- Taiwan

- /

- Semiconductors

- /

- TWSE:3545

The Market Doesn't Like What It Sees From FocalTech Systems Co., Ltd.'s (TWSE:3545) Revenues Yet

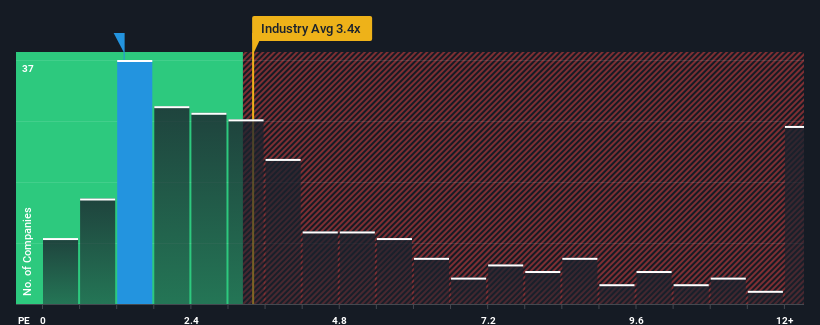

You may think that with a price-to-sales (or "P/S") ratio of 1.3x FocalTech Systems Co., Ltd. (TWSE:3545) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in Taiwan have P/S ratios greater than 3.4x and even P/S above 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for FocalTech Systems

What Does FocalTech Systems' P/S Mean For Shareholders?

FocalTech Systems certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. Those who are bullish on FocalTech Systems will be hoping that this isn't the case and the company continues to beat out the industry.

Keen to find out how analysts think FocalTech Systems' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For FocalTech Systems?

FocalTech Systems' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 1.7% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 6.4% over the next year. With the industry predicted to deliver 25% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why FocalTech Systems' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does FocalTech Systems' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of FocalTech Systems' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for FocalTech Systems with six simple checks.

If you're unsure about the strength of FocalTech Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3545

FocalTech Systems

Provides human-machine interface solutions in Taiwan, Mainland China, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026