- Taiwan

- /

- Semiconductors

- /

- TWSE:3545

Earnings Miss: FocalTech Systems Co., Ltd. Missed EPS By 6.0% And Analysts Are Revising Their Forecasts

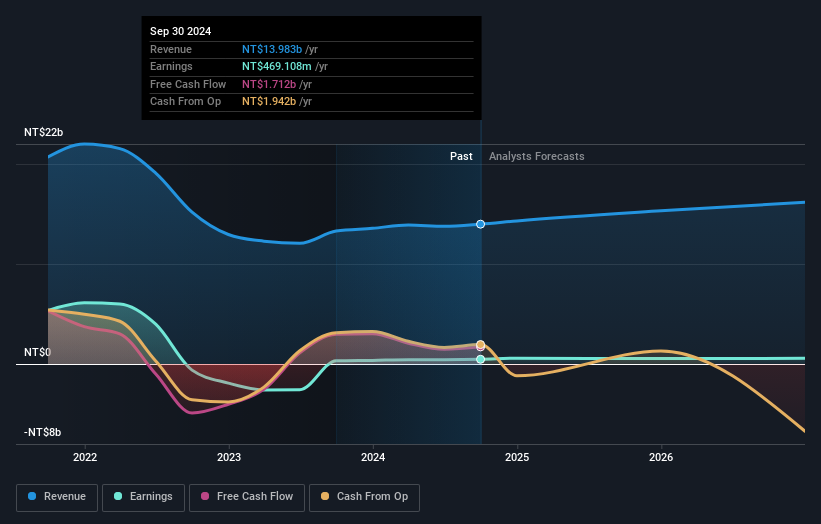

FocalTech Systems Co., Ltd. (TWSE:3545) came out with its third-quarter results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. FocalTech Systems beat revenue expectations by 3.4%, at NT$3.8b. Statutory earnings per share (EPS) came in at NT$0.79, some 6.0% short of analyst estimates. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

See our latest analysis for FocalTech Systems

Following the latest results, FocalTech Systems' twin analysts are now forecasting revenues of NT$15.3b in 2025. This would be a notable 9.6% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to grow 19% to NT$2.55. Before this earnings report, the analysts had been forecasting revenues of NT$13.7b and earnings per share (EPS) of NT$2.81 in 2025. Although revenue sentiment looks to be improving, the analysts have made a small dip in per-share earnings estimates, perhaps acknowledging the investment required to grow the business.

The consensus price target fell 15% to NT$94.00, suggesting that the analysts are primarily focused on earnings as the driver of value for this business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that FocalTech Systems' rate of growth is expected to accelerate meaningfully, with the forecast 7.6% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 3.5% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 17% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, FocalTech Systems is expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also upgraded their revenue estimates, although our data indicates it is expected to perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

You can also see our analysis of FocalTech Systems' Board and CEO remuneration and experience, and whether company insiders have been buying stock.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3545

FocalTech Systems

Provides human-machine interface solutions in Taiwan, Mainland China, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives