- Taiwan

- /

- Semiconductors

- /

- TWSE:6916

Winstar Display's (TWSE:6916) Conservative Accounting Might Explain Soft Earnings

Shareholders appeared unconcerned with Winstar Display Co., Ltd.'s (TWSE:6916) lackluster earnings report last week. We did some digging, and we believe the earnings are stronger than they seem.

View our latest analysis for Winstar Display

A Closer Look At Winstar Display's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

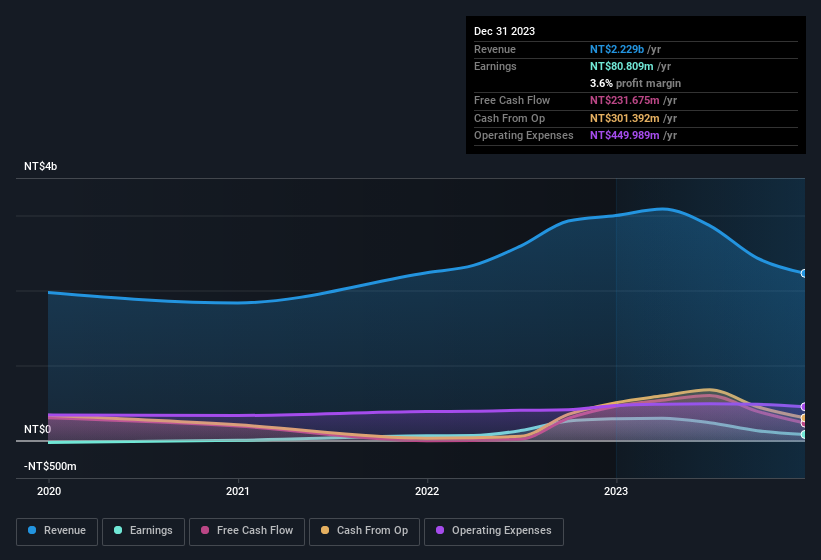

Over the twelve months to December 2023, Winstar Display recorded an accrual ratio of -0.20. That indicates that its free cash flow quite significantly exceeded its statutory profit. To wit, it produced free cash flow of NT$232m during the period, dwarfing its reported profit of NT$80.8m. Winstar Display's free cash flow actually declined over the last year, which is disappointing, like non-biodegradable balloons. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Winstar Display.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Winstar Display increased the number of shares on issue by 13% over the last twelve months by issuing new shares. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Winstar Display's historical EPS growth by clicking on this link.

How Is Dilution Impacting Winstar Display's Earnings Per Share (EPS)?

As you can see above, Winstar Display has been growing its net income over the last few years, with an annualized gain of 2,347% over three years. But EPS was only up 1,741% per year, in the exact same period. Net profit actually dropped by 72% in the last year. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 73%. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Winstar Display's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Winstar Display's Profit Performance

In conclusion, Winstar Display has a strong cashflow relative to earnings, which indicates good quality earnings, but the dilution means its earnings per share are dropping faster than its profit. Based on these factors, we think that Winstar Display's profits are a reasonably conservative guide to its underlying profitability. If you'd like to know more about Winstar Display as a business, it's important to be aware of any risks it's facing. In terms of investment risks, we've identified 4 warning signs with Winstar Display, and understanding these bad boys should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Winstar Display might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6916

Winstar Display

Engages in the manufacturing, processing, and trading of various displays and modules in Europe, Asia, the United States, Taiwan, and internationally.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026