- China

- /

- Personal Products

- /

- SHSE:603983

Asian Stocks Estimated At 36.5% To 44.8% Below Intrinsic Value

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a positive shift in sentiment, with indices such as Japan's Nikkei 225 and China's CSI 300 seeing gains. In this environment, identifying undervalued stocks can be particularly rewarding, as they might offer potential for growth when market conditions stabilize further.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥25.60 | CN¥50.32 | 49.1% |

| Bethel Automotive Safety Systems (SHSE:603596) | CN¥57.62 | CN¥114.61 | 49.7% |

| Auras Technology (TPEX:3324) | NT$487.00 | NT$963.61 | 49.5% |

| Alexander Marine (TWSE:8478) | NT$142.00 | NT$280.63 | 49.4% |

| Rakus (TSE:3923) | ¥2168.00 | ¥4270.57 | 49.2% |

| Newborn Town (SEHK:9911) | HK$8.17 | HK$16.05 | 49.1% |

| World Fitness Services (TWSE:2762) | NT$82.90 | NT$163.37 | 49.3% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.76 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.04 | HK$4.06 | 49.8% |

| Everest Medicines (SEHK:1952) | HK$49.25 | HK$96.65 | 49% |

We're going to check out a few of the best picks from our screener tool.

Guangdong Marubi Biotechnology (SHSE:603983)

Overview: Guangdong Marubi Biotechnology Co., Ltd. is involved in the R&D, design, production, sale, and service of various cosmetics in China with a market cap of CN¥19.01 billion.

Operations: The company's revenue primarily comes from its Personal Products segment, totaling CN¥2.64 billion.

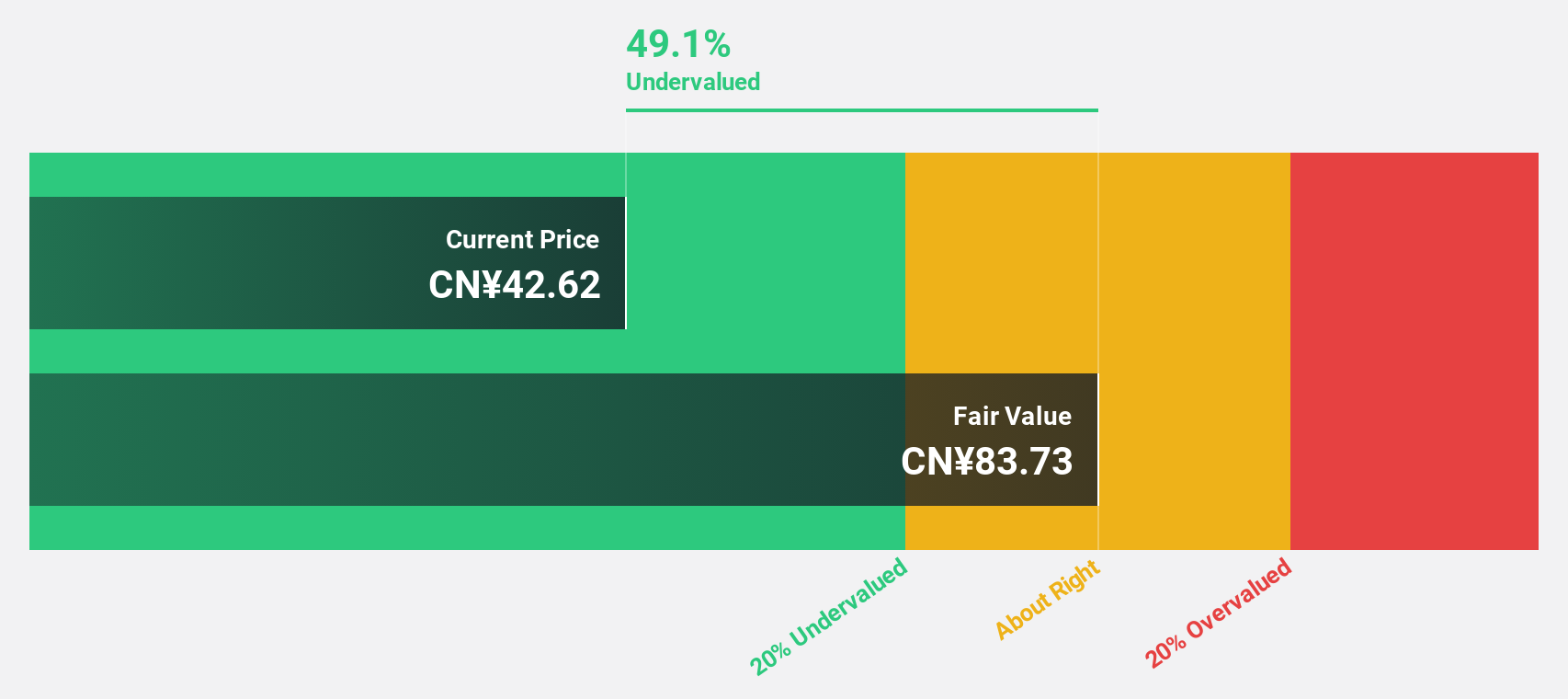

Estimated Discount To Fair Value: 37.3%

Guangdong Marubi Biotechnology's recent earnings report shows strong growth, with sales and net income rising to CNY 846.65 million and CNY 135.05 million, respectively. Despite a low forecasted return on equity of 16.2%, the stock trades at a significant discount to its estimated fair value of CN¥75.6, currently priced at CN¥47.4. Revenue is projected to grow faster than the market at 22.8% annually, although dividend coverage remains weak due to large one-off items impacting financial results.

- Our expertly prepared growth report on Guangdong Marubi Biotechnology implies its future financial outlook may be stronger than recent results.

- Take a closer look at Guangdong Marubi Biotechnology's balance sheet health here in our report.

Goldwind Science&Technology (SZSE:002202)

Overview: Goldwind Science&Technology Co., Ltd. offers wind power solutions both domestically in China and internationally, with a market cap of CN¥34.06 billion.

Operations: Goldwind Science&Technology Co., Ltd. generates revenue through its wind power solutions, serving both domestic and international markets.

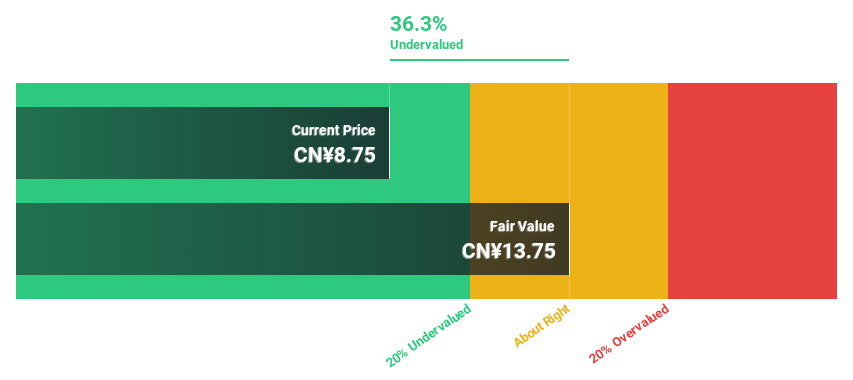

Estimated Discount To Fair Value: 36.5%

Goldwind Science & Technology's stock is trading at CN¥8.75, below its estimated fair value of CN¥13.79, presenting a potential undervaluation based on cash flows. The company's earnings grew significantly by over 500% last year, with forecasted growth outpacing the Chinese market at 25.6% annually. However, its dividend coverage is weak due to insufficient free cash flow support and debt levels not well covered by operating cash flow. Recent announcements include a share buyback program worth up to CN¥500 million, subject to shareholder approval.

- Our comprehensive growth report raises the possibility that Goldwind Science&Technology is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Goldwind Science&Technology's balance sheet health report.

ASE Technology Holding (TWSE:3711)

Overview: ASE Technology Holding Co., Ltd. offers semiconductor packaging and testing along with electronic manufacturing services across various regions including the United States, Taiwan, Asia, and Europe, with a market cap of NT$588.89 billion.

Operations: ASE Technology Holding Co., Ltd. generates revenue through its semiconductor packaging and testing services as well as electronic manufacturing services across the United States, Taiwan, Asia, Europe, and other international markets.

Estimated Discount To Fair Value: 44.8%

ASE Technology Holding is trading at NT$135.5, significantly below its estimated fair value of NT$245.44, indicating potential undervaluation based on cash flows. The company reported strong revenue growth in Q1 2025, with TWD 148.15 billion compared to TWD 132.80 billion a year ago. However, a high debt level and dividends not well covered by free cash flows are concerns despite earnings forecasted to grow significantly above the Taiwan market average annually.

- The analysis detailed in our ASE Technology Holding growth report hints at robust future financial performance.

- Dive into the specifics of ASE Technology Holding here with our thorough financial health report.

Summing It All Up

- Click through to start exploring the rest of the 270 Undervalued Asian Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Guangdong Marubi Biotechnology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603983

Guangdong Marubi Biotechnology

Engages in the research and development, design, production, sale, and service of various cosmetics in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives