- Taiwan

- /

- Semiconductors

- /

- TWSE:6451

ShunSin Technology Holdings (TWSE:6451) Has Some Way To Go To Become A Multi-Bagger

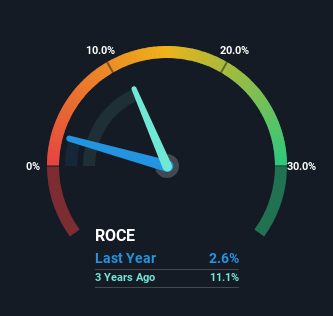

If you're looking for a multi-bagger, there's a few things to keep an eye out for. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at ShunSin Technology Holdings (TWSE:6451) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for ShunSin Technology Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.026 = NT$209m ÷ (NT$15b - NT$7.0b) (Based on the trailing twelve months to March 2024).

So, ShunSin Technology Holdings has an ROCE of 2.6%. In absolute terms, that's a low return and it also under-performs the Semiconductor industry average of 8.0%.

View our latest analysis for ShunSin Technology Holdings

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating ShunSin Technology Holdings' past further, check out this free graph covering ShunSin Technology Holdings' past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Things have been pretty stable at ShunSin Technology Holdings, with its capital employed and returns on that capital staying somewhat the same for the last five years. This tells us the company isn't reinvesting in itself, so it's plausible that it's past the growth phase. So unless we see a substantial change at ShunSin Technology Holdings in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 47% of total assets, this reported ROCE would probably be less than2.6% because total capital employed would be higher.The 2.6% ROCE could be even lower if current liabilities weren't 47% of total assets, because the the formula would show a larger base of total capital employed. Additionally, this high level of current liabilities isn't ideal because it means the company's suppliers (or short-term creditors) are effectively funding a large portion of the business.

Our Take On ShunSin Technology Holdings' ROCE

We can conclude that in regards to ShunSin Technology Holdings' returns on capital employed and the trends, there isn't much change to report on. Yet to long term shareholders the stock has gifted them an incredible 133% return in the last five years, so the market appears to be rosy about its future. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

One final note, you should learn about the 3 warning signs we've spotted with ShunSin Technology Holdings (including 2 which don't sit too well with us) .

While ShunSin Technology Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6451

ShunSin Technology Holdings

Engages in the assembly, testing, and sale of various integrated circuits related to semiconductors in Mainland China, the United States, Taiwan, Malaysia, Singapore, Ireland, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives