- Taiwan

- /

- Semiconductors

- /

- TWSE:8016

Samyung Trading And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and geopolitical tensions, investors are keenly observing the impacts on equity indices. With U.S. stocks experiencing volatility due to AI competition fears and European markets buoyed by rate cuts, the search for stable income sources becomes increasingly relevant. In this environment, dividend stocks can offer a reliable stream of income and potential portfolio stability amidst market turbulence.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

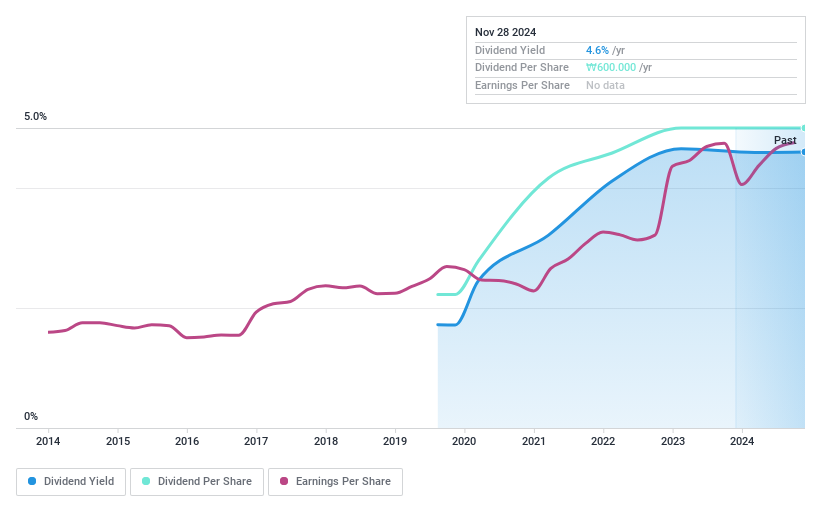

Samyung Trading (KOSE:A002810)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyung Trading Co., Ltd. primarily supplies organic and inorganic chemical products worldwide, with a market cap of ₩223.52 billion.

Operations: Samyung Trading Co., Ltd.'s revenue segments include Shoemaker at ₩213.10 million, Auto Parts at ₩252.43 million, and Spectacle Lens at ₩15.59 million.

Dividend Yield: 4.7%

Samyung Trading's recent earnings report shows growth, with net income rising to KRW 13.82 billion for Q3 2024. The company offers a competitive dividend yield of 4.73%, placing it in the top quartile of the KR market, though it has only a five-year history of payouts. Dividends are well-covered by earnings with an 18% payout ratio but have a higher cash payout ratio at 84.8%. The low P/E ratio suggests potential value for investors seeking dividends.

- Get an in-depth perspective on Samyung Trading's performance by reading our dividend report here.

- According our valuation report, there's an indication that Samyung Trading's share price might be on the expensive side.

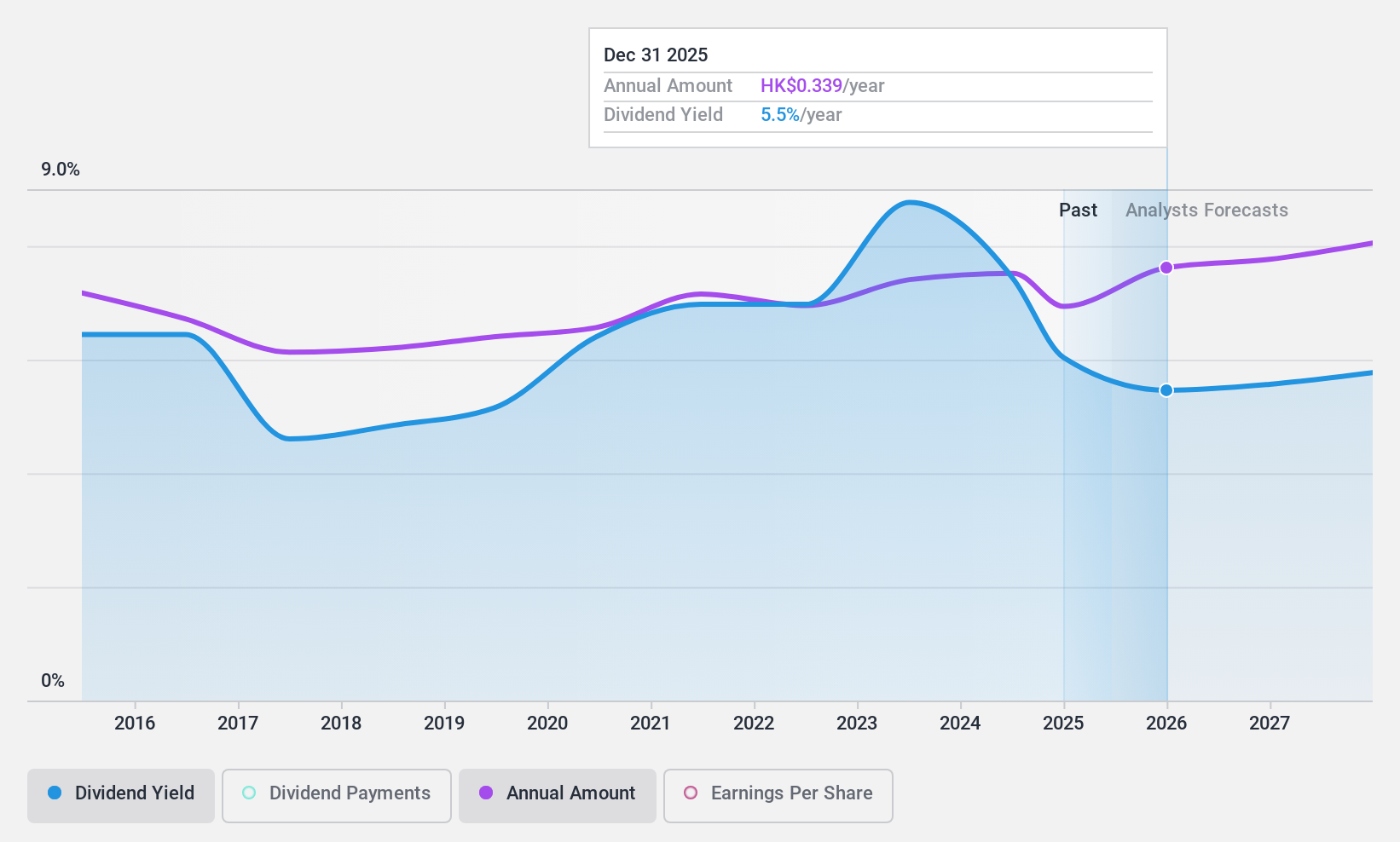

Industrial and Commercial Bank of China (SEHK:1398)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial and Commercial Bank of China Limited, along with its subsidiaries, offers a range of banking products and services both within the People's Republic of China and internationally, with a market cap of approximately HK$2.40 trillion.

Operations: Industrial and Commercial Bank of China Limited, through its subsidiaries, generates revenue by offering diverse banking products and services domestically and internationally.

Dividend Yield: 5.7%

Industrial and Commercial Bank of China offers a reliable dividend yield of 5.68%, though it is below the top quartile in Hong Kong. The bank's dividends have been stable and growing over the past decade, supported by a low payout ratio of 45.9%, indicating sustainability. Recent approval for an interim dividend underscores its commitment to shareholder returns. With earnings expected to cover future payouts comfortably, ICBC remains a consistent choice for dividend-focused investors despite recent executive changes and fixed-income offerings totaling CNY 10 billion.

- Navigate through the intricacies of Industrial and Commercial Bank of China with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Industrial and Commercial Bank of China shares in the market.

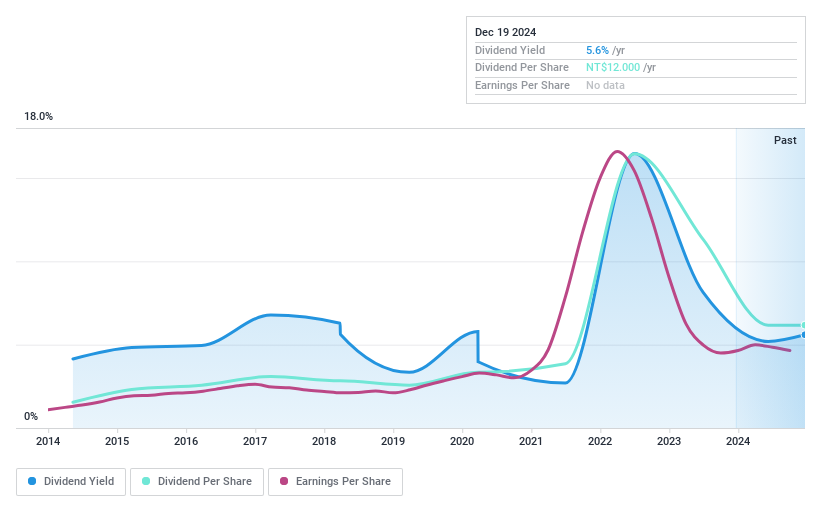

Sitronix Technology (TWSE:8016)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sitronix Technology Corporation designs, manufactures, and supplies integrated circuits and memory chips across various regions including Hong Kong, Vietnam, South Korea, Taiwan, India, and internationally with a market cap of NT$25.52 billion.

Operations: The company's revenue from semiconductors is NT$17.72 billion.

Dividend Yield: 5.6%

Sitronix Technology's dividend yield of 5.62% ranks in the top 25% of Taiwan's market, offering appealing returns. Despite a volatile and unreliable dividend history over the past decade, recent growth in earnings by 6.4% annually supports its payout ratio of 77.4%, indicating dividends are covered by earnings and cash flows (57%). However, third-quarter results showed a decline in net income to TWD 463.49 million from TWD 539.98 million year-on-year, which may impact future stability.

- Delve into the full analysis dividend report here for a deeper understanding of Sitronix Technology.

- In light of our recent valuation report, it seems possible that Sitronix Technology is trading beyond its estimated value.

Where To Now?

- Click here to access our complete index of 1955 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8016

Sitronix Technology

Designs, manufactures, and supplies integrated circuits (ICs) and memory chips in Hong Kong, Vietnam, South Korea, Taiwan, India, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives