- China

- /

- Entertainment

- /

- SZSE:002261

November 2024's Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

In the wake of a significant political shift in the U.S., global markets have experienced notable movements, with major benchmarks reaching record highs as investors anticipate potential benefits from policy changes. Amidst these developments, insider ownership in growth companies has become an area of interest for investors seeking alignment between management and shareholder interests. In such a dynamic environment, high insider ownership can be seen as a positive indicator of confidence in a company's future prospects and strategic direction.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 32% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Ceigall India (NSEI:CEIGALL)

Simply Wall St Growth Rating: ★★★★★☆

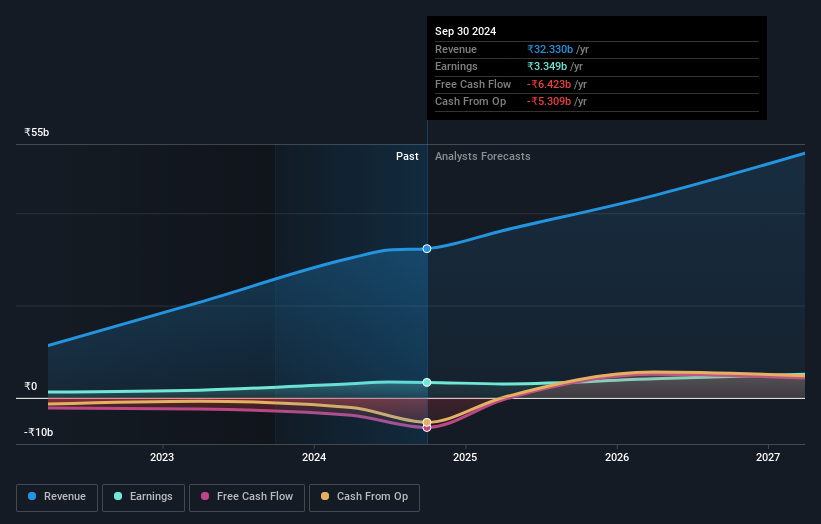

Overview: Ceigall India Limited is an infrastructure construction company in India with a market cap of ₹52.78 billion.

Operations: The company generates revenue primarily from Engineering Procurement and Construction (EPC) projects at ₹32.45 billion and Annuity Projects at ₹9.90 billion.

Insider Ownership: 37.5%

Revenue Growth Forecast: 19.9% p.a.

Ceigall India is experiencing robust growth, with earnings expected to rise significantly at 20.18% annually, surpassing the Indian market average. Despite a temporary dip in net income for the recent quarter, overall revenue and profit have shown substantial year-over-year increases. The company's price-to-earnings ratio of 15.9x suggests it is undervalued compared to the broader market. Additionally, Ceigall's strategic asset sales and high insider ownership may further align management interests with shareholders' goals.

- Click here and access our complete growth analysis report to understand the dynamics of Ceigall India.

- Our expertly prepared valuation report Ceigall India implies its share price may be too high.

Talkweb Information SystemLtd (SZSE:002261)

Simply Wall St Growth Rating: ★★★★☆☆

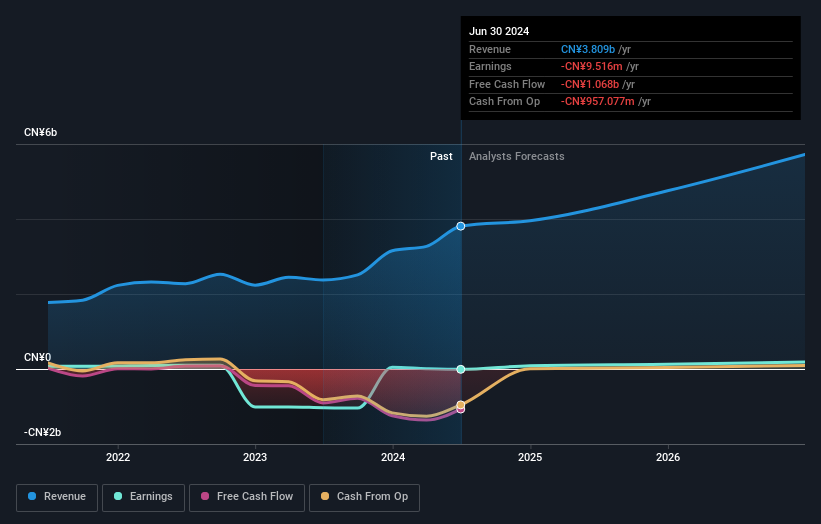

Overview: Talkweb Information System Co., Ltd. operates in China, offering education services and mobile games, with a market cap of CN¥33.15 billion.

Operations: The company generates revenue through its education services and mobile games segments in China.

Insider Ownership: 20.2%

Revenue Growth Forecast: 15.6% p.a.

Talkweb Information System Ltd. has seen a significant increase in revenue, reaching CNY 2.94 billion for the nine months ending September 2024, up from CNY 1.87 billion a year ago. However, net income declined to CNY 11.01 million from CNY 72.71 million due to rising costs or other factors impacting profitability. Forecasts indicate that revenue will grow at an annual rate of 15.6%, outpacing the Chinese market average, with expectations of profitability within three years despite low anticipated return on equity at that time.

- Unlock comprehensive insights into our analysis of Talkweb Information SystemLtd stock in this growth report.

- The analysis detailed in our Talkweb Information SystemLtd valuation report hints at an inflated share price compared to its estimated value.

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces globally, with a market cap of approximately NT$46.24 billion.

Operations: The company's revenue is primarily derived from the manufacture and sales of photoelectric product testing tools, amounting to NT$3.99 billion.

Insider Ownership: 22.8%

Revenue Growth Forecast: 44.2% p.a.

WinWay Technology is trading at 30.2% below its estimated fair value, suggesting potential for growth. Its revenue and earnings are forecast to grow significantly, at 44.2% and 63.6% annually, surpassing the Taiwan market averages of 12.7% and 19.4%, respectively. Despite the lack of recent insider trading data, these projections indicate robust expansion prospects ahead of its Q3 earnings release on November 12, when financial performance will be further clarified.

- Get an in-depth perspective on WinWay Technology's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, WinWay Technology's share price might be too optimistic.

Seize The Opportunity

- Investigate our full lineup of 1515 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Talkweb Information SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002261

Talkweb Information SystemLtd

Provides education services and mobile games in China.

Excellent balance sheet very low.