- Taiwan

- /

- Semiconductors

- /

- TWSE:8162

Micro Silicon Electronics' (TWSE:8162) Solid Profits Have Weak Fundamentals

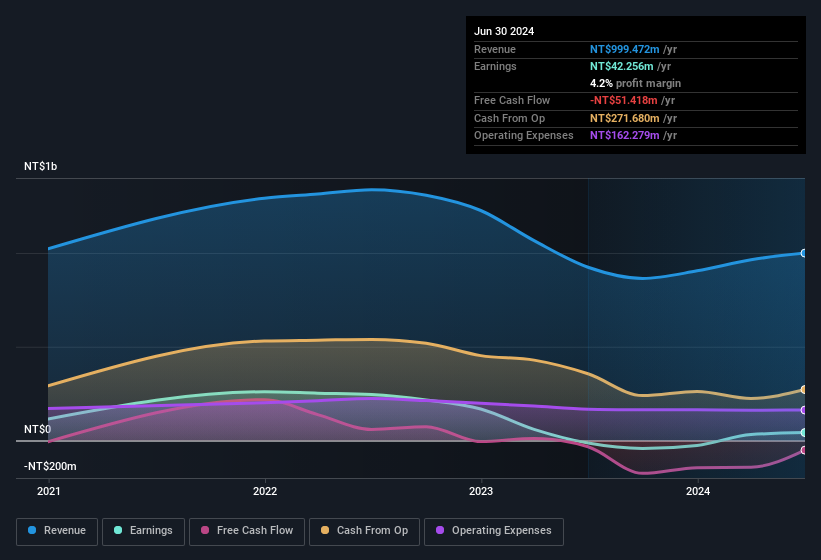

Despite posting some strong earnings, the market for Micro Silicon Electronics Co., Ltd.'s (TWSE:8162) stock hasn't moved much. Our analysis suggests that shareholders have noticed something concerning in the numbers.

View our latest analysis for Micro Silicon Electronics

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Micro Silicon Electronics expanded the number of shares on issue by 6.3% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Micro Silicon Electronics' historical EPS growth by clicking on this link.

How Is Dilution Impacting Micro Silicon Electronics' Earnings Per Share (EPS)?

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Micro Silicon Electronics' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Micro Silicon Electronics.

Our Take On Micro Silicon Electronics' Profit Performance

Micro Silicon Electronics issued shares during the year, and that means its EPS performance lags its net income growth. Because of this, we think that it may be that Micro Silicon Electronics' statutory profits are better than its underlying earnings power. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Micro Silicon Electronics at this point in time. For example, Micro Silicon Electronics has 3 warning signs (and 1 which can't be ignored) we think you should know about.

This note has only looked at a single factor that sheds light on the nature of Micro Silicon Electronics' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8162

Micro Silicon Electronics

Provides semiconductor backend services in Taiwan, the United States, Asia, and Europe.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026