- Taiwan

- /

- Semiconductors

- /

- TWSE:6695

iCatch Technology, Inc.'s (TWSE:6695) 27% Price Boost Is Out Of Tune With Revenues

iCatch Technology, Inc. (TWSE:6695) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 7.4% in the last twelve months.

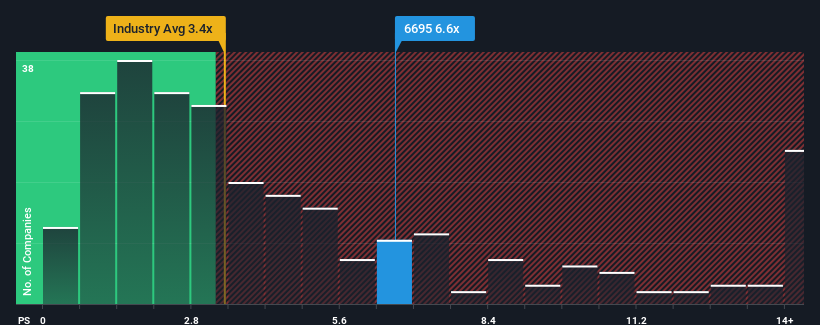

Since its price has surged higher, you could be forgiven for thinking iCatch Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.6x, considering almost half the companies in Taiwan's Semiconductor industry have P/S ratios below 3.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for iCatch Technology

How Has iCatch Technology Performed Recently?

As an illustration, revenue has deteriorated at iCatch Technology over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on iCatch Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, iCatch Technology would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.5%. This means it has also seen a slide in revenue over the longer-term as revenue is down 14% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 16,735% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we find it worrying that iCatch Technology's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does iCatch Technology's P/S Mean For Investors?

The strong share price surge has lead to iCatch Technology's P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that iCatch Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Plus, you should also learn about this 1 warning sign we've spotted with iCatch Technology.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if iCatch Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6695

iCatch Technology

Researches, develops, designs, manufactures, and sells IC products for digital and automotive imaging, and home security monitoring image processing related products.

Flawless balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives