- Taiwan

- /

- Semiconductors

- /

- TWSE:4968

The five-year decline in earnings for RichWave Technology TWSE:4968) isn't encouraging, but shareholders are still up 62% over that period

If you buy and hold a stock for many years, you'd hope to be making a profit. But more than that, you probably want to see it rise more than the market average. But RichWave Technology Corporation (TWSE:4968) has fallen short of that second goal, with a share price rise of 55% over five years, which is below the market return. Meanwhile, the last twelve months saw the share price rise 1.9%.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for RichWave Technology

Given that RichWave Technology only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last 5 years RichWave Technology saw its revenue shrink by 2.3% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 9% per year over that time. Arguably that's not bad given the soft revenue and loss-making position. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

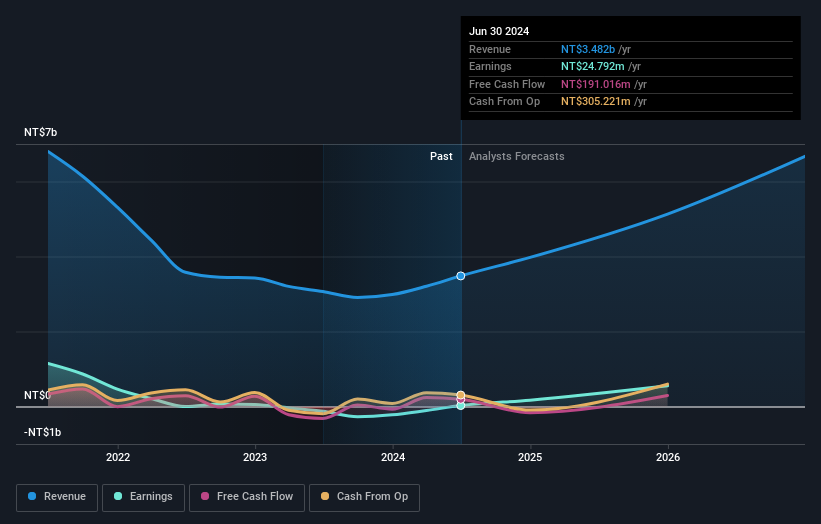

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that RichWave Technology has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for RichWave Technology in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We've already covered RichWave Technology's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. RichWave Technology's TSR of 62% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

RichWave Technology shareholders gained a total return of 1.9% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 10% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for RichWave Technology you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4968

RichWave Technology

Designs, develops, and sells radio frequency (RF) integrated circuits in Taiwan, China, Korea, and internationally.

Exceptional growth potential with adequate balance sheet.