- Taiwan

- /

- Semiconductors

- /

- TWSE:5434

Undiscovered Gems With Strong Fundamentals For November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with small-cap indices like the Russell 2000 showing significant gains yet remaining below previous highs, investors are closely watching how anticipated policy shifts might impact economic growth and inflation. In this dynamic environment, identifying stocks with robust fundamentals becomes crucial for navigating potential market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 86.64% | 24.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Jintuo Technology (SHSE:603211)

Simply Wall St Value Rating: ★★★★☆☆

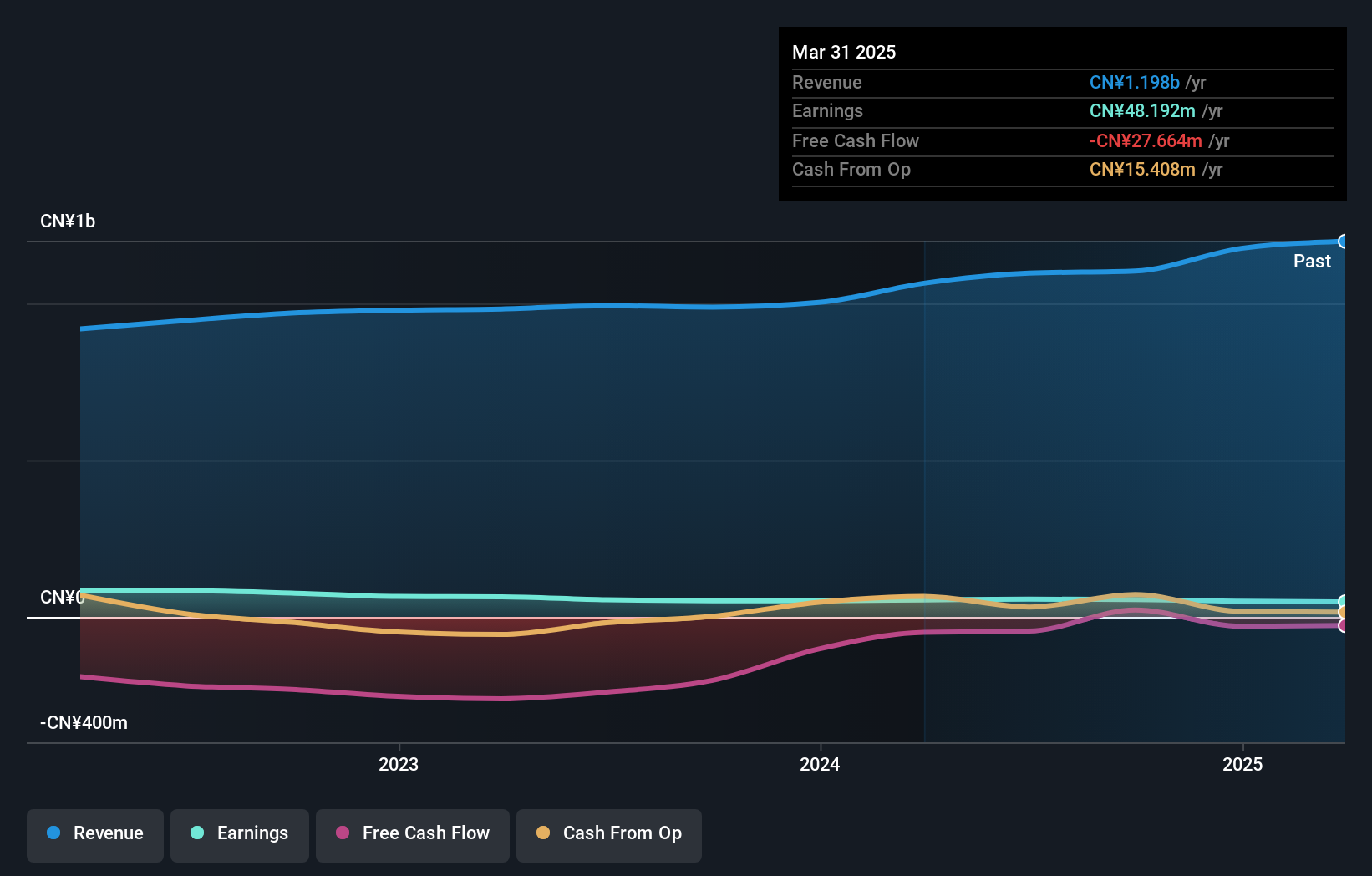

Overview: Jintuo Technology Co., Ltd. focuses on the research, development, production, and sale of aluminum alloy precision die castings with a market capitalization of CN¥4.22 billion.

Operations: The company generates revenue primarily through the sale of aluminum alloy precision die castings. Its net profit margin is notable, reflecting the efficiency in managing production costs relative to its revenue streams.

Jintuo Technology's recent performance highlights its potential as an emerging player, with earnings growing 7.8% over the past year, outpacing the broader Metals and Mining industry. The company's net income for the first nine months of 2024 reached CNY 43.07 million, up from CNY 38.99 million a year ago, reflecting a solid improvement in profitability. Despite an increase in its debt to equity ratio from 29.9% to 36.6% over five years, Jintuo maintains satisfactory debt levels with interest payments well covered by EBIT at a multiple of 5.8x, indicating robust financial health amidst growth challenges and opportunities ahead.

Sanki Engineering (TSE:1961)

Simply Wall St Value Rating: ★★★★★★

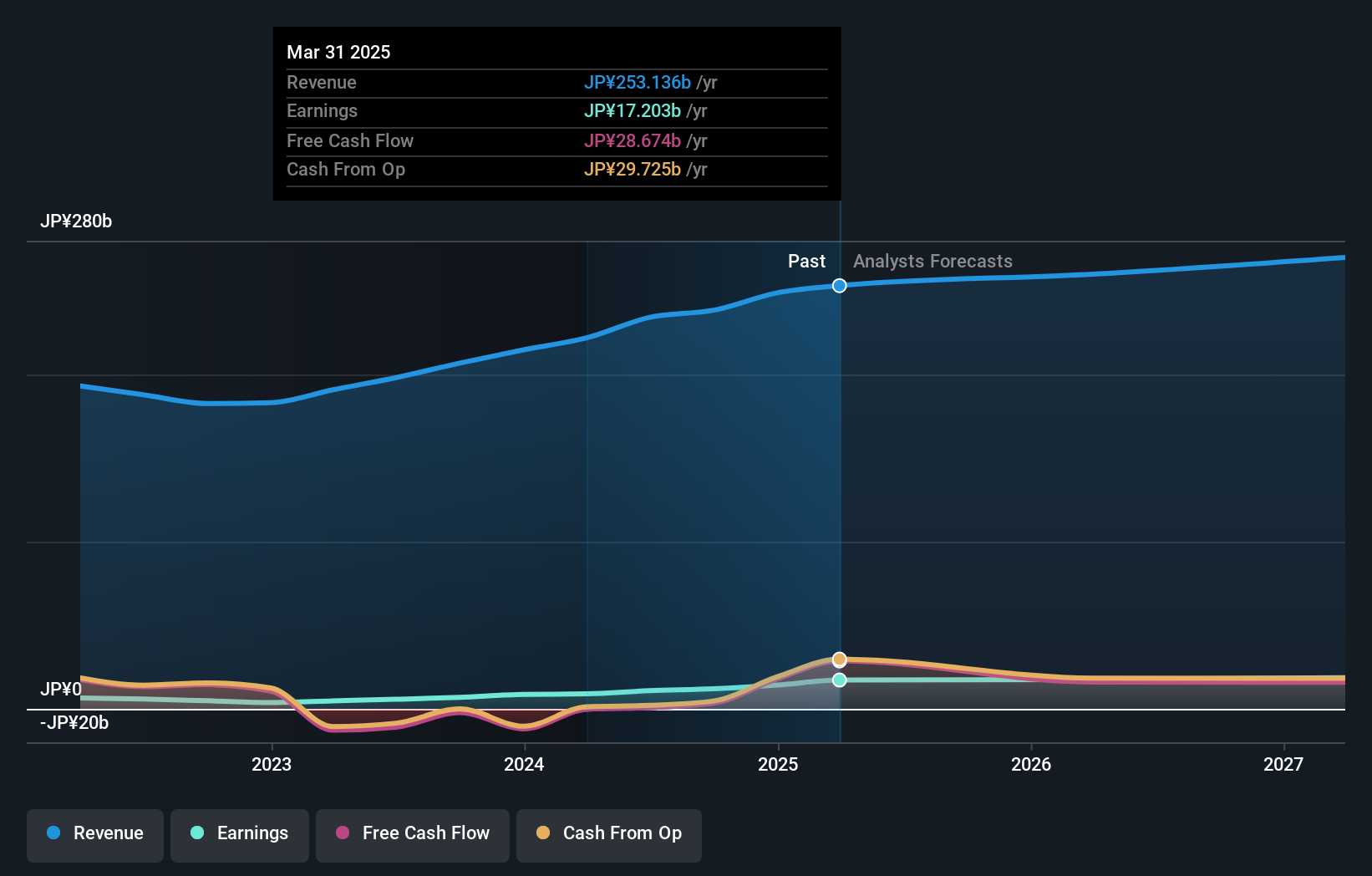

Overview: Sanki Engineering Co., Ltd. offers a range of social infrastructure services both in Japan and internationally, with a market capitalization of ¥132.65 billion.

Operations: Sanki Engineering's primary revenue streams are from its Building Equipment Business, generating ¥188.59 billion, and the Environmental Systems Business, contributing ¥27.60 billion. The Machine System Business also adds to the revenue with ¥11.20 billion, while the Real Estate Business accounts for a smaller portion at ¥2.50 billion.

Sanki Engineering, a smaller player in the construction sector, has demonstrated notable financial health and growth. Over the past five years, its debt-to-equity ratio improved from 12.6% to 7.8%, reflecting prudent financial management. The company is trading at a considerable discount of 36.4% below its estimated fair value, suggesting potential undervaluation in the market. Recent earnings have surged by 73.9%, outpacing industry averages significantly, while free cash flow remains positive—a promising sign for future operations and investments. A recent buyback saw ¥262 million spent on repurchasing shares, indicating confidence in its stock's value trajectory.

Topco ScientificLtd (TWSE:5434)

Simply Wall St Value Rating: ★★★★★☆

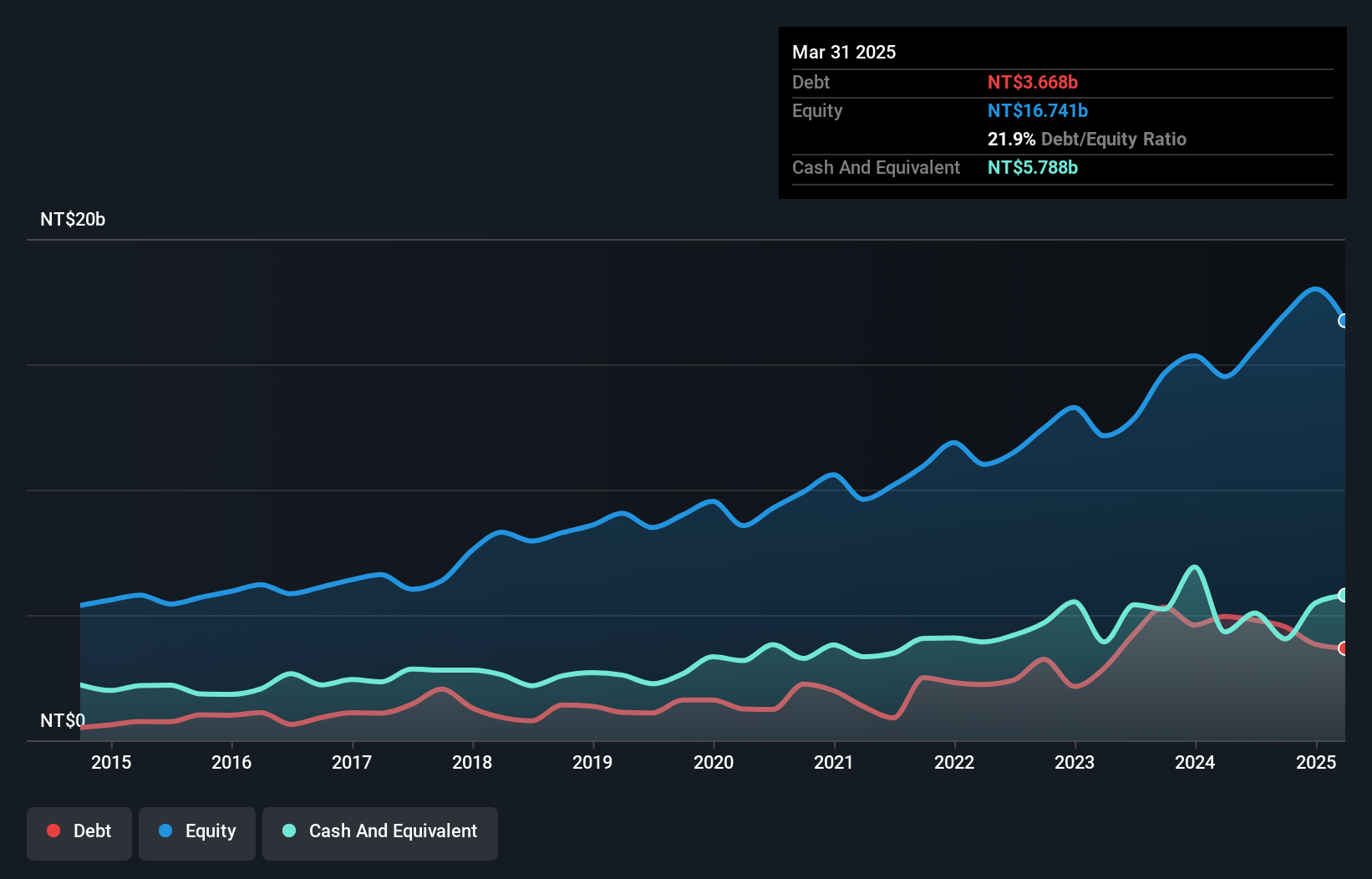

Overview: Topco Scientific Co., Ltd. engages in supplying precision materials, manufacturing equipment, and components for the semiconductor, LCD, and LED industries across Taiwan, China, and international markets with a market cap of NT$59.08 billion.

Operations: Topco Scientific generates revenue primarily from supplying precision materials, manufacturing equipment, and components for the semiconductor, LCD, and LED industries. The company reported a market capitalization of NT$59.08 billion.

Topco Scientific, a notable player in the semiconductor sector, is demonstrating strong performance with recent earnings growth of 21.7%, outpacing the industry average of 3.9%. The company is trading at a significant discount, about 82.7% below its estimated fair value, suggesting potential undervaluation. Despite an increase in its debt to equity ratio from 17.8% to 26.6% over five years, it remains satisfactory at 2.8%. Recent financials reveal robust third-quarter sales of TWD14,744 million and net income rising to TWD937 million compared to last year's figures, reflecting solid operational momentum and promising future prospects.

Turning Ideas Into Actions

- Delve into our full catalog of 4673 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topco ScientificLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5434

Topco ScientificLtd

Provides precision materials, manufacturing equipment, and components worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives