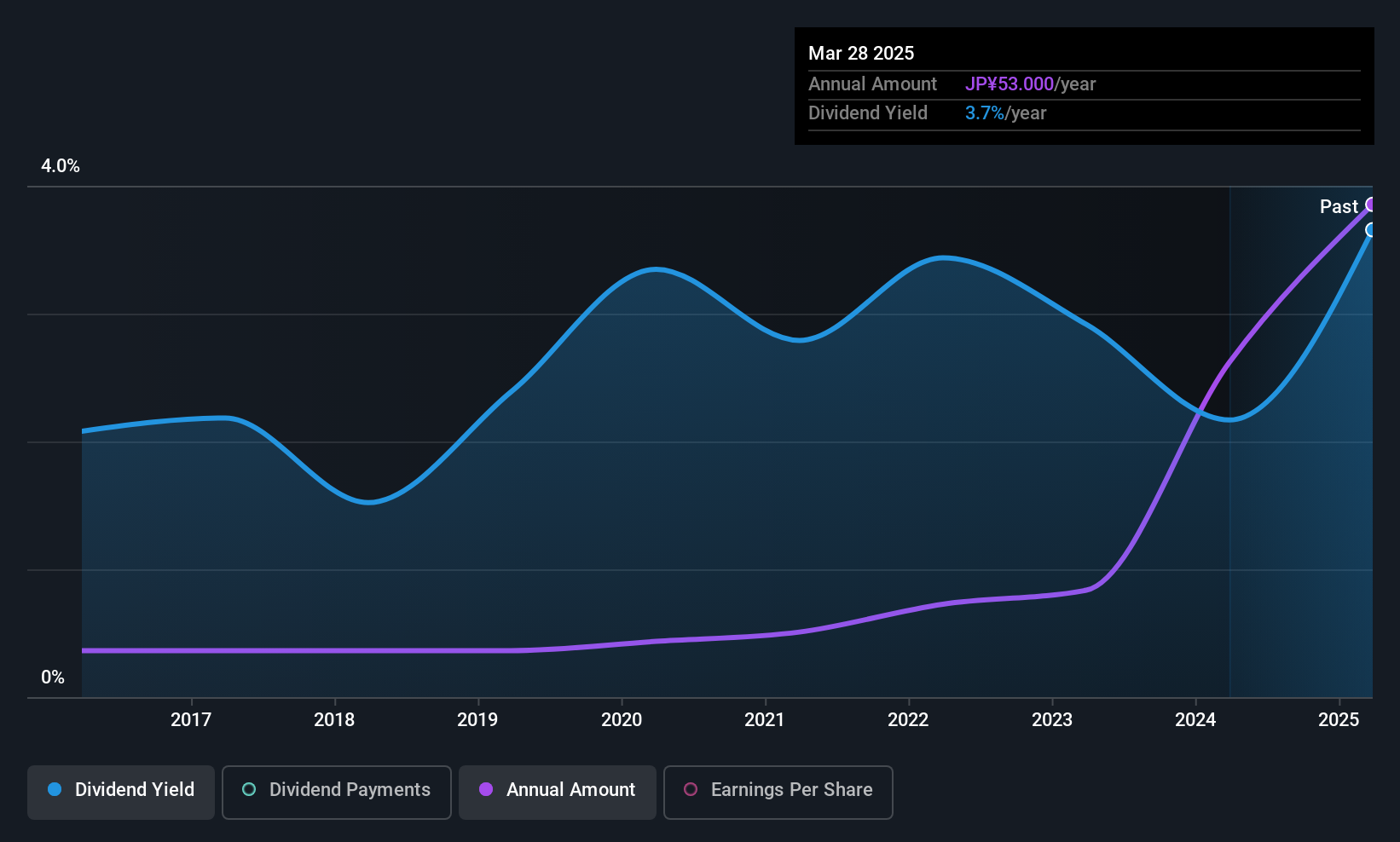

Yamax (TSE:5285)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yamax Corp. manufactures and sells concrete and cement products for construction and civil engineering projects in Japan, with a market cap of ¥21.35 billion.

Operations: Yamax Corp.'s revenue primarily comes from Architectural Cement Products, generating ¥7.56 billion, and Cement Manufacture for Engineering Works, contributing ¥16.41 billion.

Dividend Yield: 3%

Yamax's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 27.5% and covered by cash flows despite an 85.9% cash payout ratio. While its dividend yield of 3.01% is below the top quartile in Japan, the company's price-to-earnings ratio of 10.4x suggests good value compared to the market average of 14.7x. Earnings increased by 27.8% last year, reinforcing dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Yamax.

- Upon reviewing our latest valuation report, Yamax's share price might be too optimistic.

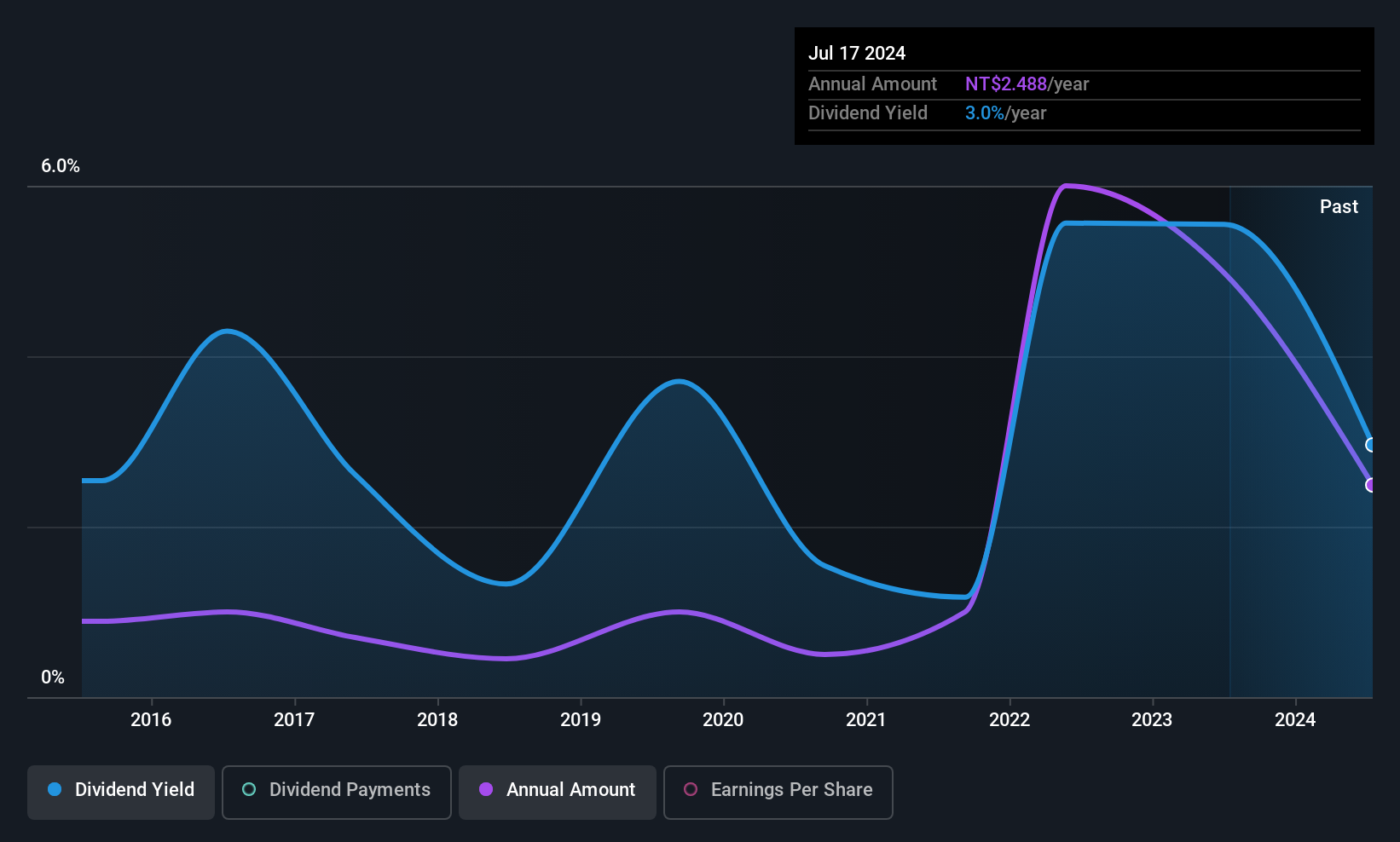

Advanced Power Electronics (TWSE:8261)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Power Electronics Co., Ltd. is a Taiwanese company that provides power discrete products, with a market cap of NT$10.91 billion.

Operations: Advanced Power Electronics Co., Ltd. generates its revenue primarily from Electronic Components & Parts, amounting to NT$3.13 billion.

Dividend Yield: 3.4%

Advanced Power Electronics has a price-to-earnings ratio of 18.6x, below Taiwan's market average, indicating relative value. Its dividend yield is 3.44%, lower than the top quartile in Taiwan, but dividends are well-covered by earnings and cash flows with payout ratios of 63.7% and 45.5%, respectively. Despite recent earnings growth and increasing dividends over the past decade, its dividend history is marked by volatility, raising concerns about sustainability amidst fluctuating income figures.

- Unlock comprehensive insights into our analysis of Advanced Power Electronics stock in this dividend report.

- Our valuation report here indicates Advanced Power Electronics may be undervalued.

Turning Ideas Into Actions

- Click here to access our complete index of 1308 Top Global Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8261

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.