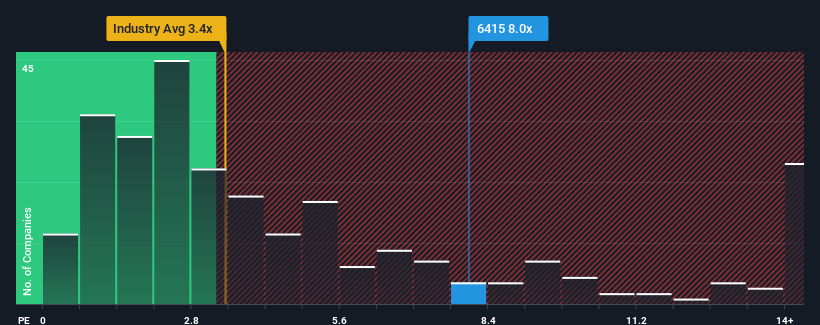

Silergy Corp.'s (TWSE:6415) price-to-sales (or "P/S") ratio of 8x may look like a poor investment opportunity when you consider close to half the companies in the Semiconductor industry in Taiwan have P/S ratios below 3.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Silergy

What Does Silergy's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Silergy has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Silergy will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Silergy's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 9.3% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 26% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 21% per annum, which is noticeably less attractive.

With this information, we can see why Silergy is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Silergy's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Silergy shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Silergy that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6415

Silergy

Designs, manufactures, and sales of various integrated circuit products and related technical services in China and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives