- Taiwan

- /

- Healthcare Services

- /

- TWSE:4104

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by geopolitical tensions, tariff uncertainties, and fluctuating consumer sentiment, investors are keenly assessing the impact on major indices and economic indicators. Amidst these challenges, dividend stocks continue to attract attention for their potential to provide steady income streams; this reliability can be particularly appealing in times of market volatility and economic uncertainty.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.64% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.06% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.90% | ★★★★★★ |

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

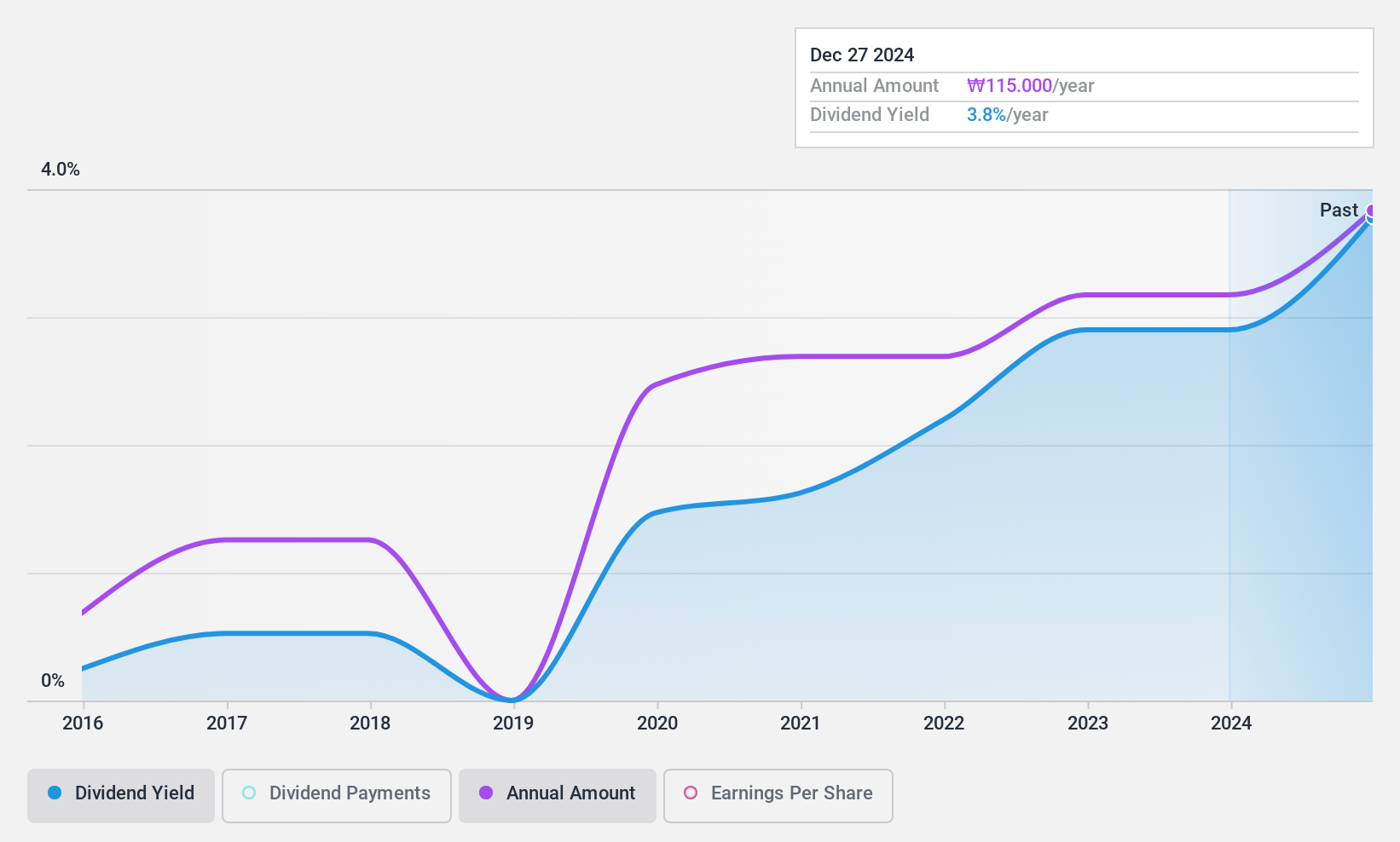

JW Holdings (KOSE:A096760)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JW Holdings Corporation, with a market cap of ₩216.78 billion, operates as a healthcare company alongside its subsidiaries in South Korea, the United States, Japan, China, and internationally.

Operations: JW Holdings Corporation generates revenue from various segments, including Medicines at ₩1.11 billion, Holding Business at ₩53.86 million, and Medical Equipment at ₩21.57 million.

Dividend Yield: 3.8%

JW Holdings offers a stable dividend supported by a low payout ratio of 10.8% and a cash payout ratio of 6.5%, ensuring dividends are well-covered by earnings and cash flows. Despite high debt levels, the company has maintained reliable dividend payments over the past decade with consistent growth. Recent authorization of a share buyback program aims to stabilize stock price and enhance shareholder value, potentially benefiting future dividend sustainability amidst its current attractive yield of 3.75%.

- Take a closer look at JW Holdings' potential here in our dividend report.

- Our valuation report here indicates JW Holdings may be undervalued.

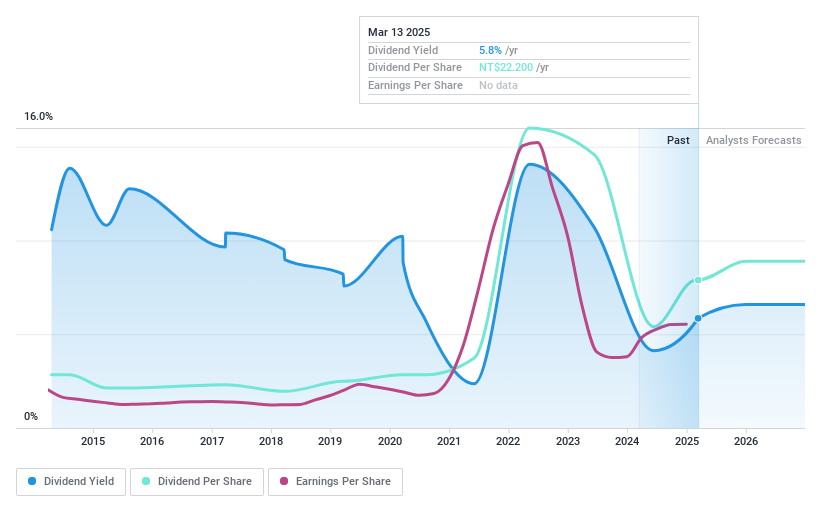

Raydium Semiconductor (TWSE:3592)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Raydium Semiconductor Corporation designs, develops, and sells integrated circuits (IC) in Taiwan, China, Hong Kong, and internationally with a market cap of NT$29.47 billion.

Operations: Raydium Semiconductor Corporation generates revenue of NT$23.60 billion from its integrated circuits segment across various international markets.

Dividend Yield: 3.9%

Raydium Semiconductor's dividend payments are covered by earnings and cash flows, with payout ratios of 55.1% and 47.9%, respectively. Despite a volatile dividend history over the past decade, recent increases in dividends suggest potential stability improvements. The stock trades at a good value, 19% below fair value estimates, but its yield of 3.91% is lower than top-tier TW market payers. Earnings growth is robust, yet dividend sustainability remains uncertain due to past volatility.

- Unlock comprehensive insights into our analysis of Raydium Semiconductor stock in this dividend report.

- According our valuation report, there's an indication that Raydium Semiconductor's share price might be on the cheaper side.

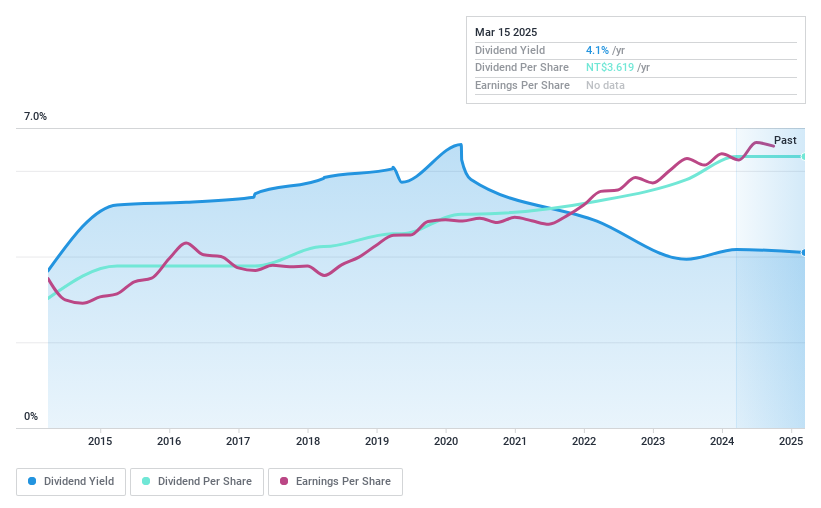

Excelsior Medical (TWSE:4104)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Excelsior Medical Co., Ltd. operates in Taiwan, Hong Kong, the Philippines, and Malaysia by selling medical supplies and equipment, medicines, and home medical devices with a market cap of NT$14.28 billion.

Operations: Excelsior Medical Co., Ltd.'s revenue segments include NT$5.31 billion from the Excelsior Medical Department, NT$1.24 billion from the Arich Enterprise Department, and NT$1.57 billion from Dynamic Medical Technologies Inc.

Dividend Yield: 4.1%

Excelsior Medical offers a stable dividend history with payments increasing over the past decade. The current yield of 4.14% is reliable, though slightly below top-tier market payers in Taiwan. Dividends are well-covered by earnings (77% payout ratio) and cash flows (14.1% cash payout ratio). The stock trades at a significant discount, 97.7% below fair value estimates, supported by consistent earnings growth of 9% annually over five years.

- Click to explore a detailed breakdown of our findings in Excelsior Medical's dividend report.

- In light of our recent valuation report, it seems possible that Excelsior Medical is trading behind its estimated value.

Taking Advantage

- Dive into all 2010 of the Top Dividend Stocks we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Excelsior Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4104

Excelsior Medical

Sells medical supplies and equipment, medicines, and home medical devices in Taiwan, Hong Kong, China, the Philippines, Malaysia, and Indonesia.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives