- Taiwan

- /

- Semiconductors

- /

- TWSE:6202

Holtek Semiconductor's (TWSE:6202) Dividend Is Being Reduced To NT$0.45

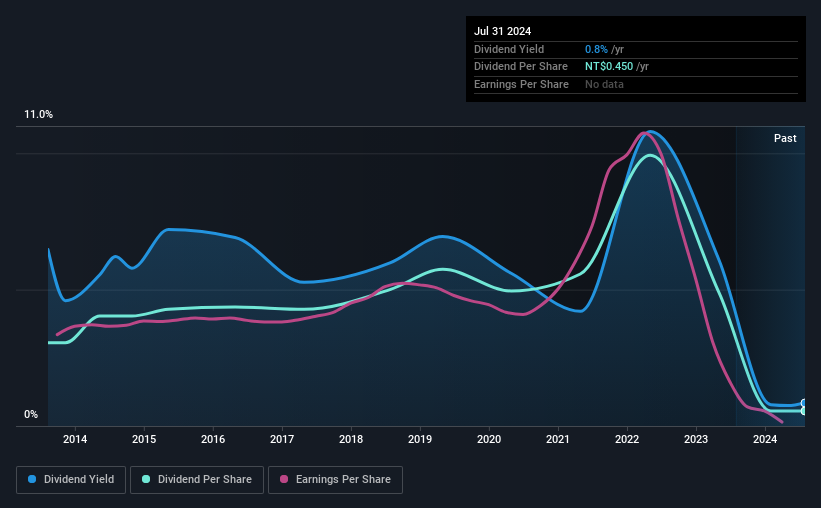

Holtek Semiconductor Inc. (TWSE:6202) has announced that on 5th of September, it will be paying a dividend ofNT$0.45, which a reduction from last year's comparable dividend. This means that the annual payment is 0.8% of the current stock price, which is lower than what the rest of the industry is paying.

See our latest analysis for Holtek Semiconductor

Holtek Semiconductor Is Paying Out More Than It Is Earning

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Prior to this announcement, the company was paying out 343% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 29%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Over the next year, EPS is forecast to expand by 150.6%. Assuming the dividend continues along recent trends, we think the payout ratio could reach 142%, which probably can't continue without putting some pressure on the balance sheet.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the dividend has gone from NT$2.50 total annually to NT$0.45. The dividend has fallen 82% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Over the past five years, it looks as though Holtek Semiconductor's EPS has declined at around 51% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Holtek Semiconductor is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Holtek Semiconductor that investors need to be conscious of moving forward. Is Holtek Semiconductor not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Holtek Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6202

Holtek Semiconductor

Engages in the research, development, production, and sale of integrated circuits in Taiwan, China, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion